Semler Scientific is looking to raise $500 million in new securities after settling a large case with the Department of Justice, according to company filings. The health care technology company will use some of the money to expand its crypto holdings, which are already in excess of 3,000 coins.

Company Enters $30 Million Settlement With Justice Department

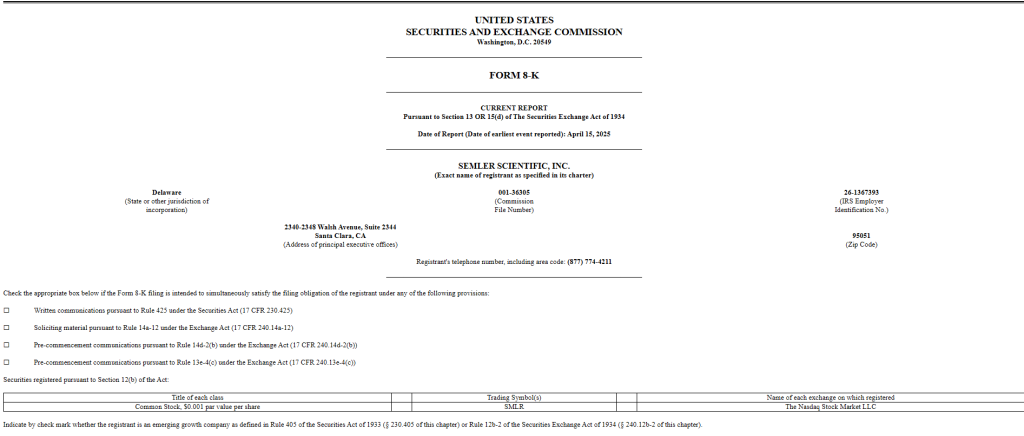

As per recent Securities and Exchange Commission (SEC) filings, Semler Scientific has reached a $29.75 million settlement with the Department of Justice regarding marketing practices for its QuantaFlo product. The probe, which started in 2017, centered on potential violations of federal anti-fraud laws regarding the manner in which the company marketed its flagship product.

The settlement negotiations progressed in recent months following years of cooperation with several subpoenas. The deal is not complete yet, according to the company’s Tuesday SEC filing, but Semler has already obtained a way to finance the payment.

Coinbase Loan To Fund Settlement Without Selling Bitcoin

Instead of liquidating its cryptocurrency holdings, Semler intends to use a loan from Coinbase to settle the DOJ case. The loan will be secured by the company’s large Bitcoin reserves, which stand at 3,190 BTC valued at about $267 million at current market prices.

This funding strategy enables Semler to satisfy its legal requirements without liquidating its cryptocurrency holding. With Bitcoin as collateral, the company can preserve its balance sheet strength while fulfilling the settlement needs.

Half-Billion Dollar Securities Filing Points To Bigger Crypto Plans

Apart from the settlement expenses, Semler has submitted an S-3 registration to the SEC to sell $500 million worth of securities. The filing indicates the company is not merely raising cash to pay the DOJ settlement but wants to increase its Bitcoin holding substantially.

The action is made at a time when other businesses continue to accumulate Bitcoin into their coffers. According to reports in the filing, Michael Saylor’s firm recently bought 3,450 bitcoins worth $286 million, increasing its holdings to 531,640 bitcoins. Another company, Metaplanet, acquired $26 million worth of Bitcoin over the same time.

Market Analysts Remain Bullish Despite Price Swings

The timing of Semler’s intended Bitcoin buys is during market volatility yet also forecasts of extreme price appreciation. An analyst, who goes by the handle “Titan of Crypto” forecasted Bitcoin to hit $137,000, although no timeframe was given for that price level.

The healthcare technology firm has not indicated precisely when it will finish its securities offering or make further Bitcoin buys. Nevertheless, the SEC filing clearly indicates that adding to cryptocurrency holdings is still a priority in addition to paying for the DOJ settlement.

Featured image from Pexels, chart from TradingView