Bitcoin this week reclaimed the $94,000 region, but the party may be lacking one key ingredient: real users. The cryptocurrency network is “like a ghost town” even with the record price increase, a crypto expert said.

Bitcoin Surges In Price—Yet Network Remains Eerily Quiet

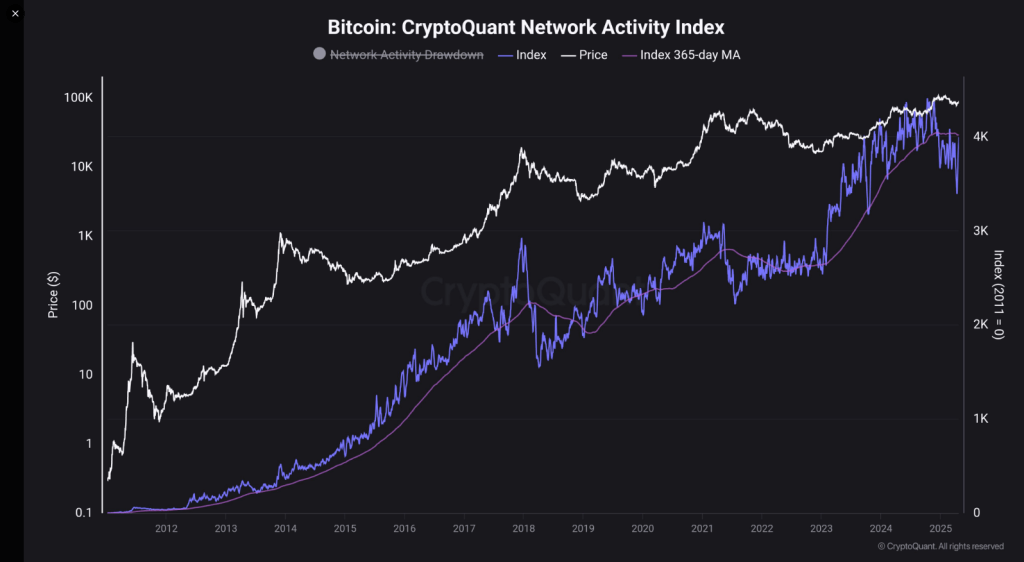

A recent report by CryptoQuant analyst Maartunn shows a dramatic disconnect between Bitcoin’s rocketing price and its underlying network activity. “The Bitcoin network is a ghost town,” the analyst explained when comparing on-chain data to the coin’s current price.

The study employs a 365-day moving average to record network activity from 2015. As years went by, activity and price followed one another. Around early 2025, though, they went different ways. Prices for bitcoin continued to rise even as growth in network activity dwindled and displayed more decreases than in the past.

The Bitcoin Network is a ghost-town

This pump is driven by:

– ETF Flows

– Open InterestThere is hardly any new visible on-chain demand. https://t.co/ceFuk9Wtnq pic.twitter.com/DmoXbxhxXx

— Maartunn (@JA_Maartun) April 24, 2025

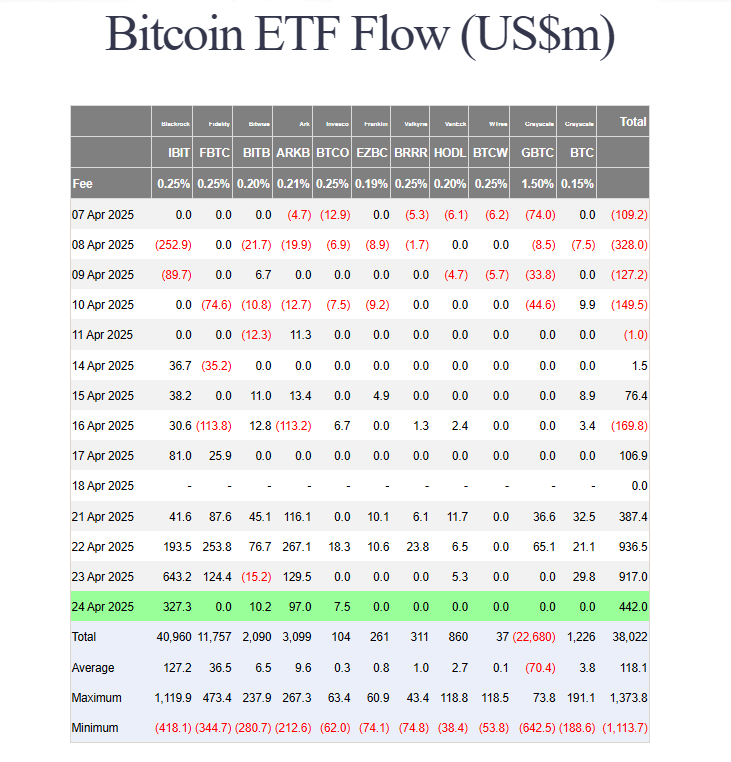

ETF Money Flooding In As Price Rises

The true driving force behind Bitcoin’s surge seems to be institutional capital. According to Farside reports, Bitcoin ETFs witnessed a dramatic surge in money inflow from April 17. By April 21, investors had invested $381 million, and by April 23, it increased to $917 million as buying was still going on.

This timing fits hand in glove with Bitcoin’s rise above $94,000 on April 23. The US Bitcoin ETFs have since inception raked in a whopping nearly $38 billion in net inflows, indicating how much big players in the financial market are transforming it.

On-Chain Data Indicates Decreasing User Activity

Meanwhile, the statistics paint a clear picture of who is not behind the price: common users. Latest data indicates network activity decreased by 0.90% last week. The number of active addresses fell by 1.50% in that particular timeframe.

Even more indicative, zero-balance addresses fell 12.50%, implying further wallets are remaining empty. Those figures create the image of a rally driven by forces beyond regular usage of the core network.

Trump Meme Coin Briefly Steals The Spotlight

In a surprise turn of events, some of the focus moved away from Bitcoin when US President Donald Trump’s staff released a statement saying that the holders of the largest amounts of the TRUMP meme coin would be invited to have dinner with the President. This created a rush to buy the meme coin.

As interest in the TRUMP coin fizzled out, so too did interest in Bitcoin and other top cryptocurrencies. Some analysts noticed that this trend indicates the market still lacks sufficient buying pressure to have multiple hot trends simultaneously.

Featured image from Gemini Imagen, chart from TradingView