With the broader crypto market sentiment still highly bearish, Ethereum’s ongoing decline has deepened as the second-largest digital asset pulls back toward the $4,100 price level. In the meantime, ETH key investors are beginning to exhibit waning confidence in the altcoin’s price action, which is indicated by a drop in whale holdings.

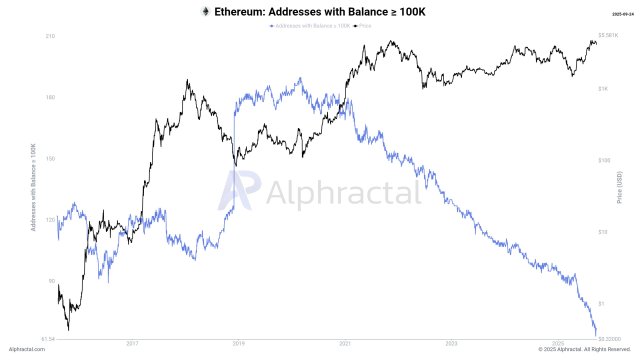

A Constant Drop In Ethereum Whale Count

While the price of Ethereum has experienced a sudden pullback, the sentiment of major key investors has flipped negative. Joao Wedson, a market expert and the founder of Alphractal, has revealed a notable shift in investors’ mood as the number of whales, those holding massive amounts of ETH, continues to decrease.

This drop suggests that big holders might be shifting their holdings, which might give smaller investors and new entrants more market power. Even though the decline in whale dominance is sometimes interpreted as an indication of decentralization and healthier market dynamics, it may also suggest cautious sentiment in the face of changing market conditions.

Given that whales are exiting, their market grip has lessened compared to other key investors. According to the market expert, ETH’s investors holding between 10,000 ETH and 100,000 ETH, considered as Sharks, are now at the forefront of the market.

While the whales are offloading their positions, the sharks have been persistently accumulating the altcoin at a rapid rate. As a result, these investors are now controlling a larger share of the market, even as broader sentiment remains mixed. Amid this crucial shift in investor dominance, Wedson highlighted that the Gini Coefficient has started to rise again after recently experiencing a drop.

The development signals that inequality on the Ethereum network is increasing, which implies that the concentration of ETH is shifting toward wealthier addresses, mostly these “sharks.” In other words, those presently stacking up and speculating on ETH are mid-sized entities, funds, and players with medium-level capital.

On the other hand, Wedson noted that whales are usually exchanges, large funds, or former miners who are continuously selling their positions to new investors or buyers. Since sharks are acquiring more coins than smaller holdings, the network inequality is moving upward once again.

ETH Accumulation Addresses’ Rise Pushes Realized Price

The current wave of buying pressure has led to a rise in Ethereum Accumulation Addresses, which has pushed the Average Realized Price. Burak Kesmeci, a market expert, reported the rise in accumulation addresses in a recent quick-take post on the CryptoQuant platform. Data shows that the average realized price of ETH accumulation addresses is currently positioned at the $2,900 level.

With the ETH ETF rally, this level surged sharply from $1,700 to $2,900. In the worst situation, this level might be a solid foundation in the altcoin’s journey. Meanwhile, the total balance of the accumulation addresses spiked, reaching approximately 27.6 million ETH.