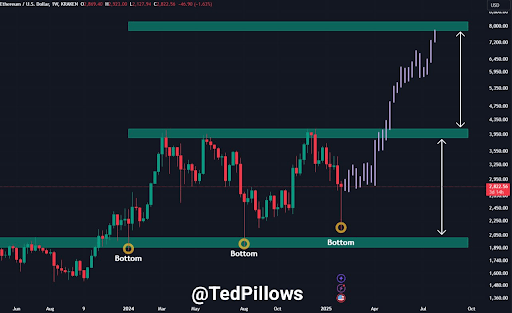

Ethereum’s price action in the past seven days has led to the creation of a capitulation candle that might send it on another surge within the next eight to twelve weeks. This capitulation candle caught the attention of crypto analyst Ted Pillows, who noted an interesting repeating capitulation pattern for Ethereum.

According to technical analysis by Ted Pillows, Ethereum has printed a capitulation candle in early 2025, just as it did in the first quarter of 2024 and the third quarter of 2023.

Capitulation Candles And Ethereum Historical Patterns

TedPillows’ analysis highlights that the Ethereum price has undergone three major capitulation events in the past two years, all of which led to substantial price rebounds. Particularly, these capitulations have taken place in the weekly candlestick timeframe, where the Ethereum price witnessed intense selling pressure throughout the week. However, historical price playout shows that these capitulations have often marked the bottom before a massive price rally.

The first of such capitulations occurred in Q1 2024 and eventually led to a 100% rally over the next three months, with the Ethereum price reaching $3,950. The second capitulation took place in Q3 2024, leading to a similar upswing. With Ethereum now experiencing another capitulation moment in early 2025, the analyst suggests that the pattern is set to repeat. He believes that Ethereum is once again forming a market bottom, setting the stage for an aggressive upward move.

Ethereum’s 100% Price Surge And Potential Peak

If Ethereum follows its previous trajectory, the next eight to twelve weeks could bring a significant price increase, even as the leading altcoin currently struggles around $2,700. A 90%-100% pump after the recent capitulation would push the Ethereum price past key resistance levels and above its current all-time high.

TedPillows’ analysis suggests that Ethereum’s ultimate price target following this capitulation could reach as high as $8,000. However, it is likely to encounter significant resistance near $3,950, a level that has historically triggered rejections in past capitulation cycles. Should Ethereum struggle to break through this barrier again, a temporary pullback could be on the horizon before any sustained move higher.

Meanwhile, Spot Ethereum ETFs are attracting heavy inflows despite Ethereum’s price downturn. Institutional investors appear to be capitalizing on the dip and increasing their ETH holdings in anticipation of a broader market rebound.

Spot Ethereum ETFs have recorded $513.8 million in inflows in the last six trading days, with BlackRock leading the charge by acquiring $424.1 million worth of ETH. This steady accumulation from institutional holders suggests growing confidence in Ethereum’s long-term potential and could lay the foundation for the projected 100% surge in the next eight to twelve months.

At the time of writing, Ethereum is trading at $2,725, down by 4% in the past 24 hours.