Crypto markets saw a modest lift after the US Federal Reserve made another move on rates, and traders are watching for a clearer follow-through. According to reports, the Fed has carried out three consecutive interest rate cuts totaling 0.75% from September to December. The move was widely expected. Still, market responses have been mixed and somewhat choppy.

Fed Moves And Market Takeaway

According to CoinEx chief analyst Jeff Ko, much of the Fed’s action was already priced in, and the updated dot plot leaned a bit more hawkish than some had hoped.

Ko pointed to $40 billion in short-term Treasury purchases as a technical step to ease liquidity and lower short-term rates, not as a broad stimulus program.

Markets took the measures as mildly positive. US stocks rose, and that helped Bitcoin find some footing after an early dip.

Santiment And The Short-Term Reaction

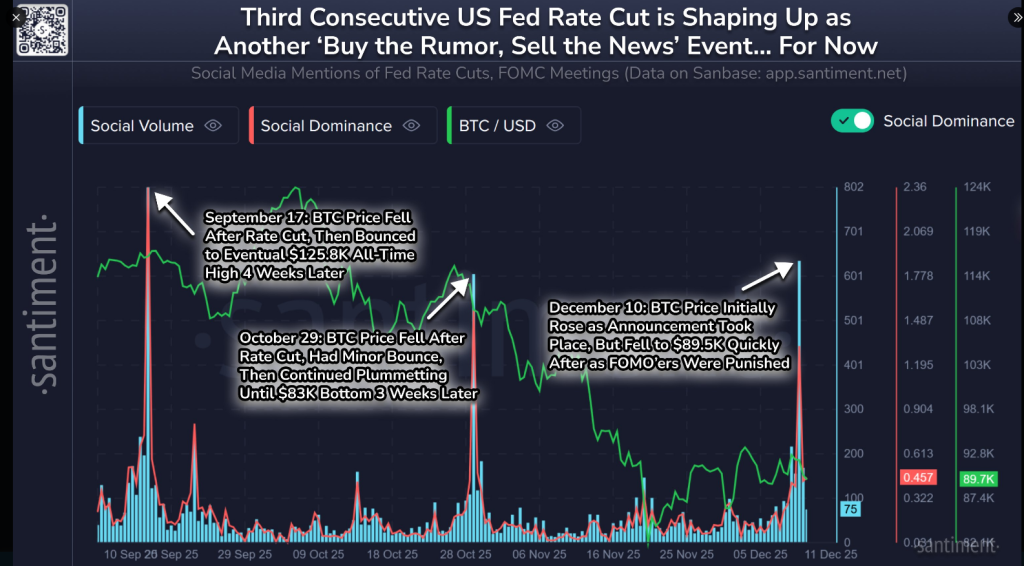

Based on reports from onchain analytics firm Santiment, each cut has prompted a classic “buy the rumor, sell the news” move where initial optimism is followed by short selling.

The US Fed made three strategic cuts over the past 3 months, resulting in a total of an 0.75% reduction to interest rates.

1⃣ September 17, 2025: Fed lowered the target range to 4.00 %–4.25 % (from 4.25 %+) at the 16–17 Sep meeting.

2⃣ October 29, 2025: Fed cut the rate to… pic.twitter.com/X6DWypvq5t

— Santiment (@santimentfeed) December 11, 2025

Cuts are seen as bullish for crypto over the long haul, yet they have triggered brief pullbacks in practice. Santiment adds that a small wave of FUD or retail selling often signals that the mild post-cut downswing is finished and a bounce may follow once things calm down.

Technical Levels Traders Are Watching

Bitcoin was volatile in the aftermath. It fell under $90,000 then popped to $93,500 on Coinbase before settling near $92,300 at the time of reporting. Key resistance sits between $97,000 and $108,000.

On the daily chart, BTC remains inside a small rising channel that sits within a larger downtrend, and technical traders note that a MACD histogram is approaching a positive crossover — a sign some see as possible renewed momentum.

ETF activity has been tepid, with only $219 million in net inflows since late November, which keeps some investors cautious.

Dollar Weakness And Equity Signals

A weaker dollar has been part of the backdrop; the DXY index fell to 98.36 and is showing bearish momentum on its own MACD.

Nasdaq’s move back above its 50-, 100- and 200-day simple moving averages helped lift risk assets briefly, and that has supported Bitcoin’s rebound attempts.

Yet correlation with equities remains uneven — losses in stocks tend to hit Bitcoin harder than gains help it, creating an asymmetric risk profile for traders.

Featured image from Impossible Images, chart from TradingView