Ethereum is tracking lower when writing, sinking roughly 18% from March 2024 highs. Even though bears appear to be in control at spot rates, keeping the second most valuable coin below $3,700, confidence is high among analysts.

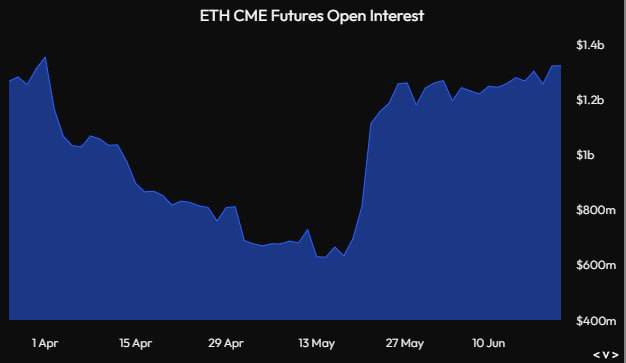

ETH Futures Open Interest Rising On CME

Taking to X, one of them noted that there are solid signs that institutions are positioning themselves to push prices higher. Citing rising open interest in Ethereum Futures at CME, a bourse, the analyst said it is highly likely that the “big money” is accumulating ETH, taking advantage of the recent correction.

To reassert this outlook, the analyst said the trend observed from the Ethereum CME futures contracts’ open interest is a reliable telltale sign.

Notably, this trend mirrors what transpired with Bitcoin futures before the launch of spot Bitcoin exchange-traded funds (ETFs). For this reason, the analyst is convinced that a similar pattern is printing for Ethereum.

Currently, Ethereum is printing discouraging lower lows. Sellers have been resilient, deflating any momentum buildup and placing caps on bulls.

So far, it is emerging that $3,700 is a resistance level for traders to monitor closely. Bulls did not launch a counter once it was broken on June 7, and the bear breakout was confirmed four days later on June 11.

Despite the current market conditions, the launch of Ethereum spot ETFs could still drive prices to new heights. The analyst predicts a potential expansion to $5,000, confirming the Q1 2024 trend and the breakout above the current flag.

Still, whether bulls will be in control depends on how price action pans out. Technically, open interest shows the cumulative summation of both open or long-leveraged positions. If buyers push prices to rise, ETH should expand in the coming days, even breaking $3,700 this week.

Spot Ethereum ETF Optimism: Will They Be A Success?

Beyond this, the recent flurry of activity surrounding spot Ethereum ETF applications bolsters this optimism. On June 21, seven applicants, whose 19b-4 forms were recently approved, submitted amended S-1 registration statements with the United States Securities and Exchange Commission (SEC). Analysts now think the regulator could approve the trading of these products by early July 2024.

While bullish for Ethereum, some analysts are not convinced they will enjoy similar success as those seen when spot Bitcoin ETFs began trading. Eric Balchunas, Senior ETF analyst at Bloomberg, predicted that spot Ethereum ETF would succeed if it grabs just 20% of all the capital inflow going to its Bitcoin counterpart.