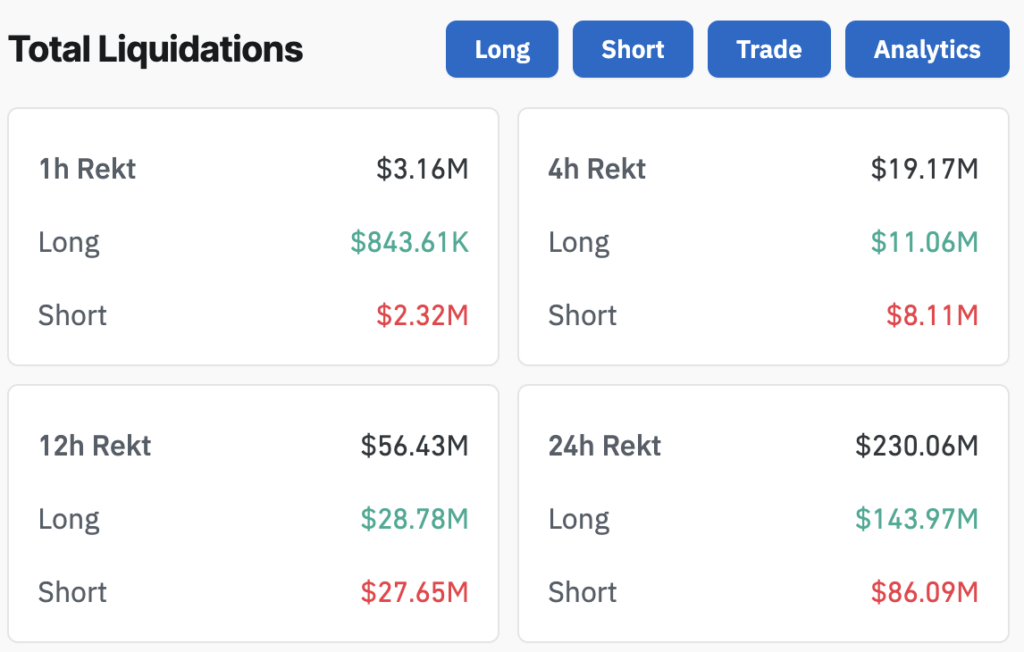

According to Coinglass, over $230 million in crypto positions were liquidated in the past 24 hours, affecting 102,073 traders. The largest single liquidation occurred on OKX, valued at $5.26 million.

Bitcoin led the liquidation figures with $51.25 million, followed by Ethereum at $30.44 million. Dogecoin and Solana saw liquidations of $13.94 million and $11.25 million, respectively. Binance recorded the highest exchange liquidations at $104.13 million, with OKX and Bybit at $66.12 million and $43.37 million.

Over the past day, liquidity was split between $144.53 million in long positions and $86.06 million in short positions.

According to CryptoSlate data, the crypto market capitalization stands at $2.25 trillion. Bitcoin’s dominance is at 60.4%, trading at $68,886—6% below its all-time high of $73,686.93. The asset experienced a 0.6% increase over the past 24 hours, with a trading volume of $34.98 billion.

The post Crypto market saw $230 million in liquidations as Bitcoin fell below $70k appeared first on CryptoSlate.