Bitcoin is currently trading around $63,500 as we start the journey into the last week of September with optimism for bullish prices. Renowned crypto analyst Willy Woo has offered an optimistic outlook for Bitcoin’s next steps, drawing attention to a key technical indicator, the Puell Multiple. In his recent analysis, Woo suggested that Bitcoin is positioned for a significant rally, forecasting bullish momentum as we head into the final quarter of 2024.

The Role Of The Puell Multiple

Willy Woo’s outlook revolves around the Puell Multiple, a metric that helps identify Bitcoin’s market cycle peaks and troughs by comparing the daily issuance of BTC to its price. That is, the Puell Multiple compares the difference between short-term BTC miner revenue to that of the longer-term revenue trend. Historically, this indicator has been used to pinpoint BTC’s best buying opportunities.

Woo took to social media platform X to post an adjusted version of the traditional Puell Multiple graph to highlight specific points where Bitcoin transitioned from bullish to bearish cycles in the past. Notably, the graph highlighted periods of Bitcoin lows after an extended downtrend and periods of accumulation after each halving. These two periods have often correlated with a change from negative to positive thresholds on the Puell Multiple.

At the time of writing, the Puell Multiple is currently sitting at a negative 1. However, recent market dynamics have seen this metric trending upwards since the beginning of 2024 and have steadily approached zero. In his analysis, Woo stated, “The best time to buy Bitcoin is at the bottom.

The second-best time to buy is at the post-halving re-accumulation.” What this essentially means is that Bitcoin is now nearing the perfect spot for accumulation after the most recent halving in April 2024. He noted that BTC’s re-accumulation phase, often marked by gradual price increases, is now unfolding. Consequently, the best time to buy Bitcoin is now, especially for long-term holders looking to get ahead.

Bullish Flag And Market Accumulation

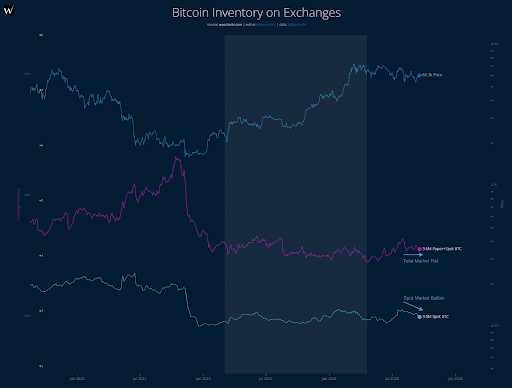

In an earlier Bitcoin analysis, Woo highlighted a reduction of BTC on crypto exchanges. He mentioned, “We’re now seeing LOTS of spot BTC being scooped up from exchanges.” At the same time, the BTC price chart is starting to exhibit a recognizable “bull flag” pattern, a signal traders often associate with a coming price breakout.

There’s no denying that the general consensus surrounding Bitcoin is a significant price rally, especially as we move into the fourth quarter of the year, which is historically known for bullish activity. This makes Willy Woo’s outlook even more compelling.

At the time of writing, Bitcoin has been trading at $63,647 and has been up by 1.30% in the past 24 hours.