The global digital asset investment market has significantly rebounded recently, marking a strong recovery for crypto-based funds. According to CoinShares, global crypto investment products brought in $321 million in net inflows last week.

This follows two weeks of outflows, signaling a shift in investor sentiment as macroeconomic conditions, such as the recent US Federal Reserve’s decision to cut interest rates, play a major role in the crypto market’s direction.

Bitcoin And Solana Lead The Inflow Surge

As revealed in the CoinShares report, Bitcoin-based investment products continue to dominate the market, accounting for most of last week’s inflows.

CoinShares shows that Bitcoin products alone saw net inflows of $284 million. This marked a major shift in momentum for the leading crypto, which has consistently outperformed other digital assets in attracting institutional investment.

Interestingly, short-Bitcoin products—those that profit from a drop in Bitcoin’s price—also saw modest inflows of $5.1 million, showing that some investors remain cautious, hedging against potential volatility.

Solana-based funds have also been a standout in recent weeks. According to CoinShares, the asset saw $3.2 million in net inflows last week.

However, while Bitcoin and Solana enjoyed positive momentum, Ethereum-based investment products saw another week of net outflows.

CoinShares report shows that last week alone, Ethereum products recorded $29 million in outflows, extending their losing streak to a fifth consecutive week. This brings the total outflows for Ethereum-based funds to $187.7 million during this period.

What About Regional Flows?

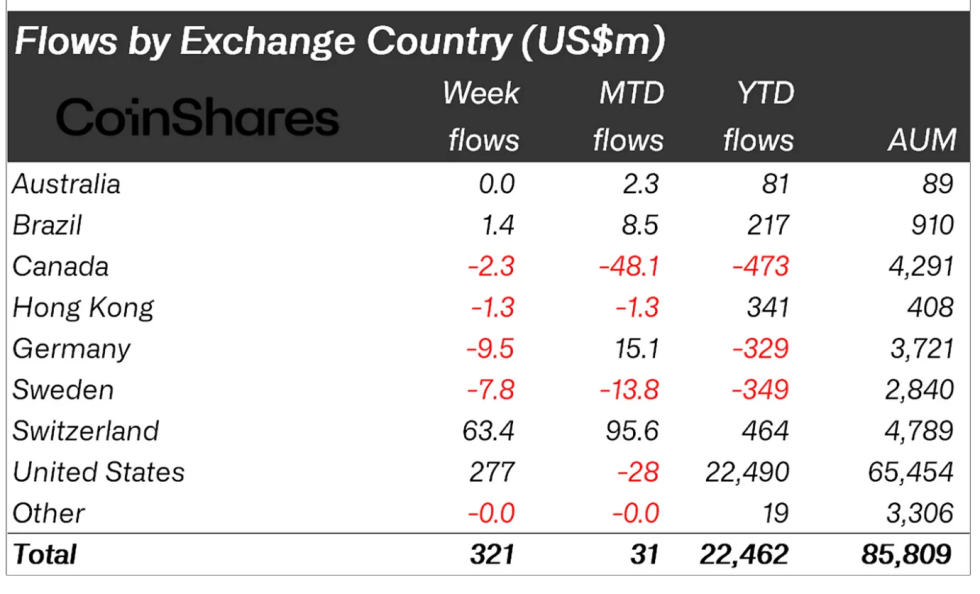

Regionally, the US remains the dominant player in the global crypto investment market, with American-based funds bringing in $277 million in net inflows.

Switzerland followed with its second-largest weekly inflows of $63 million, while countries like Germany, Sweden, and Canada faced net outflows, showing a more mixed picture of global crypto investment.

Notably, the rebound seen in both Bitcoin and Solana, as revealed by CoinShares Head of Research James Butterfill was largely driven by a shift in US monetary policy, particularly the Federal Open Market Committee’s (FOMC) “more dovish stance” and the 50-basis-point interest rate cut.

This monetary easing provided a favorable environment for risk assets, including cryptocurrencies, encouraging increased global inflows into digital asset products.

So far, Bitcoin’s positive inflows have been reflected in its market performance, with BTC now trading back above the psychological $60,000 level. Particularly, at the time of writing, Bitcoin trades for $62,775, down slightly by 1.1% in the past day.

This increase in price performance has also boosted Bitcoin’s market capitalization valuation from below $1.15 trillion last week to currently above $1.25 trillion.

Featured image created with DALL-E, Chart from TradingView