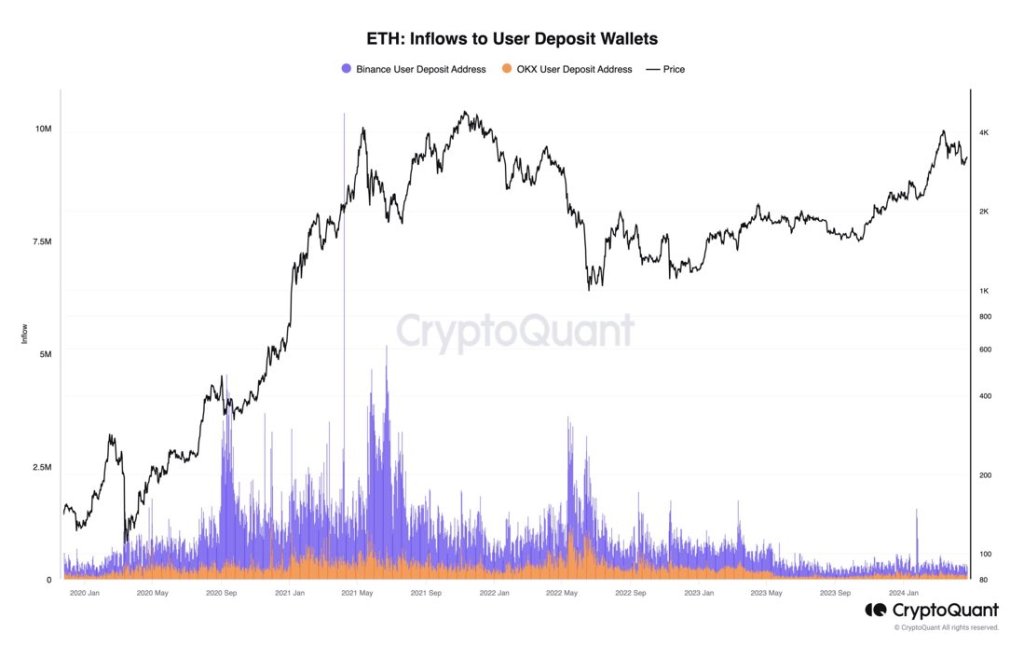

Taking to X on April 26, one analyst notes that there is a high probability of Ethereum spiking in the sessions ahead because of thinning sell-side liquidity across major centralized exchanges like Binance and Coinbase.

Thin Sell-Side, Big Potential Move For ETH

Thinning sell-side liquidity, as seen on order books across CEXes, means that few sellers are willing to liquidate. With few sellers on the market, a small upsurge in demand could theoretically see prices skyrocket.

Even so, market makers could fill this imbalance by considering how the market works. At the same time, prices are not guaranteed to rally even if they remain as they are.

Unlike new meme coins, for instance, Ethereum is extremely liquid; it is the second largest coin by market cap, only trailing Bitcoin. That means billions will be needed to push prices above the immediate resistance levels at $3,300 and $3,700, as clearly shown in the daily chart.

Ethereum has been under pressure for the better part of April following a drop from its all-time high of $4,090. Looking at the development in the daily chart, the coin is down 23% from all-time highs, finding strong rejection from the middle BB–or the 20-day moving average.

Analysts expect buyers to take over and reverse mid-April losses if a comprehensive breakout above $3,300 is marked by expanding volume. If not, ETH risks falling below $2,800, aligning with the April 12 and 13 sell-off.

Spot Ethereum ETF Launch In Hong Kong, Adoption Fuel Optimism

However, traders are generally bullish, anticipating a price rebound in the months ahead. Several factors could propel ETH prices upwards. A major catalyst is the highly anticipated launch of spot Ethereum exchange-traded funds (ETFs) in Hong Kong. Like the impact of spot Bitcoin ETFs on BTC prices, this product for ETH may prop up the coin, allowing traditional investors to gain exposure to the second world’s most valuable coin.

In the United States, the largest obstacle preventing the Securities and Exchange Commission (SEC) from approving a similar product is the uncertainty of ETH’s classification. On April 25, ConsenSys sued the regulator, pressing the regulator to classify the coin as a commodity.

Beyond the launch of this product by the end of the month, Ethereum’s core strengths remain. The ongoing adoption of Ethereum and Layer 2 scaling solutions continues. As more protocols choose to deploy on the smart contracts platform, it fosters optimism for Ethereum’s long-term viability and growth.