Technology behemoth Google has modified its policy about cryptocurrency-related advertising to permit adverts concerning crypto trusts starting at the end of January, the month in which it is anticipated that spot Bitcoin exchange-traded funds (ETFs) would be given the green light in the US.

The modification concentrates on coin trusts for cryptocurrencies, which are financial products that let investors trade in trusts that hold significant pools of cryptocurrency. Put simply, these trusts give investors equity in cryptocurrencies rather without actually holding any.

Google’s Crypto Ad Guidelines: Global Impact

The updated guidelines are applicable outside of the US, and to any accounts that promote cryptocurrency coin trusts on a global scale.

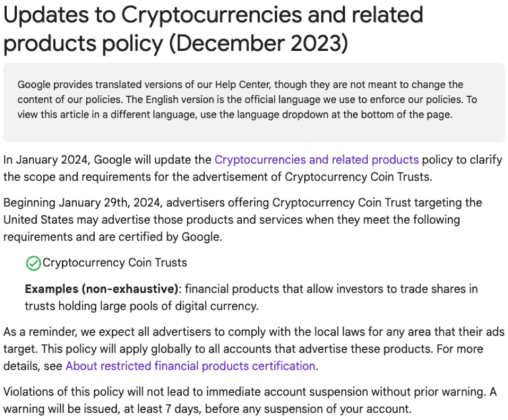

The goal of these modifications, which go into effect on January 29, 2024, is to give customers access to more trustworthy information and shield them from any risks involved in investing in cryptocurrencies.

Marketers aiming to reach American consumers may endorse these goods and services if they follow the guidelines specified in the revised specifications and gain Google certification.

As of this writing, certain digital asset goods are still eligible for advertising. Google now prohibits advertisements for DeFi protocols, NFT-based gaming platforms, initial coin offerings, and businesses that provide trading recommendations.

By January 10, 2024, there is a 90% chance that a spot Bitcoin ETF would be approved in the US, according to Bloomberg ETF analysts. It is possible that the SEC will approve many pending applications at the same time.

Approvals are the bet for the crypto space. With Bitcoin up around 74% over the last ninety days, some analysts predict that it will reach a new all-time high in 2024.

Google’s Evolution: Crypto Ad Approach Shifts

In 2018, Google made a bold move by outlawing all marketing pertaining to cryptocurrencies. Google’s director of sustainable ads, Scott Spencer, emphasized that the corporation was approaching cryptocurrencies with “great caution” at that time.

After taking a hard line at first, Google decided to soften its prohibition in 2019, effectively reaching out to regulated cryptocurrency sites.

This calculated action revealed a subtle shift in Google’s advertising strategies, recognizing the development and legal compliance of certain bitcoin companies while keeping an eye on the larger cryptocurrency scene.

The change to Google’s crypto ad policy coincides with a rise in fraudulent cryptocurrency ad campaigns. According to a recent Lloyds Bank survey, 66% of cryptocurrency investment scams originate from social media adverts and increasingly target individuals between the ages of 25 and 34.

The value of the world’s cryptocurrency market at the time of writing was close to $1.6 trillion, up 1.0% over the previous day.

Featured image from Shutterstock