The post Ethereum on the Edge: What Could Happen if ETH Falls Below $4,200? appeared first on Coinpedia Fintech News

Ethereum (ETH) has long been a key player in the crypto market, but recent volatility has investors on edge. Analysts are now closely watching the $4,200 mark, a crucial support level that could determine ETH’s short-term trajectory. A drop below this threshold is believed to trigger a wave of selling, impact market sentiment, and influence DeFi and NFT ecosystems built on Ethereum. Could the ETH price bounce back to $4,500, or are we heading toward a bearish slide toward $3,800?

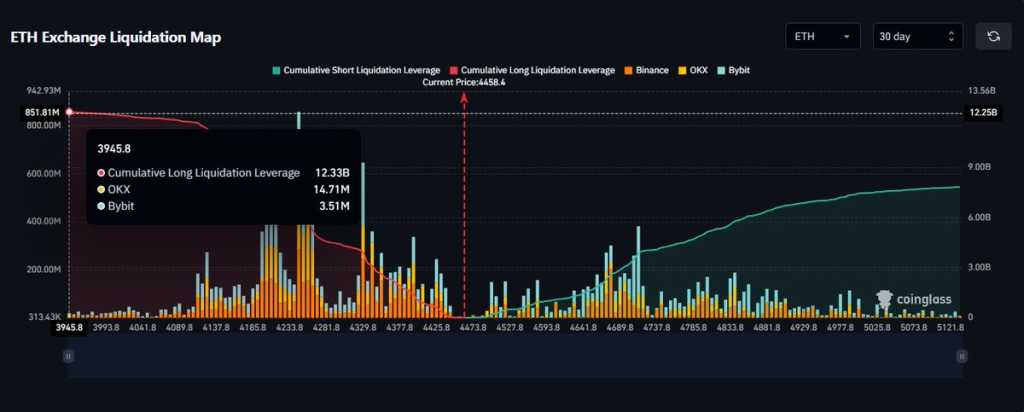

Massive Liquidation Risk for ETH Holders

Ethereum has been steadily trading above $4,000 for over a week now, displaying the growing strength of the bulls. The latest ETH exchange liquidation map from Coinglass, shared by Ted, highlights a critical setup for price action. The chart reveals a significant concentration of leveraged long positions between $3,945 and $4,200. If Ethereum were to dip into this zone, it could trigger a wave of long liquidations, potentially accelerating a move lower as cascading sell orders amplify downside pressure.

On the other hand, a sizable cluster of short liquidations is forming above $4,500 to $4,700. A sustained breakout above these levels could set off a short squeeze, forcing traders to cover their positions and fueling a rapid price rally.

Overall, the data suggests Ethereum is approaching a high-volatility zone. Price could either sweep lower liquidity levels before rebounding or break higher and liquidate shorts aggressively. Traders should watch the $4,200 support area closely and monitor whether ETH can reclaim and hold above $4,500, which could open the door to a strong bullish continuation.

What’s Next for the ETH Price Rally?

The ETH price had been facing immense resistance at $4000 as the bears prevented it from rising above the range. Meanwhile, after surpassing the resistance, the bulls have firmly held above the levels. This hints towards a potential breakout that could help price to achieve fresh highs.

Ethereum is consolidating near $4,470 after a strong uptrend that started in May, trading within a well-defined ascending channel. Price action shows ETH holding above its mid-channel support and the 20-day Bollinger Band basis line, signaling sustained bullish momentum. The RSI is hovering near neutral levels around 55, suggesting room for a potential continuation move. Immediate resistance lies at $4,869, while key supports remain at $4,271 and $4,050.

A break above $4,869 could pave the way to $5,000 and the upper channel trendline, whereas a drop below $4,271 could result in a deeper correction toward channel support for the Ethereum (ETH) price rally.