Decentralized finance (DeFi) protocol Synthetix (SNX) is working toward launching its application blockchain, dubbed SNAXChain, according to a blog post published on September 4, 2024.

Synthetix SNAXChain To Launch On Optimism’s Superchain Infrastructure

Ethereum-based derivatives liquidity protocol Synthetix is set to unveil SNAXChain, an application blockchain built on Optimism’s Superchain infrastructure.

For the uninitiated, Ethereum layer-2 (L2) scaling network Optimism’s Superchain is essentially a network of L2 chains, known as OP chains. These chains share security features a communication layer, and are powered by an open-source technology stack.

The Superchain ecosystem is governed by the Optimism Collective, a decentralized autonomous organization (DAO). Examples of existing OP chains include Base, Lyra, Mode, and Zora, with SNAXChain poised to join the list.

The launch of SNAXChain aims to improve the protocol’s efficiency and scalability to offer a more seamless and cost-effective experience to DeFi enthusiasts interested in issuing and trading synthetic assets. SNAXChain will also boost Synthetix’s liquidity to keep up with the growing demand for synthetic assets.

The Synthetix team notes that SNAXChain will be a neutral hub for on-chain governance and protocol decisions. At the same time, the protocol will continue to expand to additional blockchain networks and L2 solutions.

Notably, Synthetix has partnered with Conduit to manage chain infrastructure. It partnered with Wormhole to provide cross-chain messaging between SNAXChain, Optimism, and Ethereum mainnet.

Synthetix will kickstart a new governance epoch alongside the launch of the new application blockchain. According to the official post, interested individuals or groups can nominate themselves for various governance councils on SNAXChain.

A small amount of Ethereum (ETH) must be bridged to the chain for gas. After bridging the ETH, interested nominees may connect their wallets to the Synthetix governance app and nominate themselves for the appropriate council. Voting for the Synthetix governance council is slated to begin on September 6, 2024.

Can DeFi Make A Comeback?

Despite the rapid pace of development and innovation in the Ethereum DeFi space with the launch of layer-2 scaling solutions such as Optimism and Arbitrum, DeFi has not quite managed to take hold of the industry like it did during the ‘DeFi summer’ of 2020.

However, recent on-chain trends and patterns could indicate a potential DeFi comeback later this year. For instance, Optimism witnessed strong network activities earlier this year, helping its native OP token surge by 9%. As the network expands to more chains, user activity can continue upward.

Similarly, leading decentralized exchange (DEX) Uniswap recently made a cumulative $50 million in total revenue, making a strong case for the undervaluation of its native UNI token, down 86% from its all-time high value of $44.92.

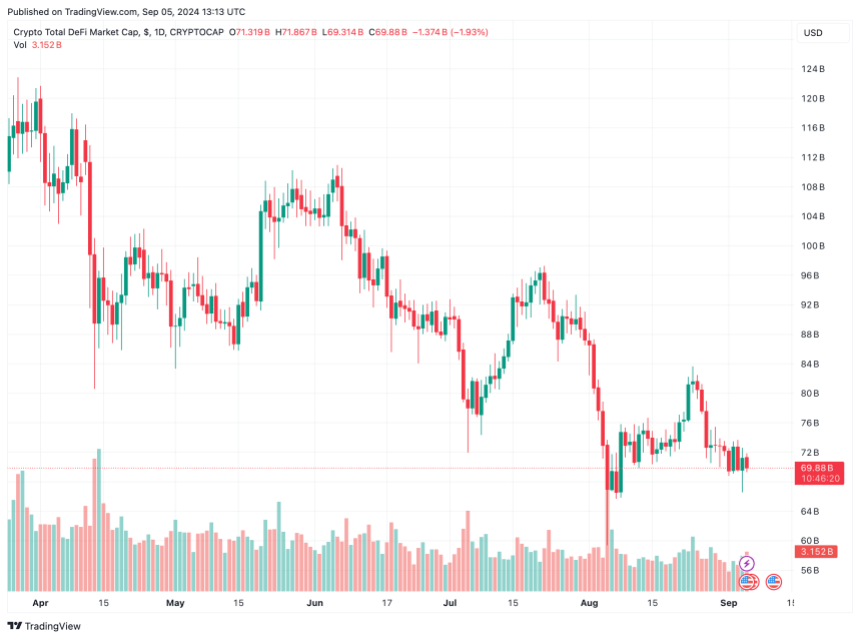

Similarly, one of the earliest DeFi lending protocols, AAVE, has recently seen a resurgence in interest from crypto whales. The total DeFi market cap sits at $69.88 billion at press time.

Featured Image from Binance Academy, Chart from TradingView.com