Crypto markets are confronting a fast-moving repricing of US monetary policy expectations, and macro trader Alex Krüger argues that even after last week’s sharp dovish turn, futures curves still fail to discount what a Trump-aligned Federal Reserve leadership could look like.

Fed Cut Mispricing Sets Up Crypto Repricing Event

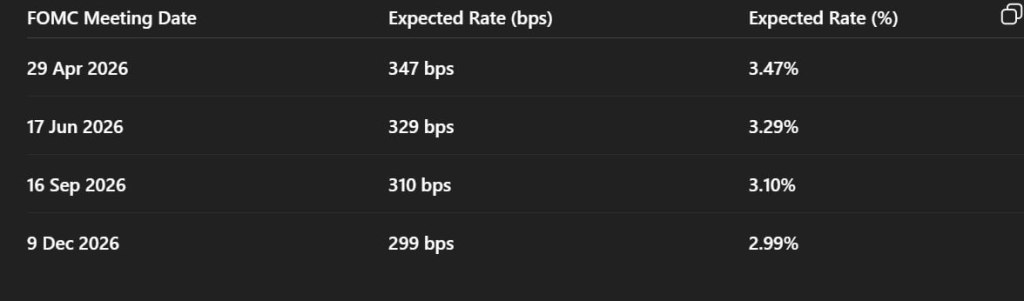

In a post on X, Krüger shared a CME-derived table of implied policy rates for late-stage 2026 and framed it as the market’s baseline for the post-Powell transition. The table shows an expected fed funds rate of 3.47% for the April 29, 2026 FOMC meeting (347 bps), drifting to 3.29% for June 17, 2026 (329 bps), to 3.10% for September 16, 2026 (310 bps), and to 2.99% for December 9, 2026 (299 bps).

In other words, the curve prices roughly 48 basis points of easing between late April and early December 2026 about two quarter-point cuts across that span—implying a relatively gradual descent toward just under 3%.

Krüger’s core claim is that this path is inconsistent with the policy preferences he associates with the Trump camp, and therefore inconsistent with an “ultra dovish” chair appointment. He situates the April 2026 meeting as the last one under Jerome Powell’s chairmanship, whose four-year term ends in mid-May 2026, and then treats the June 2026 meeting as the first under a new chair.

Against that transition, Krüger points to Fed Governor Stephen Miran—whom he casts as a proxy for Trump-world monetary instincts—as advocating a much faster return to neutral. In Krüger’s telling, Miran has argued that the “appropriate fed funds rate” is “roughly 2% to 2.5%,” has linked this year’s tighter stance to a rise in the neutral rate, and has characterized his divergence from colleagues as centered on “speed of cuts,” not destination.

Krüger also highlights Miran’s preference for “50 bps cuts” over 25-bp steps as the way to get policy back to neutral. On Krüger’s arithmetic, a futures curve that delivers only about 50 bps of easing from the first post-Powell meeting in June 2026 through December 2026 is not a curve that has truly priced a Trump-era chair willing to front-load larger moves.

Put simply, he sees the market as still anchored to a Powell-style glide path, even while political risk is skewing toward more abrupt easing. “The Trump camp wants faster and bigger cuts, many of them. The Fed only cutting 50bps between the new Fed Chair’s FOMC in June and December 2026 falls short. That’s why I sustain an ultra dovish Fed Chair appointed by Trump is not priced in,” Krüger concludes.

December Rate Cut Seems Likely

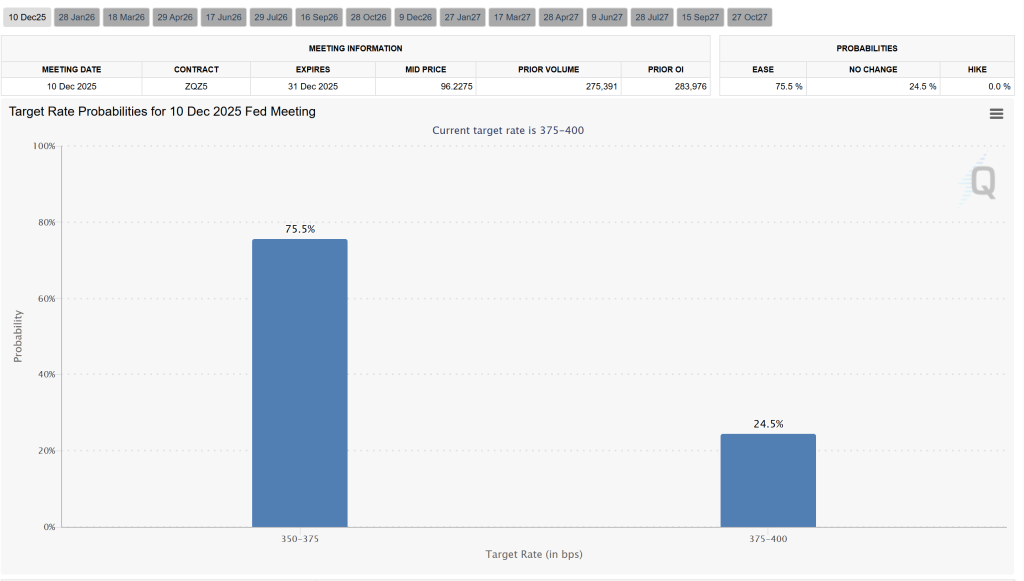

The timing of Krüger’s warning matters because the front end has already undergone a dramatic swing. Last week, traders sharply increased the probability of another cut at the Fed’s December meeting after New York Fed President John Williams said rates could fall “in the near term,” a remark that pushed implied odds of a quarter-point December move into the mid-70% range on CME FedWatch, up from roughly 40% the day before.

In parallel, Goldman Sachs chief economist Jan Hatzius reiterated a baseline in which the Fed cuts in December, then again in March and June 2026, taking the policy band down to roughly 3.00%–3.25%.” We expect another Fed cut in December, followed by two more moves in March and June 2026 that take the funds rate to 3-3.25%,” said Hatzius.

GOLDMAN SEES DOWNSIDE RISKS FOR ECONOMY NEXT YEAR

Goldman Sachs economists expect the Fed to cut rates in December, followed by a few more cuts in 2025, bringing rates just above 3%. Chief economist Jan Hatzius warns the economy could slow more than expected, requiring…

— *Walter Bloomberg (@DeItaone) November 24, 2025

His path is modestly more dovish than what the curve had discounted earlier in the month, but it still resembles the gradualism embedded in Krüger’s CME table: sequential 25-bp steps, aiming for an early-2026 rate around the low-3% area rather than a rapid drop toward the low-2s.

For the crypto markets, the dispute is less about whether cuts are coming than about the speed and terminal rate. Crypto is structurally levered to shifts in dollar liquidity and real-rate expectations; what Krüger is flagging is a scenario where the curve’s “destination” and, especially, its pacing remain too conservative relative to a potential political reorientation of the Fed.

If traders are right that the Williams-sparked repricing is the beginning of a slower, data-dependent easing cycle, then current crypto asset valuations already incorporate the relevant macro impulse.

If Krüger is right, the curve is still missing a regime change in reaction function—one in which larger front-loaded cuts compress cash yields faster than expected, steepen risk-on positioning, and force another round of cross-asset duration and liquidity repricing. That gap between a Powell-era slope and a Trump-era shock path is what he means when he says an ultra-dovish chair “is not priced in” for crypto markets.

At press time, the total crypto market cap was at $2.92 trillion.