The cryptocurrency market has witnessed a significant surge after a prolonged bear market and the intensified crypto winter caused by the collapse of crypto exchanges and firms during 2022 and part of 2023.

Notably, Bitcoin and other major cryptocurrencies have experienced substantial price surges, accompanied by renewed interest from institutional investors entering the market through recently approved spot Bitcoin exchange-traded funds (ETFs).

Adding to the industry’s positive outlook, asset manager and Bitcoin ETF issuer, Grayscale, believes that the current state of the market indicates that the industry is in the “middle” stages of a crypto bull run.

Grayscale recently released a comprehensive report detailing their key findings and insights into what lies ahead. A closer analysis of the report by market expert Miles Deutscher sheds light on the factors contributing to this assessment.

On-Chain Metrics And Institutional Demand

Grayscale’s report starts by highlighting several key signals indicating that the market is currently in the middle of a bull run. These include Bitcoin’s price surpassing its all-time high before the Halving event, the total crypto market cap reaching its previous peak, and the growing attention from traditional finance (TradFi) towards meme coins.

To understand how long this rally might sustain, Grayscale emphasizes two specific price drivers: spot Bitcoin ETF inflows and strong on-chain fundamentals.

Grayscale notes that nearly $12 billion has flowed into Bitcoin ETFs in just three months, indicating significant “pent-up” retail demand. Moreover, ETF inflows have consistently exceeded BTC issuance, creating upward price pressure due to the demand-supply imbalance.

Grayscale’s research focuses on three critical on-chain metrics: stablecoin inflows, decentralized finance (DeFi) total value locked (TVL), and BTC outflows from exchanges.

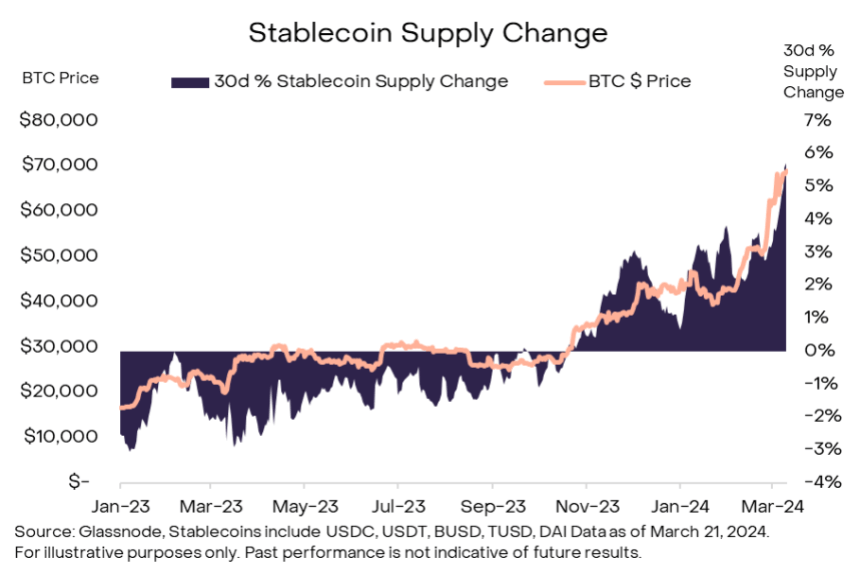

According to Deutscher, the increase in stablecoin supply on centralized exchanges (CEXs) and decentralized exchanges (DEXs) by approximately 6% between February and March suggests enhanced liquidity, making more capital readily available for trading.

Furthermore, for the analyst, the doubling of the total value locked into DeFi since 2023 represents growing user engagement, increased liquidity, and improved user experience within the DeFi ecosystem.

The outflows from exchanges, which currently account for about 12% of BTC’s circulating supply (the lowest in five years), indicate rising investor confidence in BTC’s value and a preference for holding rather than selling.

Based on these catalysts, Grayscale asserts that the market is in the “mid-phase” of the bull run, likening it to the “5th inning” in baseball.

Promising Outlook For Crypto Industry

Several key metrics support Grayscale’s analysis, including the Net Unrealized Profit/Loss (NUPL) ratio, which indicates that investors who bought BTC at lower prices continue to hold despite rising prices.

According to Deutscher, the Market Value Realized Value (MVRV) Z-Score, currently at 3, implies that there is still room for growth in this cycle. Additionally, the ColinTalksCrypto Bitcoin Bull Run Index (CBBI), which integrates multiple ratios, currently stands at 79/100, suggesting that the market is approaching historical cycle peaks with some upward momentum remaining.

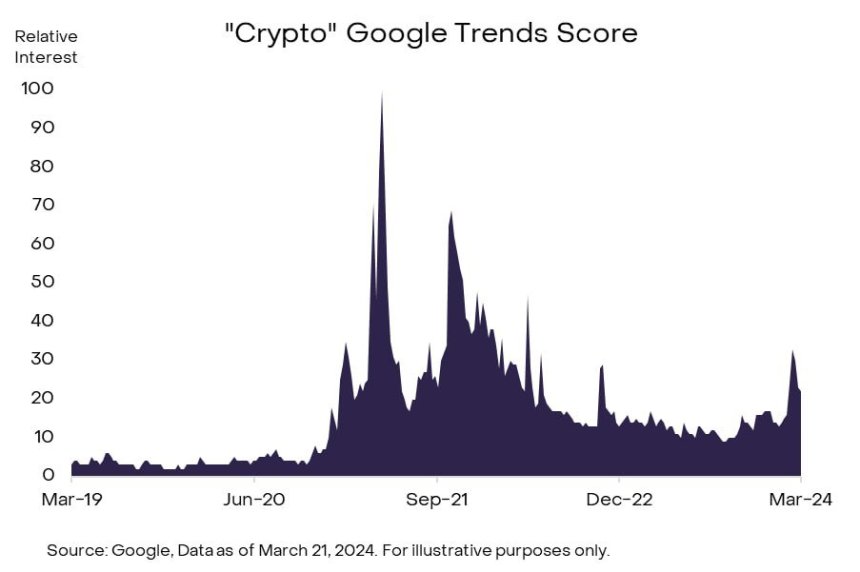

Furthermore, retail interest has yet to fully return this cycle, as evidenced by lower cryptocurrency YouTube subscription rates and reduced Google Trends interest for “crypto” compared to the previous cycle.

Ultimately, Grayscale retains a “cautiously optimistic” stance regarding the future of this bull cycle, given the promising signals and analysis outlined in their report.

Featured image from Shutterstock, chart from TradingView.com