During what many anticipated would be the year of a major Bitcoin (BTC) bull run, market expert Axel Adler has revealed that the leading cryptocurrency finds itself at the midpoint of a bear cycle.

A Mild Bear Cycle Compared To History

As of now, Bitcoin has recorded a modest year-to-date decline of 4%. However, the cryptocurrency has shown some stability this week, consolidating in the range of $89,000 to $94,000, with the latter figure serving as immediate resistance.

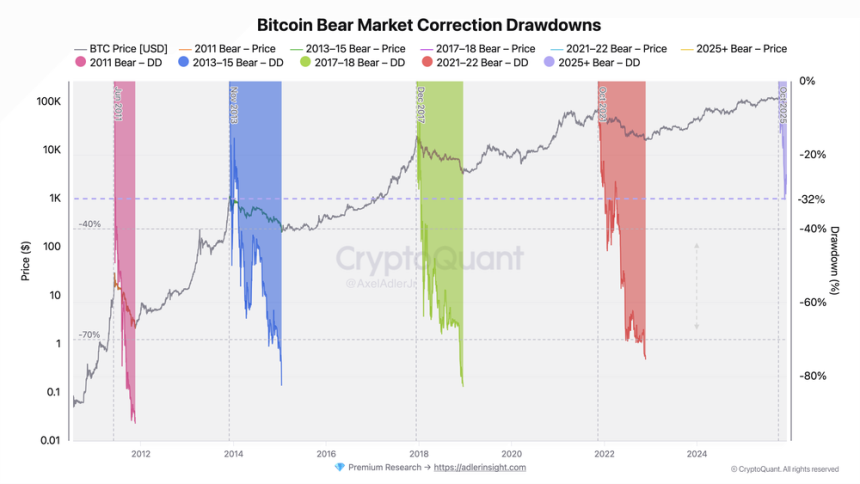

According to Adler, this current correction, which stands at approximately -32%, is considered less severe compared to previous bear cycles. He emphasizes that approximately 88% of Bitcoin holdings remain in unrealized profit, while only about 12% of the total supply is currently at a loss.

Adler points out that Bitcoin’s price action has remained relatively steady within the $90,000 zone, reflecting a mild drawdown in historical context.

The crucial question as the year approaches its end is whether this correction will stabilize between -35% and -40% from its all-time high, indicating a new, more “flattened” cycle, or if the market will follow historical trends that typically lead to deeper declines of -60% to -70%.

Analyzing past cycles, Adler notes that major bear markets in 2011, 2016, 2019, and 2023 were characterized by a significant increase in the percentage of coins at a loss, often rising to around 60%. These levels typically marked capitulation points in the market.

In contrast, the current landscape shows only 12% of holders experiencing unrealized losses, which diverges sharply from the patterns observed during past bear markets.

Can Bitcoin Avoid Deeper Declines?

The expert further noted that during recent local cycle peaks, only about 17% of coins were in the red, a figure that remains three to four times lower than traditional capitulation levels.

This unusual configuration suggests that the current market may resemble a correction within a bullish supercycle rather than the final downturn of a full-blown bear market.

Adler believes that the market appears to be testing the resilience of this correction structure, which stands at -32% from its peak, while maintaining a high ratio of profitable positions.

He argues that if Bitcoin can sustain this maximum drawdown above the -35% zone alongside moderate unrealized losses, it could bolster the case for a shift towards more “flat” corrections influenced by institutional demand and a structural supply deficit.

On the contrary, should Bitcoin’s correction extend beyond the -40% mark, the likelihood of entering a classic bear market increases significantly. Such a scenario would pave the way for deeper declines, potentially reaching the -60% to -70% range, and could trigger a full capitulation phase in terms of unrealized loss metrics.

At the time of writing, the market’s leading cryptocurrency is trading at $93,000, marking gains of 5% and nearly 9% in the 24-hour and 14-day time frames, respectively.

Featured image from DALL-E, chart from TradingView.com