Global ETFs

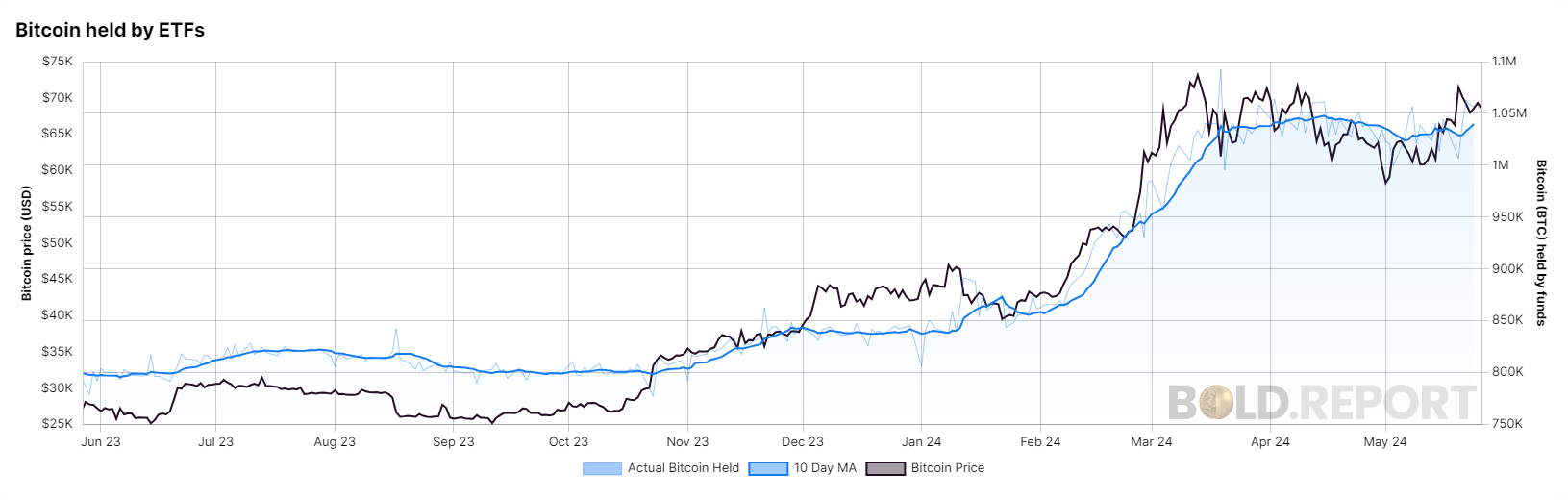

According to Bold.report data, all Bitcoin exchange-traded funds (ETFs) collectively hold over one million Bitcoin, a milestone first achieved on March 12. These ETFs are distributed across several countries, including the US, Sweden, Hong Kong, Germany, Switzerland, Canada, Brazil, and Australia. US-based ETFs lead the pack, with Grayscale GBTC holding roughly 292,000 BTC, followed by BlackRock IBIT with approximately 280,000 BTC, and Fidelity FBTC at 162,000 BTC. These three giants together hold approximately 734,000 BTC.

US ETFs

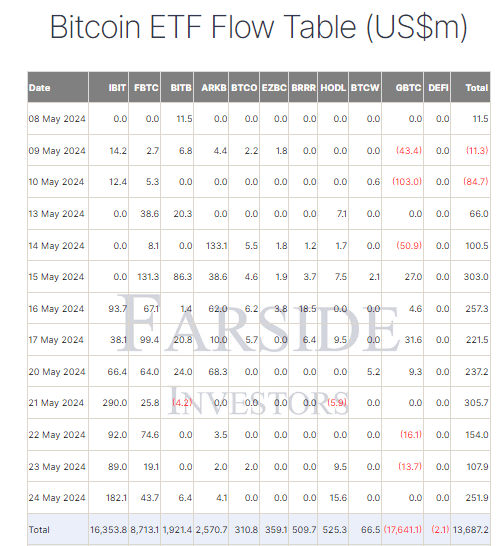

Farside data shows that May 24 marked another robust day for US Bitcoin ETFs, with inflows reaching $251.9 million. This continues a streak of ten consecutive trading days of positive inflows into US Bitcoin ETFs. BlackRock IBIT led the pack with an inflow of $182.1 million, bringing their total net inflow to $16.4 billion. Fidelity FBTC followed with a $43.7 million inflow, pushing their total net inflow to $8.7 billion. VanEck HODL also experienced significant activity, recording a $15.6 million inflow, which raised their total net inflow to $525.3 million. Grayscale GBTC reported no inflows or outflows, maintaining a net outflow of $17.6 billion.

Overall, the total net inflows into US Bitcoin ETFs have now reached $13.7 billion, according to Farside data.

The post Global Bitcoin ETFs surpass 1 million BTC under management appeared first on CryptoSlate.