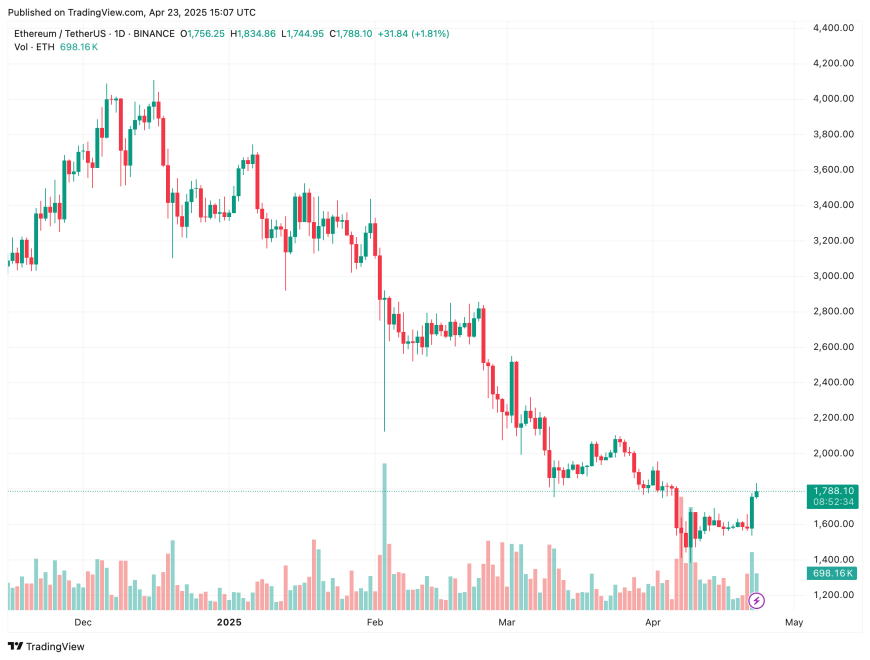

Ethereum (ETH) is beginning to show signs of a potential bullish reversal, with the second-largest cryptocurrency by market cap climbing 9.1% in the past 24 hours. Alongside the price surge, Ethereum’s network activity has seen a notable uptick.

Ethereum Network Activity Explodes Amid Price Rally

According to a recent CryptoQuant Quicktake post by analyst Carmelo_Aleman, Ethereum’s active addresses have surged significantly over the past few days. Between April 20 and April 22, ETH active addresses jumped from 306,211 to 336,366 – an increase of 9.85% in just 48 hours.

The analyst notes that such a sharp rise in active addresses points to increased on-chain activity. However, they caution against analyzing this metric in isolation, emphasizing the need to also track other metrics such as exchange volume, transaction count, and gas fees for a fuller picture.

Latest data from Ycharts indicates that Ethereum transactions per day have witnessed a significant spike over the past few days. Specifically, the number of transactions has climbed from 1.042 million on April 19, to 1.293 million on April 22.

Additionally, DefiLlama reports a significant rise in Total Value Locked (TVL) across the Ethereum decentralized finance (DeFi) ecosystem. Notably, TVL climbed from $46.28 billion on April 19, to $49.99 billion at the time of writing.

Despite the recent growth, TVL remains well below the December 2024 high of approximately $76 billion. Trading volume on ETH-based decentralized exchanges (DEX) has also surged, jumping from $932 million on April 20, to $2.44 billion today.

Beyond bullish on-chain metrics, technical indicators are also pointing to a potential reversal. In a recent post on X, crypto analyst Titan of Crypto highlighted that ETH has broken out of a falling wedge pattern on the daily chart – a classically bullish signal.

Furthermore, Ethereum’s Relative Strength Index (RSI) has broken out of a long-term downtrend. The RSI is currently hovering around 50, suggesting there’s significant room for upward momentum if the price follows suit.

Some Warning Signs For ETH

Despite improving sentiment, the Ethereum Fear & Greed Index is flashing a reading of 64 – indicating that ETH might be entering overbought territory at its current price level.

Additionally, ETH could face strong resistance around the $2,300 mark if the current bullish momentum continues. At press time, ETH is trading at $1,788, up 9.1% over the past 24 hours.