The post Ethereum Fusaka Upgrade Goes Live Dec 3, Will ETH Price Rise appeared first on Coinpedia Fintech News

Ethereum, one of the biggest blockchain networks, is gearing up for a major upgrade. On December 3, 2025, the long-awaited Fusaka upgrade goes live, a change builders say will speed the network and cut costs for Layer-2s.

Now, traders are wondering if this upgrade will possibly give ETH’s price a new boost. So, what exactly is Fusaka Upgrade all about?

What Is the Ethereum Fusaka Upgrade?

The Fusaka upgrade is Ethereum’s next major network update, scheduled for December 3, 2025. One of the biggest changes is PeerDAS (Peer Data Availability Sampling), which allows validators to check blockchain data by sampling only small pieces instead of downloading everything.

This reduces validator bandwidth and data load by up to 85%, making it easier and cheaper for more people to operate nodes.

Fusaka also increases Ethereum’s block gas limit from about 36 million to 60 million, meaning each block can hold far more transactions. Overall, Fusaka aims to make Ethereum faster, cheaper, and ready for much greater demand from users and developers.

How Fusaka Benefits the Ethereum Network

Fusaka delivers several improvements that directly strengthen the Ethereum ecosystem.

First, it greatly lowers costs for Layer-2 networks such as Arbitrum, Optimism, and Base by expanding storage space for “blobs” and reducing the cost of posting data. Developers expect transaction costs on Layer-2s to fall by 40–60%, making Ethereum-based apps cheaper to use.

Second, higher network capacity means less congestion during busy periods, allowing more activity without gas prices spiking.

Third, with PeerDAS, validators don’t need huge storage or bandwidth. This lowers the barrier to run a node..

Lastly, by improving speed, scalability, and cost efficiency, Fusaka makes Ethereum more attractive for developers building DeFi, gaming, and real-world asset applications, pushing long-term growth for the entire ecosystem.

How Could the Upgrade Impact the ETH Token Price?

The Fusaka upgrade is expected to strengthen Ethereum’s technical base, and many analysts believe this could support ETH’s price in the coming months. If Layer-2 usage increases by 30–50%, it would boost network fees, increase staking demand, and reduce selling pressure.

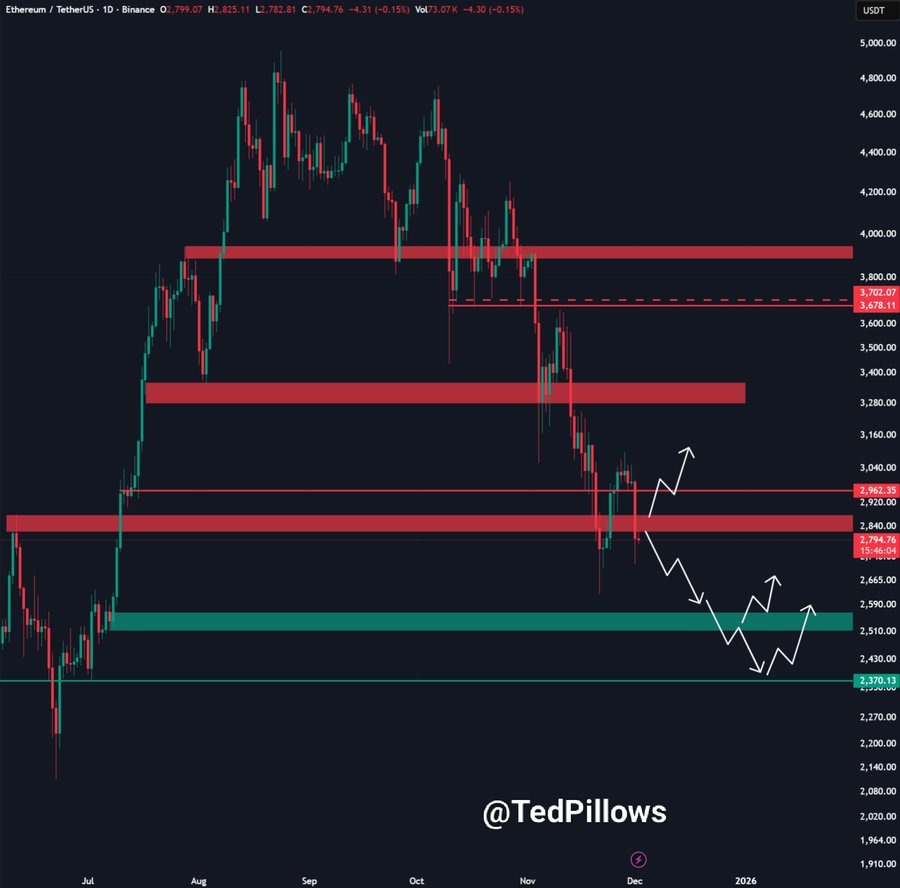

However, crypto trader TED warns that ETH has already fallen below its key support zone at $2,800–$2,850. If it fails to climb back above this level soon, the price could drop toward the next major support near $2,500, where buyers are likely to step in again.

On the upside, reclaiming $2,800 could push ETH back above $3,000, especially if the upgrade leads to strong activity on Layer-2 networks. A successful post-upgrade surge could even help ETH retest the $3,500 region.