The post Ethereum Price to Eye All-Time High, Amid Short Squeeze Risk? appeared first on Coinpedia Fintech News

The crypto market today has faced the brunt of macroeconomic conditions. This has led to major assets dropping on their charts. The largest altcoin, Ethereum, is at $4,632.79, down 2.23% in 24 hours but still up 18.65% over the past week. This pullback follows ETH’s sharp weekly rally, making it vulnerable to profit-taking.

Successively, derivatives markets show signs of stress: $800M in crypto liquidations in 24h, including $50M in ETH longs, as open interest surged 16% to $895B. Adding to the sell pressure, Turkish exchange BtcTurk suspended withdrawals after a $48M security breach, including suspicious ETH transfers.

Wondering if a new ATH is still on the cards? Join me as I take you through analyst views and short-term Ethereum price analysis.

What Does the Analyst Have to Say?

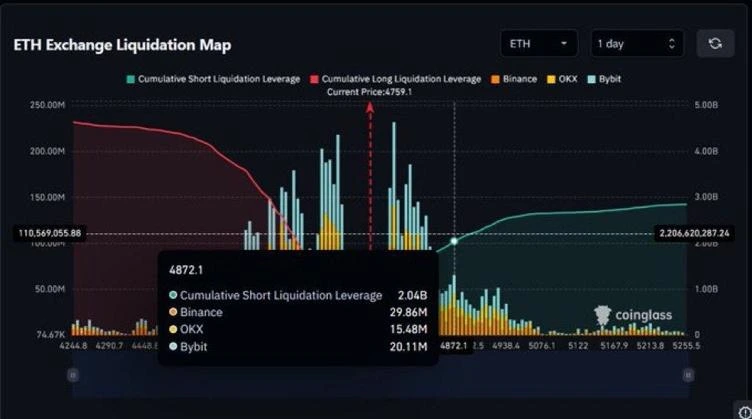

Market analyst Peter notes that according to Coinglass data, a push above $4,872 could liquidate more than $2 billion in short positions. Which would be on major exchanges such as Binance, OKX, and Bybit. These overleveraged shorts sit in a vulnerable zone, and if Ethereum breaks through this level, it could ignite a powerful short squeeze.

Successively, such a move would likely attract momentum buyers and push ETH into uncharted territory above its previous all-time high. He further highlights that, historically, similar setups have triggered rapid upside rallies. Thereby making Ethereum’s price reaction near $4,800 and trading activity around $4,872 crucial signals to watch for a breakout confirmation or a potential fakeout trap.

ETH Price Analysis

Technically speaking, the Ethereum price is holding support around the $4,500 psychological level. This is with a deeper pullback, potentially exposing $4,144, which aligns with the 38.2% Fibonacci retracement. That being said, a sell-off cascade could drag the price down to $3762.34.

On the upside, resistance remains in the $4,878–$4,891 zone near the previous all-time high, and a breakout above this range could spark a rapid move toward $5,067 as short liquidations fuel buying pressure.

FAQs

ETH fell due to a market-wide correction, leverage flush-out, and a security breach on the BtcTurk exchange.

It could trigger over $2B in short liquidations, driving a sharp upward move.

Support sits at $4,500, with deeper downside risk toward $4,144. Resistance is near $4,878–$4,891, and a breakout above that zone targets $5,067.