Welcome to the February CryptoSlate Alpha Monthly Snapshot, an exclusive round-up designed for our CryptoSlate Alpha subscribers.

In February, our comprehensive reports and insightful articles delved deep into the crypto ecosystem, offering a blend of market analysis, research insights, and forward-looking trends that could shape the future of finance and technology.

Our February Alpha Market Reports included an in-depth look at the economic implications of the Fed’s reverse repo (RRP) facility and its potential ripple effects on Bitcoin, alongside a critical analysis of credit spreads and their significance for the crypto market.

We also explored why governments should favor regulating stablecoins over developing Central Bank Digital Currencies (CBDCs), offering a nuanced perspective on digital currency governance.

Research articles highlighted record-breaking economic investment in Bitcoin, analyzed the calm before the storm in Bitcoin’s market behavior, and presented the unprecedented stability in Bitcoin futures and options open interest.

Notably, our insights pointed out the critical role of US exchanges in providing liquidity to the Bitcoin market and the shifting trend towards long-term holding as exchange balances dipped to their lowest since 2018.

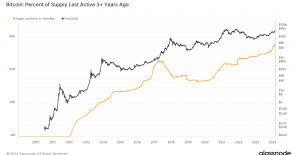

Our top Alpha Insights offered a comprehensive view of the crypto landscape, from the implications of HODL waves and on-chain metrics suggesting a speculative market and potential network health declines to the significant impact of short-term trading volumes and institutional participation.

We dissected the true cost of mining one Bitcoin, examined the speculative and resilient nature of Bitcoin investors, and provided a granular analysis of Bitcoin’s trading patterns, supply distribution, and the effects of ETFs on market dynamics.

Join us as we unpack these topics, offering our Alpha subscribers a wide array of data-driven analyses and expert commentary on the evolving crypto space.

February α Market Reports

The economic implications of the Fed’s reverse repo (RRP) facility

CryptoSlate explores the intricacies of the RRP facility, exploring its impact on traditional financial markets and its potential effects on Bitcoin.

What are credit spreads, why are they tight, and what does it mean for Bitcoin?

CryptoSlate’s dives into the concept of credit spreads and analyze their current state to understand their impact on the broader financial and crypto markets, especially on Bitcoin.

Why governments should regulate stablecoins instead of developing CBDCs

CryptoSlate looks into the benefits of stablecoin regulation to explore why it would serve both private and public interests better than CBDCs.

February α Research Articles

Record high realized cap shows unprecedented economic investment in Bitcoin

The Bitcoin network and its participants have never been as economically invested in BTC as as they are now.

The Bitcoin market faces a critical moment amid soaring unrealized profits

Spot ETF inflows and bullish sentiment buoy Bitcoin, despite potential volatility from unrealized gains.

Bitcoin’s surge to $57K did not result in liquidation storm, defying expected trend

Despite Bitcoin’s high flying, liquidations remain grounded — indicating a market that is cautious.

Bitcoin futures and options open interest soars in February

Bitcoin’s options tilt towards bullish calls, despite a short-term uptick in defensive puts

Bitcoin network congestion eases as mempool clears in February

Bitcoin’s mempool unclogs in February bringing a breath of fresh air to transaction processing.

How do US exchanges contribute to Bitcoin’s market liquidity?

US exchanges account for a relatively small portion of the global trading volume but provide 49% of the global liquidity, which suggests they have greater market depth to facilitate larger transactions for a smaller number of traders.

Bitcoin exchange balance dips to lowest since 2018 as market shifts to HODLing

Bitcoin holders move away from exchanges in long-term holding trend.

Rising stablecoin supply shows an influx of capital into the crypto market

Growing stablecoin market cap shows increased capital flow into crypto and investor readiness for market movements.

On-chain data shows Bitcoin supply is tightening

Unspent transaction outputs and accumulation trends signal a tightening Bitcoin supply amid rising institutional interest.

Futures open interest hits two-year peak with Bitcoin above $50k

Record high in Bitcoin futures open interest aligns with its price breakthrough.

Bitcoin’s risk-adjusted return potential skyrockets as Sharpe Signal surges

Glassnode’s new metric shows a promising rebound in Bitcoin’s market sentiment.

Why did Bitcoin’s market cap surge by over $102 billion while realized cap only grew by $4 billion?

While Bitcoin’s market cap witnesses drastic increase, its realized cap offers a more grounded perspective of value.

Bitcoin above $44k spurs market confidence with spike in unrealized profits

Profitability skyrockets among Bitcoin investors as market sentiment improves.

What Bitcoin’s trading patterns on centralized exchanges tell us about the market

CryptoSlate’s analysis of Kaiko data showed that the majority of global Bitcoin trading takes place outside the U.S. on Binance.

Bitcoin options show long-term bullishness and near-term pessimism

Bitcoin options data shows a bullish future outlook amidst current market hesitation.

How ETFs affected Bitcoin’s supply distribution across cohorts

Spot Bitcoin ETFs caused significant shifts in Bitcoin supply distribution.

Short-term trading volume peaks as Bitcoin crosses $43,000

Bitcoin’s SLRV ratio shows spot Bitcoin ETFs most likely spurred unprecedented short-term trading volumes.

Whales and institutions lead the charge in Bitcoin’s exchange volume surge

Glassnode data shows whales and institutions as primary actors in Bitcoin’s exchange volume rise.

Here’s why Bitcoin perpetual futures market saw high volatility in January

January sees traders reassessing Bitcoin perpetual futures amidst emerging ETF options.

Marathon vs Riot: Analyzing the true cost of mining 1 bitcoin

Estimating the true average cost of mining a single Bitcoin for two of the largest publicly traded Bitcoin mining companies.

February Top α Insights

Analysis of HODL waves reveals a speculative market at play

Bitcoin’s journey from $25,000 to $50,000 not marked by extreme short-term speculation.

On-chain metrics reveal Bitcoin network’s health hinting at potential decline

Monthly and yearly metrics of Bitcoin on-chain activity reveal network health and utilization trends, highlighting potential declines.

Bitcoin’s STH Realized Price nears $40,000, signaling strong market momentum

Analyzing Bitcoin’s dynamics: The STH Realized Price’s role in current market trends.

U.S. leads in Bitcoin price surge as Asia sees decline

The United States, with its bullish stance, leads the pack with a whopping 12,200% price change.

Analysis challenges Bitcoin diminishing returns theory amid recent gains

Bitcoin’s current cycle showcases strength with a nearly 287% appreciation from the low, challenging the diminishing returns theory.

2021 Bitcoin investors showcase long-term holding resilience

Bitcoin investors from 2021 lower their cost basis through strategic purchases in a bear market.

After 153 days in $40k-$45k range, Bitcoin aims to close 6th ever monthly close above $50k

Navigating above $50,000, Bitcoin suggests ongoing consolidation after breaking long-term range.

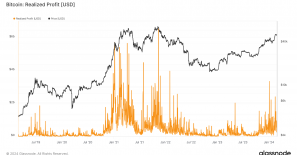

Short term holders sent record $3 billion in profit to exchanges

Spot ETF success propels Bitcoin beyond $58,000, showcasing investor confidence.

Bitcoin investors realize net profits for 128 consecutive days

Despite Bitcoin’s robust performance, 2024’s profit-taking intensity fails to match the 2021 bull run’s fervor.

From record highs to notable lows: Bitcoin fees after the inscription booms

Bitcoin fees hit a new low, miners see fee-based revenue stabilize at 6%.

The post From credit spreads to HODLing patterns: Navigating February’s crypto market shifts appeared first on CryptoSlate.