The post Ethereum Price Faces $90 Million Liquidation After Rejection, But Bullish Sentiment Remains Strong appeared first on Coinpedia Fintech News

Ethereum price has bled hard after facing a strong rejection around the $4,700 level. In the last 24 hours, Ethereum attempted multiple times to break above the resistance channel but failed to meet buyers’ demand. This resulted in over $90 million in liquidations; however, the ETH chart pattern shows positive sentiment along with promising on-chain data.

Ethereum Struggles to Clear Resistance

Over the last 24 hours, sellers have increased their domination to keep Ethereum below the bullish breakout channel. As a result, the price of ETH has declined sharply, resulting in strong liquidation. Data from Coinglass shows that ETH faced nearly $90 million in liquidations, of which buyers closed around $66.4 million worth of positions. This level of liquidation strengthened the resistance level, trapping the price.

Analysts highlight that a record $10 billion worth of Ethereum (ETH) is now stuck in Ethereum’s validator exit queue, as stakers line up to withdraw their funds from the network. This massive exit queue suggests rising profit-taking pressure as Ethereum trades around $4,500, just 9.8% below its all-time high.

However, institutional demand could help offset any bearish pressure on ETH, since these investors tend to buy more whenever prices dip. Data from StrategicETHReserve shows that corporate holders now own about 5.66 million ETH (around 4.68% of the total supply), while spot Ethereum ETFs hold roughly 6.81 million ETH (about 5.63%). Together, that’s more than 12.47 million ETH in institutional hands.

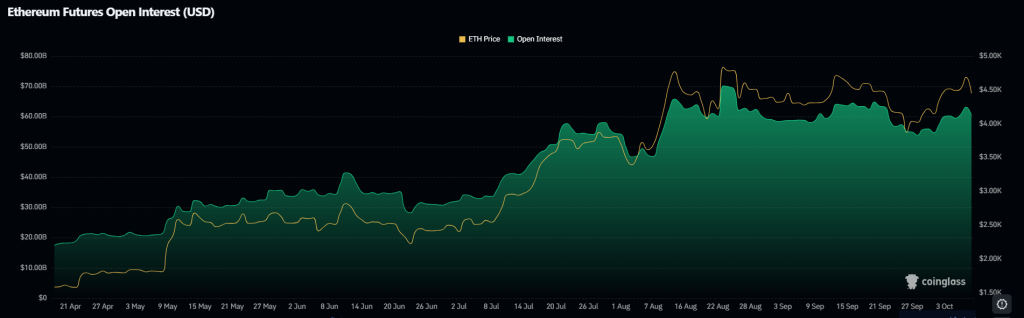

In October alone, U.S.-listed spot Ether ETFs saw $621.4 million in net inflows, more than double September’s $285.7 million, according to SoSoValue. Additionally, the open interest for Ethereum continues to surge as the metric rose from a low of $54 billion to over $60 billion in the last week. This suggests that trading activity continues to increase despite Ethereum’s downward correction, hinting at a possible rebound.

Also read: Ethereum Price Prediction 2025, 2026 – 2030: Can ETH Reach $10k?

The long/short ratio has also jumped toward 1.25, and 55.5% of total positions now expect the ETH price to rebound, strengthening the chances of a bullish reversal.

What’s Next for ETH Price?

Ether broke above its resistance line on Monday, suggesting that buyers are starting to take control. However, the recent rejection above $4,700 triggered strong selling pressure, plunging the price below immediate Fib levels. As of writing, the ETH price trades at $4,466, declining over 1.6% in the last 24 hours.

If the price manages to defend the immediate support at $4,400, it could mean the correction phase is ending. In that case, Ether might again try to climb above $4,700, and possibly $5,000 after that. Sellers will likely defend the $5,000 level strongly, but if buyers push through, the price could rally further to around $5,500.

On the other hand, if the price continues to face resistance, it might sharply fall below the 20-day EMA. In this case, it could catch bullish traders off guard and pull the ETH/USDT pair down to the $4,000–$3,700 support zone.