Grayscale’s victory against the U.S. Security and Exchanges Commission (SEC) triggered over $90 million in liquidations during the past four hours, significantly impacting traders betting on the further decline of the market.

According to data from Coinglass, short traders accounted for 88% of the $97.63 million liquidations recorded in the market over the past four hours as Bitcoin (BTC) and Ethereum (ETH) spiked by more than 5%, respectively.

Bitcoin and ETH cumulatively saw more than $60 million of the liquidations, while traders with positions in assets such as BNB, XRP, Bitcoin Cash, Solana, and others recorded millions in losses.

This is the highest liquidation level since the market flash crashed on Aug. 17. The crypto industry is currently undergoing one of its lowest volatility periods, with BTC and ETH not seeing significant price action.

Meanwhile, when the liquidation timeframe is extended to the past 24 hours, the losses amount to $123.52 million.

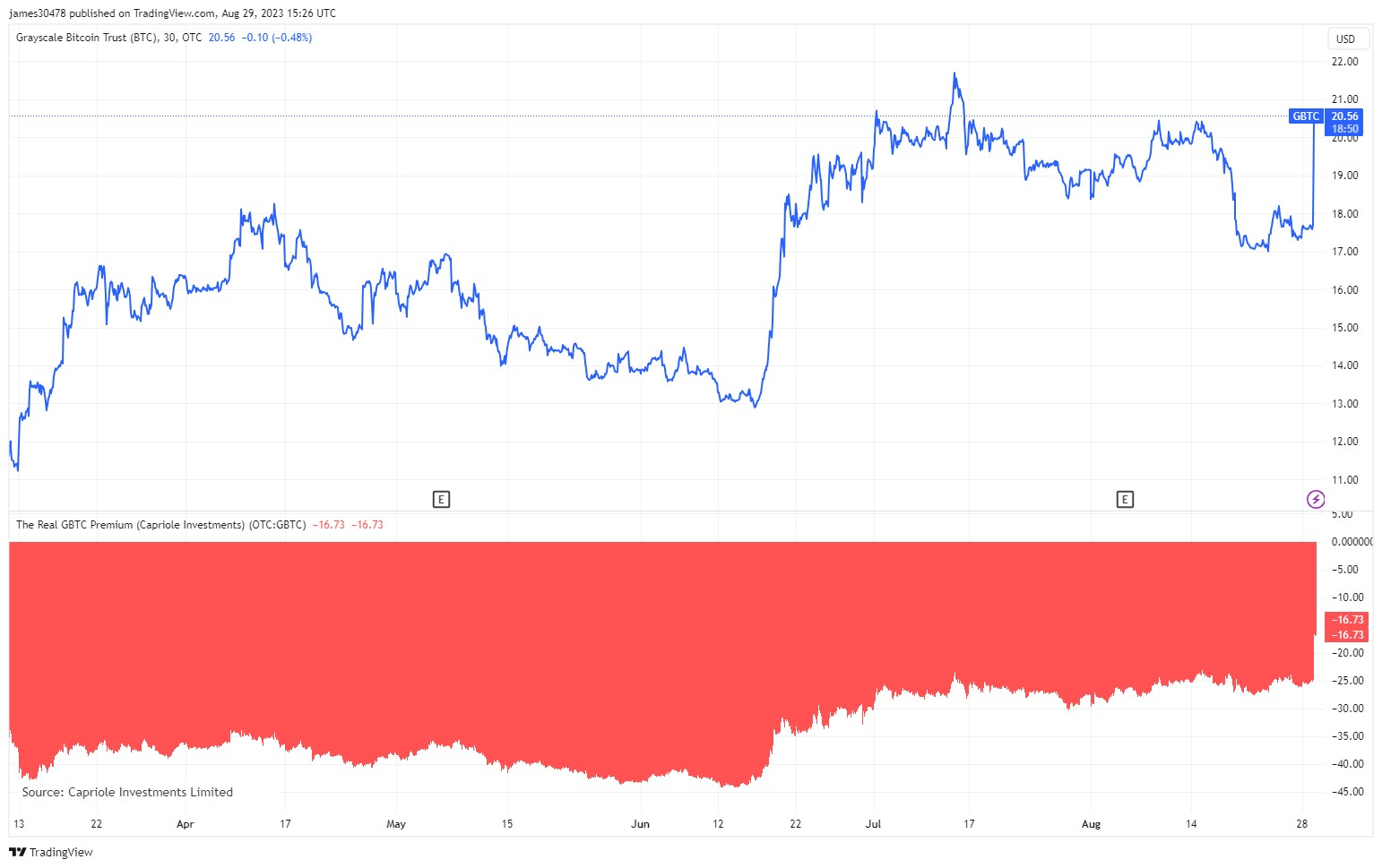

GBTC discount narrows

Meanwhile, Grayscale’s Bitcoin Trust (GBTC) reacted positively to news of its parent company’s victory, rapidly compressing to 18%, its lowest level in the last 2 years.

The GBTC discount peaked at almost 50% last year and has mostly stayed around 40% this year. However, the metric began to significantly decline following BlackRock’s application for a spot BTC ETF before dropping below 20% for the first time since early 2022.

Earlier today, the United States Court of Appeals for the District of Columbia Circuit handed Grayscale a significant win by overturning the SEC’s previous order. This ruling marks a pivotal moment in Grayscale’s lawsuit regarding converting its Bitcoin Trust into a spot Bitcoin ETF.

The crypto investment firm has consistently maintained that the financial regulator acted “arbitrarily and capriciously” in rejecting spot Bitcoin ETF applications while highlighting the SEC’s “unfair discrimination” against spot Bitcoin ETF issuers.

The post Grayscale victory against SEC sparks $90M in market liquidations, slims GBTC discount appeared first on CryptoSlate.