On-chain data shows the largest of the Ethereum whales have continued to buy more recently as their supply sets another new all-time high.

Largest Ethereum Wallets Have Been Rapidly Accumulating

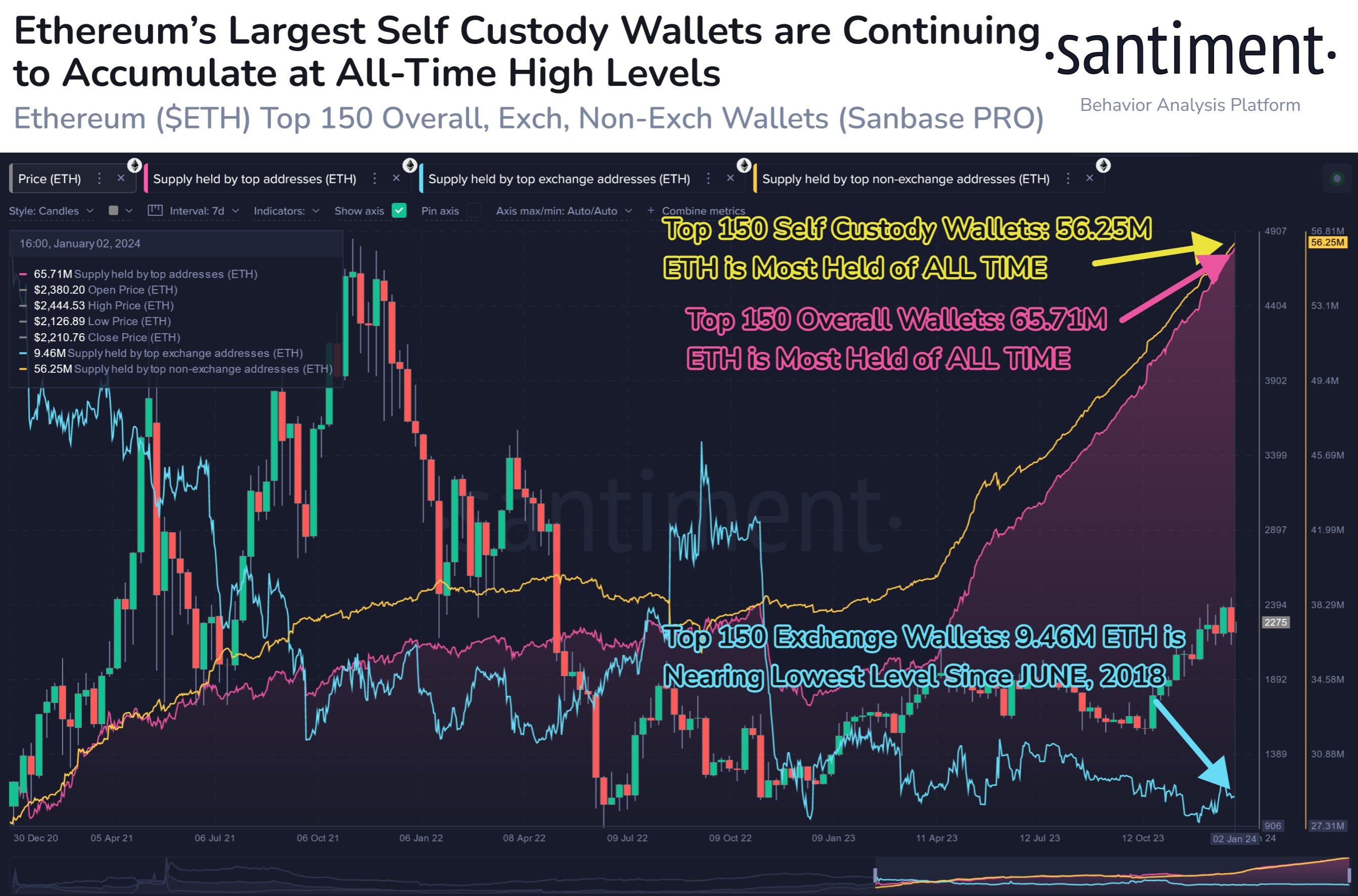

According to data from the on-chain analytics firm Santiment, the largest non-exchange Ethereum wallets have continued to show some rapid accumulation recently.

The relevant indicator here is the “supply held by top non-exchange addresses,” which keeps track of the total amount of Ethereum that the 150 largest self-custodial wallets are carrying in their combined balance right now.

Naturally, the 150 largest non-exchange wallets would belong to the top whale entities of the network. As such, the trend in the metric can provide hints about the sentiment around the cryptocurrency among these humongous holders.

When the indicator goes up, it means that these whales are expanding their holdings currently. Such a trend naturally suggests that they are bullish on the asset at the moment.

On the other hand, the metric registering a decline can be bad news for the cryptocurrency’s price, as it implies that these large investors have decided to participate in some selling.

Now, here is a chart that shows the trend in the supply held by the top non-exchange Ethereum addresses over the past couple of years:

As displayed in the above graph, the supply held by these top 150 whales has been rapidly going up since April 2023. This would suggest that the rally in the early months of the year caught the attention of these large entities, leading them to accumulate.

Interestingly, the slump between August and October was also not enough to dissuade these holders, as they only continued to buy more. Likewise, these whales have continued to push through the latest plunge in the cryptocurrency’s price as well.

After the most recent buying spree, the supply of these top non-exchange Ethereum wallets has reached 56.25 million ETH, which is a new all-time high for the indicator.

In the same chart, the analytics firm has also attached the data for the supply held by the top exchange addresses. This metric naturally measures the total number of coins that wallets attached to centralized platforms are carrying currently.

While the self-custodial whales have ramped up their supply, the top 150 exchange-bound wallets have moved flat in the same period. At present, this indicator has a value of 9.46 million ETH right now, which is nearly the lowest level observed since June 2018.

Generally, one of the main reasons why investors deposit their coins to exchanges is for selling purposes. So the supply of these exchange whales remaining low is a positive sign.

The rapid accumulation that the self-custodial whale entities are showing, combined with the fact that the top exchange wallets are at low levels, could mean the long-term outlook may be optimistic for Ethereum.

ETH Price

While Bitcoin has already made some recovery from its crash, Ethereum has only been able to rebound a bit so far, as its price is trading around the $2,250 level.