Shiba Inu has been added to the FTSE Grayscale Crypto Sectors Framework, a move that gives the meme coin fresh institutional recognition.

Marketing lead Lucie announced the development on X with a post titled “Good News for SHIB Holders.”

According to the listing, SHIB joins the Consumer & Culture sector alongside Dogecoin, identifying it as a token tied to community, culture, and entertainment.

Good news for SHIB holders

Grayscale’s Market Byte Here Come the Altcoins from October 2025 officially lists Shiba Inu SHIB under the Consumer & Culture crypto sector in the FTSE Grayscale Crypto Sectors framework.

SHIB is recognized by Grayscale Investments and FTSE Russell as… pic.twitter.com/8jBpKkP9PL

— 𝐋𝐔𝐂𝐈𝐄 (@LucieSHIB) November 2, 2025

Inclusion Signals Institutional Recognition

Based on reports, the FTSE–Grayscale framework was launched in 2023 to sort crypto assets into clearer groups for investors.

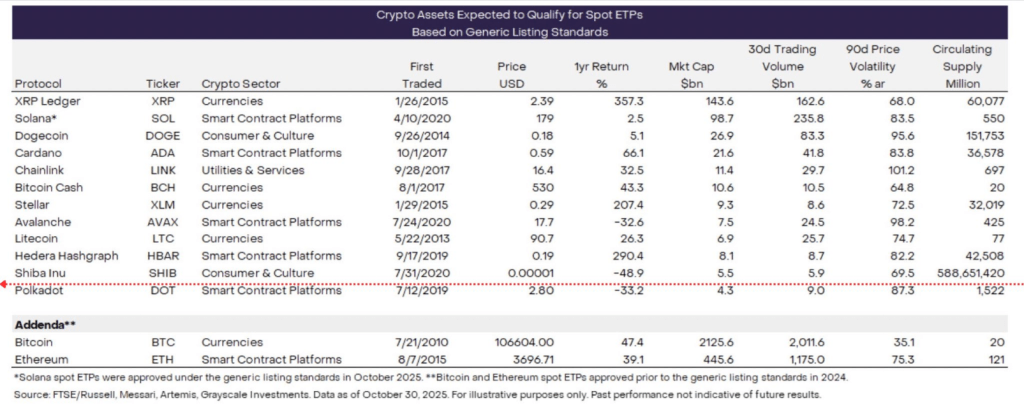

The framework covers five niches, and Grayscale’s latest report lists SHIB among the assets that meet the SEC’s Generic Listing Standards (GLS) criteria.

The GLS rules, approved in September, let exchanges list crypto ETPs under a set of generic requirements rather than seeking individual sign-off for each token.

That opens the door for more straightforward pathways to spot ETPs, although a token still needs an effective registration statement to trade as an ETF.

Shiba Inu Among A Few Eligible Tokens

Reports have disclosed that at least 11 cryptocurrencies across four sectors meet the GLS thresholds. In the Currencies sector, XRP, Litecoin, Stellar, and Bitcoin Cash are named.

Smart contract platforms that qualify include Polkadot, Cardano, Solana, and Avalanche. Chainlink stands alone in Utilities & Services.

In consumer and culture, only Shiba Inu and Dogecoin are recognized. Solana and Litecoin ETFs are already trading in the US, while Cardano, XRP, Dogecoin, and Bitcoin Cash are still awaiting approvals.

Valour Inc. has issued a SEK-denominated ETP tied to SHIB in Europe, and asset manager T. Rowe Price has mentioned SHIB as a candidate for inclusion in its Active Crypto ETF, but SHIB does not yet have a standalone spot ETF filing in the US.

Market Moves And Technical Notes

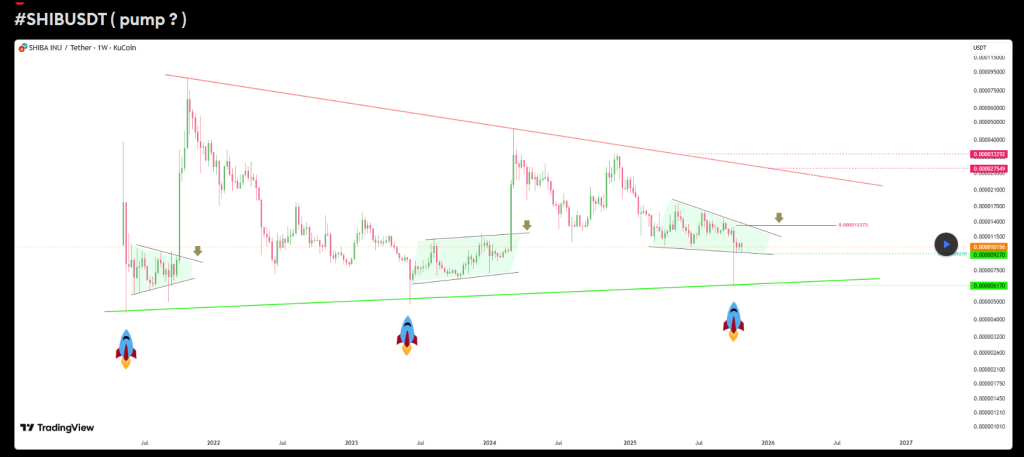

Meanwhile, SHIB’s price action has been mixed. Based on market data cited by analysts, the token fell by over 6% in the past 24 hours and has experienced about 13% and 30% corrections in the last week and month, respectively.

Those moves have pushed SHIB down to 34th in the crypto market cap rankings.

TradingView commentator “Akbarkarimzsfeh” flagged a long-term support trendline that has in past cycles preceded sharp rebounds.

The analyst argued that dips to that area have been followed by rapid rallies, suggesting the current pullback may be temporary.

Featured image from Unsplash, chart from TradingView