Data shows the Dogecoin Futures Open Interest has continued to rise, a sign that the price pullback hasn’t discouraged speculative activity.

Dogecoin Futures Open Interest Is Up Almost 64% Over Past Week

In a new post on X, the analytics firm Glassnode has talked about the latest trend in the Futures Open Interest of Dogecoin. The “Futures Open Interest” here refers to a metric that keeps track of the total amount of futures positions related to DOGE that are currently open on all centralized derivatives exchanges.

When the value of this metric goes up, it means the investors are opening up more positions on the market. The total leverage present in the sector usually goes up when new positions appear, so this kind of trend can lead to more volatility for the asset’s price.

On the other hand, the indicator observing a decline suggests the holders are either closing up positions of their own volition or getting liquidated by their platform. Usually, the cryptocurrency becomes more stable following such a trend.

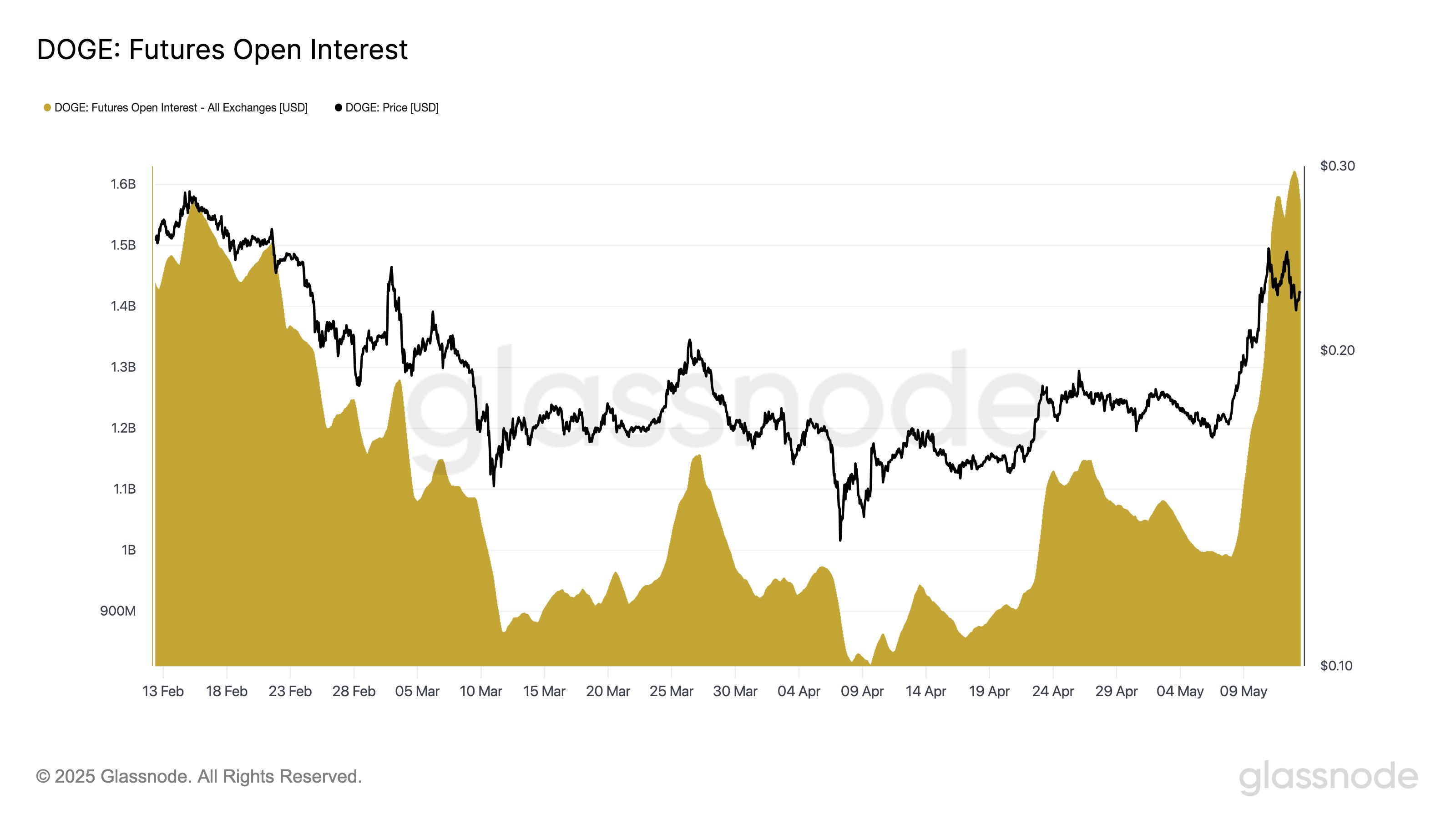

Now, here is a chart that shows the trend in the Dogecoin Futures Open Interest over the last few months:

As displayed in the above graph, the Dogecoin Futures Open Interest has witnessed a huge increase recently, a sign that investors have put up a large number of bets related to the memecoin. Over the past week, the metric’s value has gone from $989 million to $1.62 billion, which implies growth of almost 64%.

Initially, this strong uplift in speculative activity coincided with DOGE’s sharp recovery rally. Investors usually find rallies to be exciting, so they tend to open up more positions on the futures market during them.

Interestingly, though, despite the fact that the Dogecoin rally has gone cool most recently and the price has even registered some pullback, the Futures Open Interest has only continued to move up. “This decoupling suggests persistent speculative positioning, even as price momentum fades – a setup worth monitoring,” notes the analytics firm.

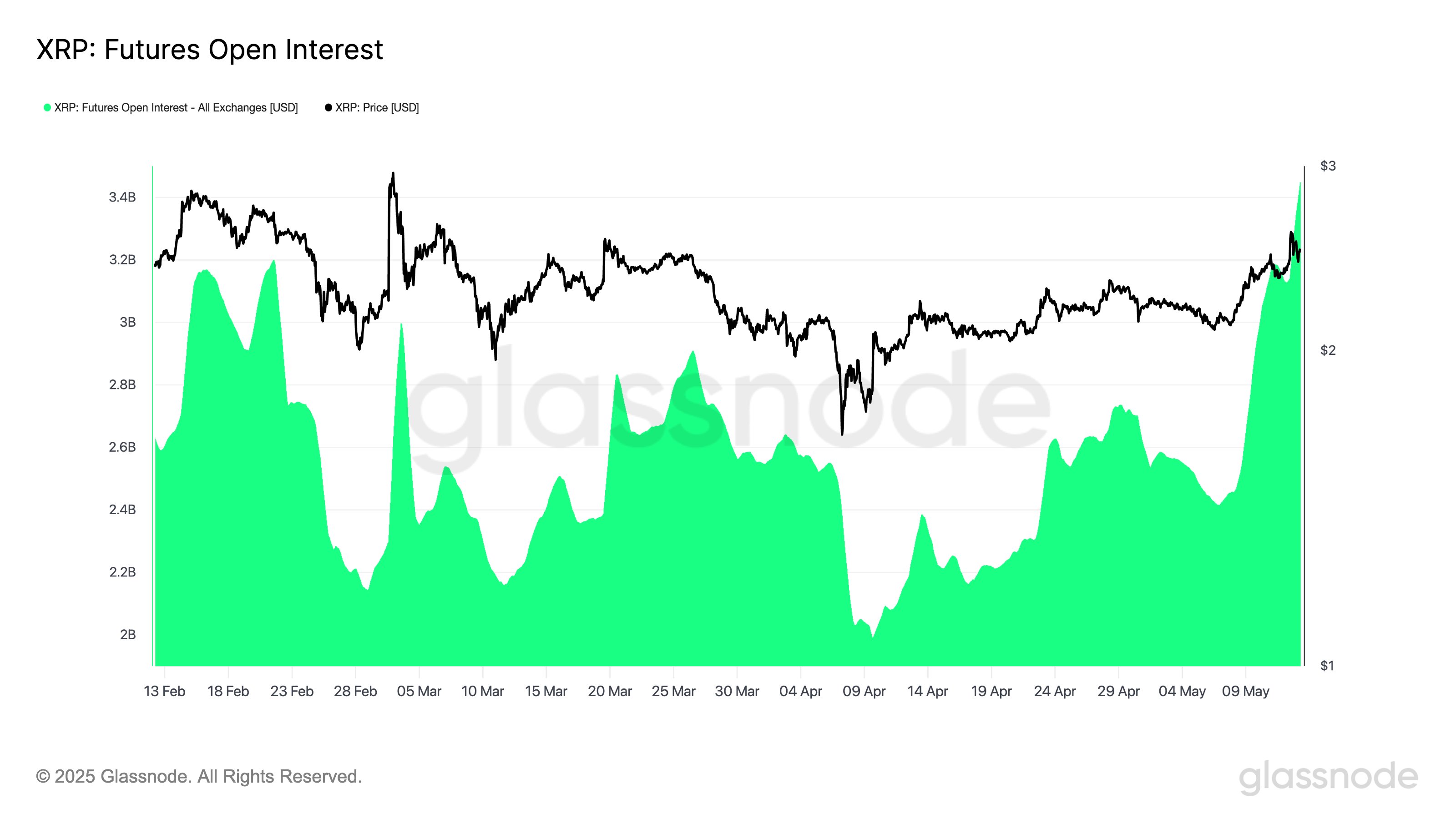

DOGE isn’t the only asset that has enjoyed a boost in speculative activity recently. As Glassnode has pointed out in another X post, XRP has also seen its Futures Open Interest shoot up.

During the same window as Dogecoin’s Open Interest increase, XRP has observed the indicator go up by 41.6%, from $2.4 billion to $3.4 billion. “This sharp increase in leverage coincides with a price rally from $2.14 to $2.48, suggesting elevated speculative activity and growing directional conviction,” says the analytics firm.

DOGE Price

At the time of writing, Dogecoin is trading around $0.236, up more than 42% over the past week.