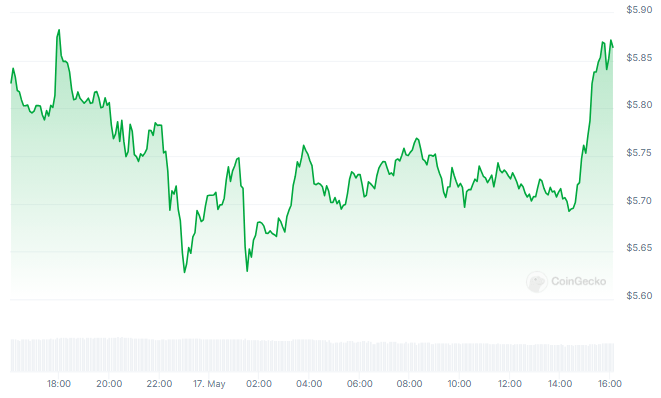

After a period of correction, Filecoin (FIL) is teasing a potential price surge, buoyed by bullish technical indicators and analyst predictions. As of Friday afternoon, FIL is hovering around $5.80, but whispers of a $15 target in the coming weeks are swirling in the cryptosphere.

Recent Price Surge Ignites Investor Interest

FIL has been on a tear lately, defying the overall slump in the cryptocurrency market. Over the past 24 hours, the token saw an increase of over 7%, accompanied by a healthy trading volume exceeding $420 million. This surge in price and activity has grabbed the attention of market watchers, with many speculating on the possibility of a sustained upward trend.

Analyst Eyes $15: Falling Wedge Breakout Hints At Price Reversal

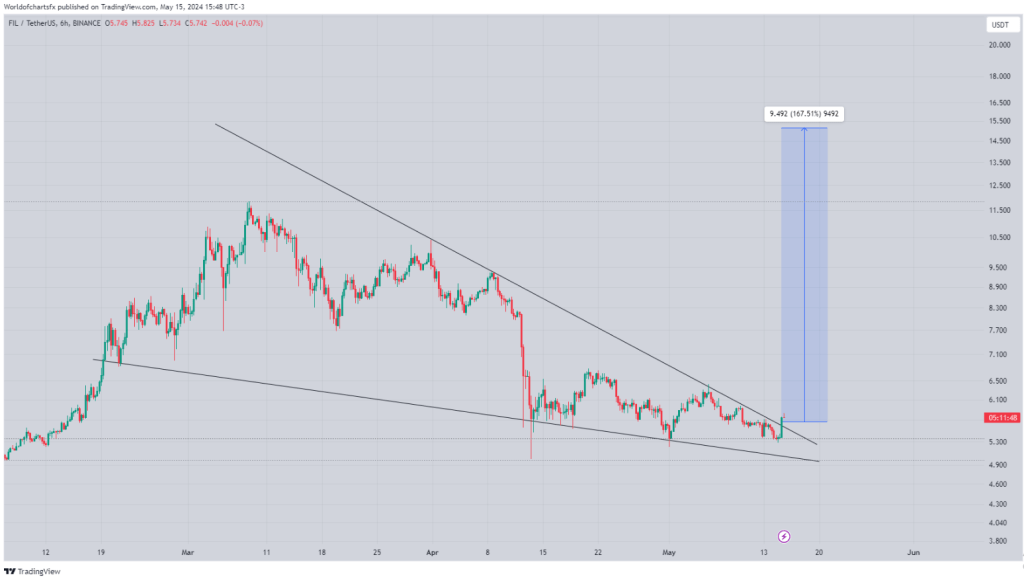

Adding fuel to the fire is crypto analyst World Of Charts, who has expressed a decidedly bullish sentiment on FIL’s future. According to their analysis, the recent price correction appears to be nearing its end.

Healthy Correction Has Almost Over Seems Like #Fil Will Recover From Here Falling Wedge Breakout Has Already Confirmed Expecting Move Towards 15$ In Coming Weeks#Crypto #Filcoin pic.twitter.com/O61j9B02ha

— World Of Charts (@WorldOfCharts1) May 15, 2024

They point to a confirmed falling wedge breakout pattern, which historically indicates a potential trend reversal. This technical indicator suggests FIL could be poised for a significant rebound, with World Of Charts setting a target price of $15 in the coming weeks.

FIL’s Resilience Bodes Well For Future

Further bolstering the bullish case is FIL’s defiance of the broader downward trend in the crypto market. While many digital assets have been experiencing significant price drops, FIL has managed to hold its ground. This resilience suggests strong underlying support and potential for future growth.

Filecoin: Technical Indicators Flash Green

Technical analysis also paints a positive picture for FIL. The RSI (Relative Strength Index), a momentum indicator, is currently exhibiting a slow but steady upward trajectory. This suggests that FIL is not overbought and has room for further price appreciation.

Additionally, FIL has historically displayed a pattern of high trading volume at price peaks and low volume during price dips. This ongoing trend signifies strength in the token’s price action.

Breach Of Support Could Dampen Optimism

However, the bullish outlook is not without its caveats. A breach below the crucial $5.50 support level could trigger negative sentiment and potentially lead to a price decline. This highlights the inherent volatility of the cryptocurrency market, where unforeseen events can quickly alter price movements.

Furthermore, market sentiment is highly sensitive to external factors such as regulatory news, macroeconomic trends, and technological developments within the crypto space.

Any adverse developments, such as stringent regulatory crackdowns or security breaches, could exacerbate selling pressure and undermine investor confidence.

Featured image from Wallpapers.com, chart from TradingView