The post Ethereum Whales Turn Bullish; Can They Fuel An End Of Year Rally? appeared first on Coinpedia Fintech News

Ethereum (ETH) price has gradually signaled bullish sentiment in the last few days. As the fear of further crypto capitulation subsided in the recent past, the large-cap altcoin, with a fully diluted valuation of about $388 billion at press time, has recorded three consecutive weekly green candlesticks.

What’s Next for Ethereum Price?

Following the gradual ETH price surge in the past three weeks, the altcoin is well-positioned to rise to the liquidity range between $3,450 and $3,500 in the coming days. Moreover, the ETH/BTC pair has signaled bullish sentiment after establishing a rising trend following a breakout of a multi-year bear market.

Crypto analyst @seth_fin on X noted that the ETH/USD pair has broken above and retested a falling logarithmic trendline. The midterm bullish sentiment for ETH will be invalidated if the ETH price consistently closes below $3,050, which will increase the odds of a drop towards $2,900.

Source: X

ETH Whales on a Buying Spree

The midterm bullish outlook for ETH is bolstered by the mainstream adoption from institutional whale investors. Raoul Pal, CEO of Real Vision, stated during the Binance Blockchain Week 2025 that Ethereum has significantly benefited from the strong liquidity and mainstream institutional adoption.

According to onchain data from Arkham, the popular $10 billion Hyperunit whale, who made $200 million during the October 11 crypto crash, has been buying Ethereum for the past four days. At press time, this Hyperunit whale had accumulated more than $400 million in Ethereum.

Arkham data also showed that Tom Lee led BitMine purchased $112 million of ETH during the past 24 hours, thus currently holding 3,898,455 ETH valued at $12.41 billion.

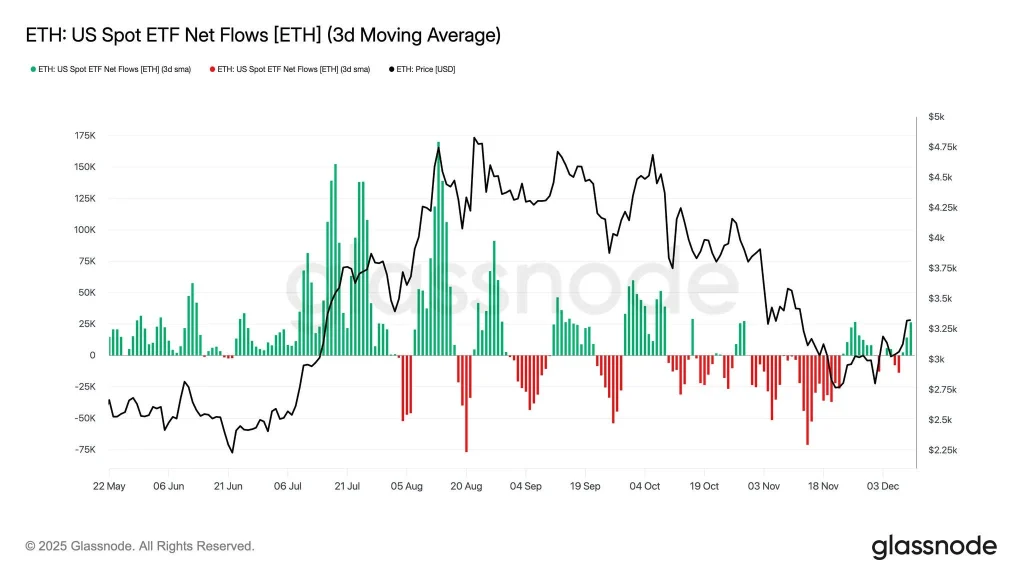

Source: Glassnode

Meanwhile, Glassnode data shows the U.S. spot Ether ETFs have resumed accumulation. If the spot ether ETFs continue to buy in the coming days, the ETH price will likely close 2025 above $4k.