In recent on-chain data from Spot On Chain, an Ethereum whale appears to have engaged in significant accumulation activity, sparking interest and speculation within the ETH community.

According to the platform, the whale address in question has purchased a total of 64,501 ETH in the past three days, amounting to roughly $187 million at current market prices,

Ethereum Whale Accumulation

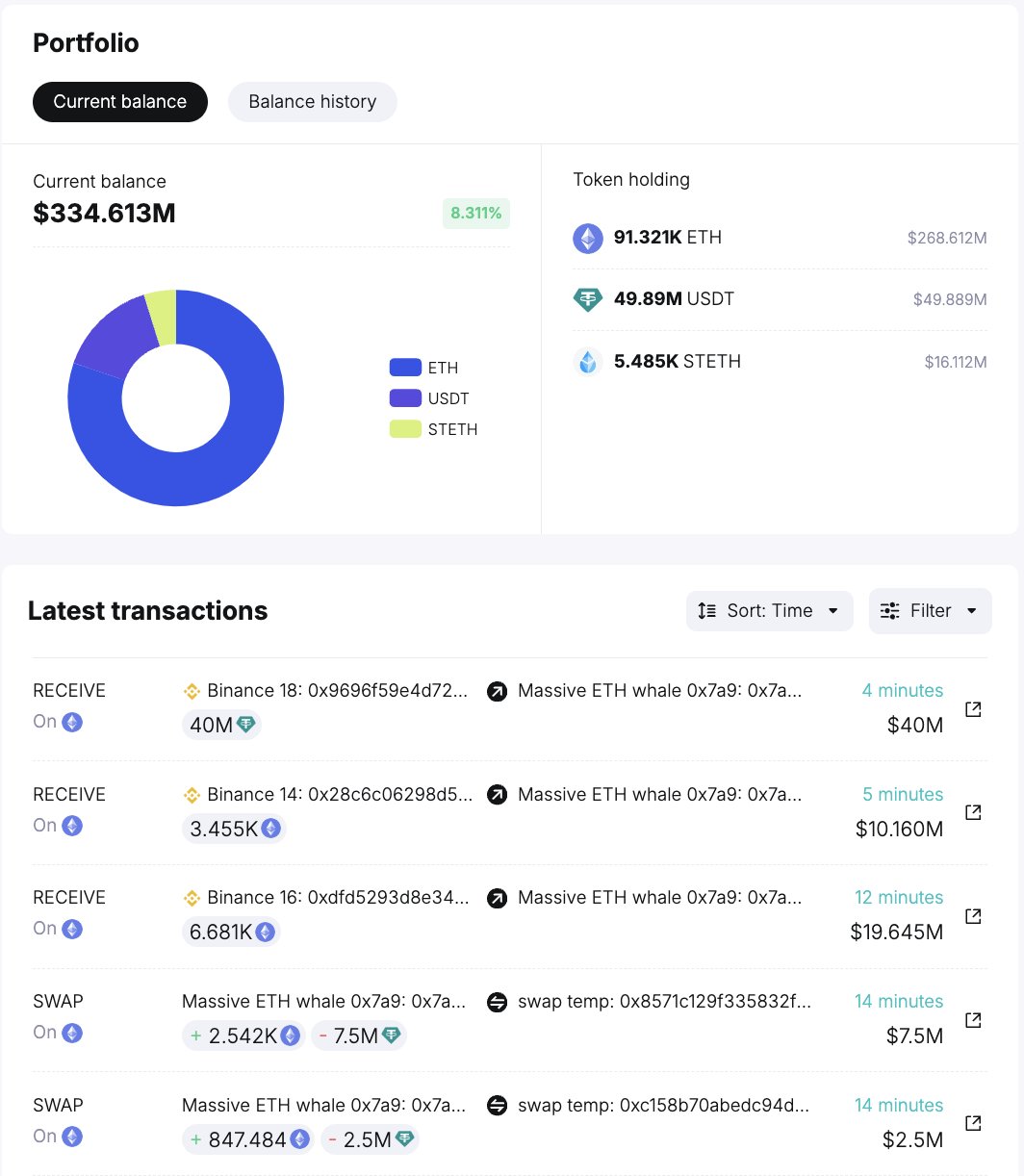

Spot On Chain reported that earlier today, the whale acquired approximately 13,526 ETH at an average price of $2,947 per ETH. This accumulation, valued at over $39 million, adds to the already substantial holdings of the whale, suggesting a bullish outlook on Ethereum’s future trajectory.

The platform’s data further reveals that the whale withdrew 10,136 ETH from Binance while purchasing 3,390 ETH from 1inch. These purchases have compounded the whale’s accumulation of ETH in the past three days to a total of 64,501 ETH.

Additionally, Spot On Chain highlights the withdrawal of an additional 40 million USDT from Binance, prompting speculation regarding its potential use for further Ethereum purchases.

According to the portfolio image above that Spot On Chain shared, the whale’s wallet holds a total of 91,321 ETH, in addition to approximately $49.8 million worth of USDT and 5,485 STETH. These assets, in total, are estimated to be $334 million.

Giant whale 0x7a9 allegedly bought 13,526 $ETH ($39.85M) at ~$2,947 again!

• withdrew 10,136 $ETH ($29.85M) from #Binance

• bought 3,390 $ETH with 10M $USDT #1inchOverall, the whale has bought 64,501 $ETH ($185.5M) in the past 3 days!

It also withdrew another 40M $USDT from… https://t.co/UHIVXfx6Wq pic.twitter.com/ySbvIv2mux

— Spot On Chain (@spotonchain) February 21, 2024

Ethereum’s Price Action And Expert Sentiment

Ethereum has continued to showcase bullish momentum, trading up by nearly 6% over the past week. However, despite briefly surpassing the $3,000 mark, Ethereum has retraced slightly in the past 24 hours, trading around $2,900 at the time of writing.

This pullback has not dampened optimism within the crypto community, with many anticipating further upward movement. Industry experts have weighed in on Ethereum’s performance, with Stefan von Haenisch of OSL SG Pte in Singapore noting the cryptocurrency’s potential to outperform Bitcoin in the coming months.

Haenisch attributes this optimism partly to speculation surrounding the potential approval of spot Ethereum exchange-traded funds in the US. Michaël van de Poppe, CEO of MN Trading, echoes this sentiment, forecasting a potential surge for Ethereum to $3,800 to $4,500 shortly.

#Ethereum is on its way towards $3,800-4,500. pic.twitter.com/TfoBGloBsH

— Michaël van de Poppe (@CryptoMichNL) February 19, 2024

Featured image from Unsplash, Chart from TradingView