Hedera (HBAR) has surged by 13.7% in the past 24 hours and a notable 31.5% over the last week. This uptick is part of a broader “altcoin season,” where select altcoins are experiencing significant gains. Scott Melker, a prominent figure in the crypto analysis space, today shared his insights into the altcoin market and specifically on HBAR’s potential for growth.

Altcoin Market Overview

Melker, also known as the “Wolf of all Streets,” has highlighted the significance of the Total 3 market cap, which excludes Bitcoin (BTC) and Ethereum (ETH), to gauge the health of the altcoin market. According to Melker, Total 3 reaching a new cycle high of approximately $550 billion on a weekly close is a clear indicator of a robust altcoin market poised for further expansion.

He stated, “Looking at it generally gives us a clearer picture of what is happening with altcoins. […] With that in mind, it is important to note that TOTAL 3 just made a new cycle high on the weekly close, around $550B. This indicates that the altcoin market remains healthy and likely to continue to grow.”

Technical Analysis Of Hedera (HBAR)

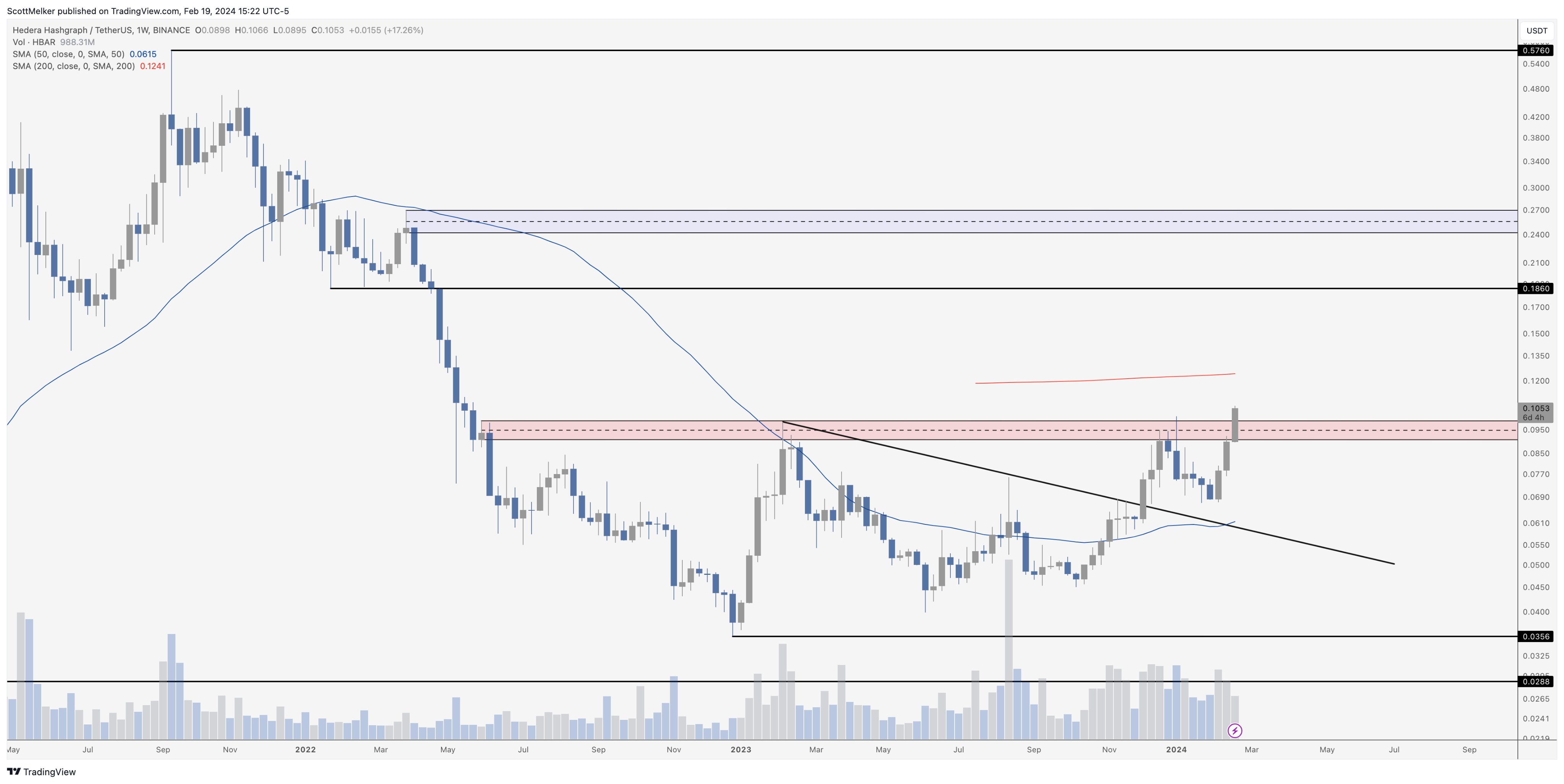

This dynamic is the basis for HBAR (1-week chart, HBAR/USDT), for which Melker’s analysis shows a very optimistic scenario. Currently, the Hedera price is challenging a significant resistance zone. Melker has identified the $0.10 level as pivotal for HBAR’s potential uptrend.

This resistance zone, highlighted by Melker in red, is crucial because a consistent close above this level on the daily and weekly charts would signal a shift in momentum favoring the bulls. At press time, HBAR was trading just above this key resistance zone, with yesterday’s daily candle closing above $0.10 for the first time since May 2022. The price closed at approximately $0.1117. Melker states:

HBAR is pushing hard into the key resistance zone that I discussed many months ago. To keep it more simple, a push above 10 cents should do the trick. Bulls want to see daily and weekly closes above the red zone. A retest of that zone as support would be an ideal entry.

Two Simple Moving Averages (SMAs) are plotted on the chart: the 50-day SMA at around $0.0615, which HBAR is currently well above, and the 200-day SMA at approximately $0.1241, which is slightly above the current price action. The price positioning between the two SMAs can be interpreted as a consolidation zone where the price needs to establish a firm direction.

Melker points out that past the $0.10 resistance zone, there appears to be minimal historical resistance until nearly a 2x increase around the $0.186 level. This lack of resistance suggests that if HBAR can maintain its position above the red zone, there is potential for a relatively unobstructed upward trajectory.

“As you can see on the left of the charts, there is almost NO RESISTANCE until nearly 2x, around .186. This coin dropped hard, leaving a vacuum. It should do well if it can push through here,” Melker remarks.

However, if HBAR manages to break through the $0.186 resistance zone, Melker’s final target is the blue zone around $0.25. This would net investors more than a 2x on their investment.

At press time, HBAR traded at $0.10647.