Dogecoin, despite being held up around the $0.21 to $0.23 price zone, has seen its user base grow with adoption among crypto investors of all types. Notably, on-chain data shows that Dogecoin has now surpassed 8 million in terms of addresses holding a non-zero balance.

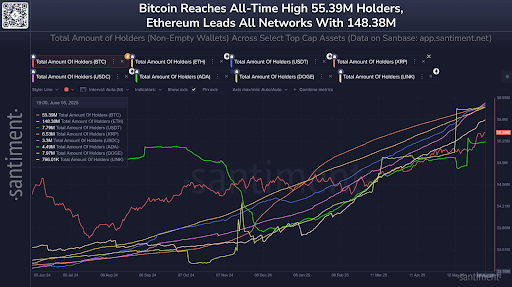

On‑chain analytics from Santiment reveal that Dogecoin has risen from approximately 6.9 million holders earlier in 2025 to the latest 8 million milestone. Only Ethereum and Bitcoin exceed Dogecoin when it comes to user base size.

Dogecoin Holder Count Keeps Surging

The momentum behind Dogecoin’s adoption shows no sign of slowing down, and the number of addresses holding the meme cryptocurrency is now above 8 million. This trend in Dogecoin holders stems from the cryptocurrency increasingly becoming the go-to asset for many retail traders. This, in turn, has seen the number of Dogecoin holders continue to surge this year, especially as retail investors start to transition from other large market-cap cryptocurrencies like Bitcoin, which many now argue is the crypto for institutions.

Although Dogecoin also saw a huge growth in the number of holders in 2024, the growth in 2025 is outpacing the trend seen in 2024, To put this into perspective, it took the whole year to add 1 million new DOGE holders in 2024, whereas in 2025, the same milestone has taken less than eight months. This is a substantial increase from about 6.9 million holders in the beginning of 2025.

The latest figures place Dogecoin well ahead of other large market cap cryptocurrencies such as Cardano (ADA), Chainlink (LINK), and XRP, as well as major stablecoins including USDT and USDC, in terms of total holder count. Only Ethereum, with about 148 million addresses, and Bitcoin, with around 55 million, surpass Dogecoin’s adoption levels.

DOGE Whales Continue Accumulating

The steady increase in new Dogecoin addresses has been supported by a corresponding increase in whale accumulation. Trading data shows that large wallets have added more billions of Dogecoins in recent weeks. For instance, recent on-chain data shows that wallet addresses holding between 100 million and 1 billion Dogecoin recently added about 2 billion Dogecoin worth $448 million to their holdings within a week. At the institutional level, Bit Origin made headlines after committing $500 million to a Dogecoin treasury last month when the price was hovering around $0.24.

Technical traders are also paying close attention. One analyst known as Trader Tardigrade pointed out that DOGE’s current chart setup is nearing the final stages of consolidation before a pump on the daily candlestick timeframe chart. If this pump were to manifest, the analyst projects a pump to $0.41 after breaking out of a triangular consolidation pattern.

Interestingly, a longer-term analysis from the same analyst on the monthly candlestick timeframe chart shows that Dogecoin has built a support base and is ready for the next leg up that would take it to as high as $4.

At the time of writing, Dogecoin is trading at $0.222, up by 4.3% in the past 24 hours.