Ethereum (ETH) has seen a 17% drop in the last month, trading below $1,850 for the past few days. Amid its current performance, an analyst has warned investors the cryptocurrency risks dropping to 17-month lows if it fails to reclaim key resistance levels.

Ethereum Could See Drop To $1,550

Ethereum has been trading below a key support zone for the past two days, hovering between $1,750-$1,840 after failing to recover the $1,900 mark on Wednesday. The second-largest cryptocurrency by market capitalization lost its 15-month range in early March, dropping below $2,100 for the first time since December 2023.

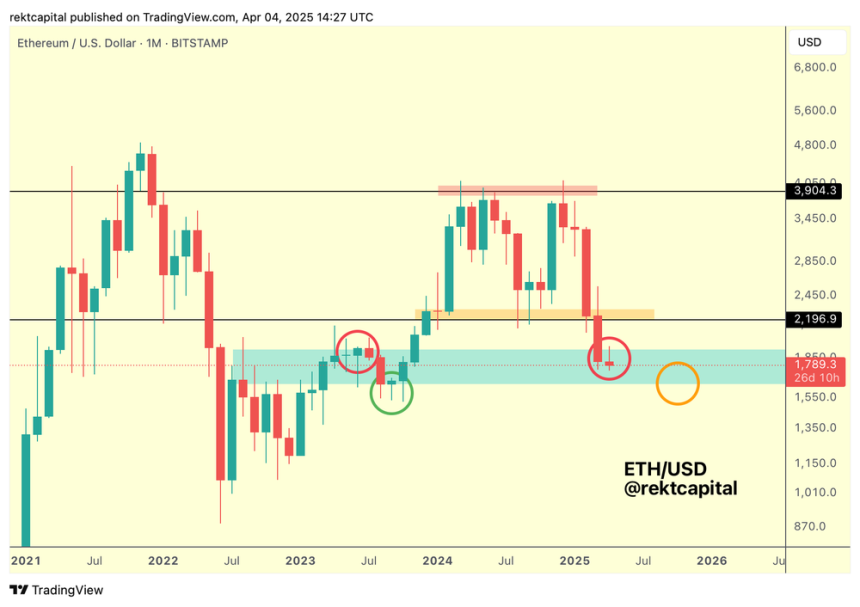

Since losing this level, ETH has seen its worst performance in seven years, recording a negative monthly close for the fourth consecutive month. Analyst Rekt Capital highlighted that this performance validated Ethereum’s double top formation that developed within its $2,196-$3,904 Macro Range.

After breaking down from this range, Ethereum trades within a historical liquidity pool, between the $1,640-$1,930 range, and “effectively has positioned itself for a bearish retest” of the range’s top with its monthly close within this area, which could turn this level into a new resistance.

As the analyst explains, turning this level into resistance has historically seen ETH’s price drop to the current range’s lower zone. “In other words, turning the red level into resistance (red circle) has historically preceded a drop into the support at the bottom of the light blue historical demand area (orange circle),” he detailed.

As such, Ethereum must reclaim the top of this demand area “to challenge a move to the old Macro Range Low of $2,196.” Meanwhile, a rejection from the $1,930 mark, which it has been unable to reclaim over the past week, would see ETH risk a 15% drop to the $1,550 area.

Is A 20% Rally Coming?

Rekt Capital also pointed out that since June 2023, ETH’s Dominance has dropped from 20% to 8%, historically a reverse area for the cryptocurrency. When Ethereum’s Dominance touched the $7.5%-8.25% range, it reversed “to become more market-dominant,” which could signal a reversal for the King of Altcoins.

Several analysts consider that the key levels to watch are the $1,750 support and the $2,100 resistance, as a break above or below these levels will determine ETH’s next significant move.

Analyst Sjuul from AltCryptoGems suggested that Ethereum could eye a 20% rally based on a Power of 3 setup in ETH’s lower timeframe chart. The analyst highlighted that the cryptocurrency had an accumulation phase after dropping below the $2,150 support, hovering within the $1,840 and $2,100 levels since March 10.

After dipping below the $1,840 mark, the cryptocurrency has been in the manipulation phase, the chart shows, which could trigger a push to the $2,150 resistance if ETH breaks out and starts the distribution phase.

As of this writing, Ethereum trades at $1,808, a 2.2% surge in the daily timeframe.