Quick Take

Since the approval of Bitcoin ETFs on Jan. 11, the price performance of the digital asset has illustrated an unpredictable pattern, peaking around $49,000 before dipping below $40,000. As of now, Bitcoin hovers around $48,000. This volatile behavior extends to crypto equities and Bitcoin ETFs, which have displayed divergent performances.

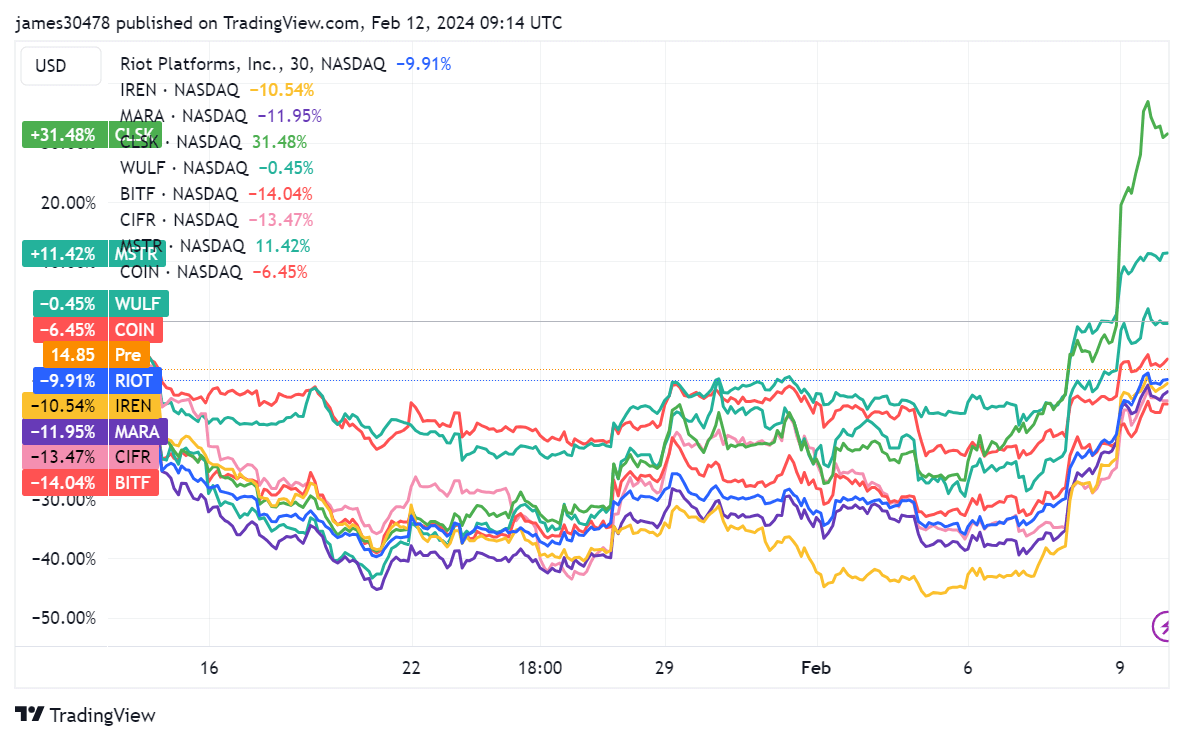

Bitcoin-related mining stocks such as Iris Energy and Marathon Digital Holdings have notably experienced double-digit declines of 11% and 12%, respectively. However, not all equities mimic this downward trajectory. CleanSpark and MicroStrategy, for instance, have seen their stock prices surge by 31% and 11%, respectively. Meanwhile, Coinbase suffered a 6% decline and is set to release its Q4 2023 earnings report on Feb. 15.

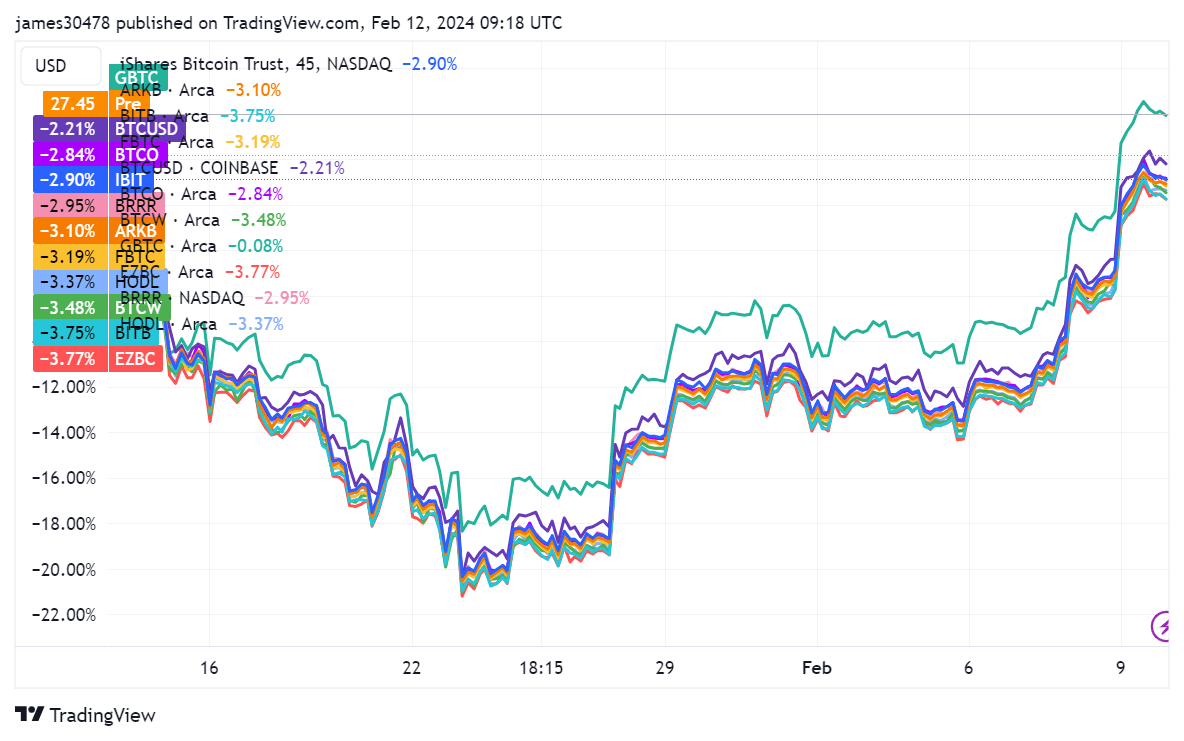

Owing to the slight decline in Bitcoin since the ETF approval, Bitcoin ETFs have recorded roughly a 3% drop, with GBTC remaining relatively flat. GBTC now records a small premium of 0.02% to its net asset value (NAV), according to YCharts. Nevertheless, the recent Bitcoin resurgence of over $48,000 has injected optimism in the pre-market, with many ETFs and crypto equities witnessing a rise.

The post Divergent performances highlight resilience and challenges for Bitcoin ETFs and equities appeared first on CryptoSlate.