In an X (formerly Twitter) thread, Coinbase’s director of product strategy & business operations at Coinbase and on-chain sleuth Conor Grogan has revealed how FTX’s Alameda Research allegedly contributed to Tether’s USDT dominance.

Alameda Minted $39.55B of USDT

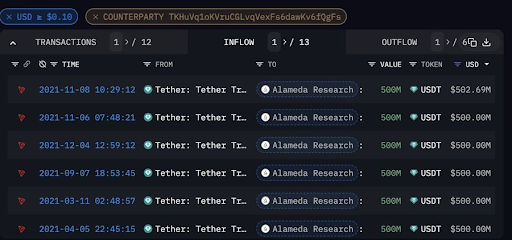

On-chain data gathered by Grogan revealed that the trading firm minted $39.55 Billion worth of USDT, a figure said to account for “475 of Tether’s circulating supply today.” According to data from CoinMarketCap, Tether’s circulating supply currently stands at 83,494,944,358 USDT.

While a previous report had estimated the total number of USDT, which Alameda minted, at $36.7 Billion, Grogan was able to come up with the additional figures with the additional wallets he found on-chain.

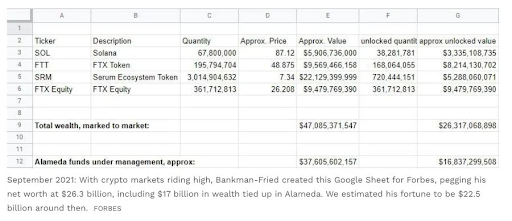

Interestingly, Grogan noted that the amount of USDT minted by Alameda was higher than the firm’s asset under management (AuM) at the crypto peak. According to the data that SBF reportedly submitted to Forbes, Alameda had approximately $37.6 Billion as its funds under management.

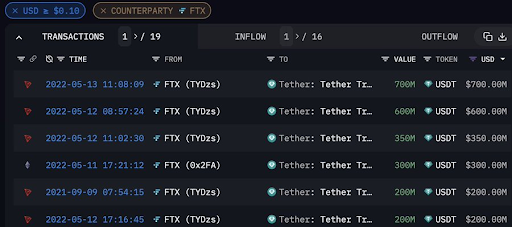

Meanwhile, he highlighted the difficulty in getting accurate data on USDT redemptions. However, by assuming that all USDT redemptions from FTX were from Alameda, he stated that Alameda possibly redeemed $3.9 Billion USDT, with most of these redemptions coming in May 2022, around the time when Terra Luna imploded.

Alameda Had Earlier Revealed Close Ties To USDT

In his thread, Grogan referenced an earlier thread by Alameda’s ex-CEO, Sam Trabucco. In Sam’s thread (made in 2021), he mentioned how traders, including Alameda, took advantage of the arbitrage opportunities that USDT provided, especially when there was a huge demand for the token with people “buying a lot” and “really aggressively.”

Trabucco also seemed to suggest that Alameda contributed to driving USDT’s price above its dollar peg and placing “big bets” on it. He said this was possible as Alameda had the “necessary setup to do large creations and redemptions.”

Alameda’s former CEO, Sam Bankman-Fried (SBF), also quoted Trabucco’s tweet and confirmed that the trading firm created and redeemed USDT using the US dollar. He elaborated that this was done directly with Tether and that they usually created these USDTs in “big size.” As to why they had to create such huge amounts of USDT, SBF stated that they got a “ton of OTC and on-exchange USDT demand.”

SBF, founder of crypto exchange FTX, is standing trial on seven fraud-related charges, with his trial set to continue on October 10. It is expected that his one-time girlfriend and Alameda’s ex-CEO, Caroline Ellison, will take the stand to testify that same day.