Dogecoin has witnessed a strong uptick in whale accumulation this week, with large investors aggressively increasing their holdings. On-chain analytics platform Santiment reveals that wallets holding between 100 million and 1 billion DOGE have ramped up their balances this week, which is one of the most notable buying sprees in recent weeks.

This accumulation coincided with Dogecoin’s push from $0.26 on September 15 to briefly crossing above the $0.28 level on September 18, suggesting that whale activity has been an important factor in the token’s latest rally.

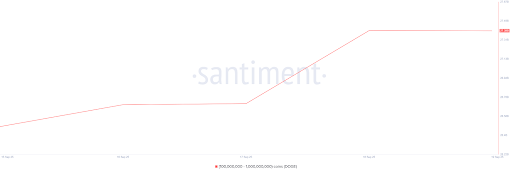

Whales Add About 1 Billion DOGE To Holdings

According to Santiment’s data, whales in the balance category of 100 million to 1 billion DOGE boosted their combined holdings from 26.48 billion DOGE on September 15 to 27.39 billion DOGE by September 19. This means about 910 million DOGE were accumulated by these addresses in just four days, equivalent to over $250 million at the current price of Dogecoin.

This increase in whale-controlled supply typically signals growing confidence in the asset while also reducing the liquidity available in open markets. The timing of these purchases points to a deliberate accumulation strategy as Dogecoin tested a local price support at $0.26.

Whales purchasing hundreds of millions of tokens not only reduce available supply but also tend to encourage retail traders to follow suit. The scale of this accumulation appears to have had a direct impact on Dogecoin’s price action. Between September 15 and 18, Dogecoin rose from $0.26 to above $0.28, a rally of nearly 8% within three days.

This rally was all on the action of whales alone, as Santiment data shows a corresponding holding decrease in the cohort of addresses holding between 10 million DOGE and 100 million DOGE tokens.

Dogecoin Technical Analysis

As it stands, Dogecoin’s ability to extend its rally will depend on how it holds above the $0.28 price level in the coming days. However, a bullish technical analysis that aligns with this whale accumulation trend suggests that Dogecoin is now on track to new all-time highs.

Crypto analyst Trader Tardigrade confirmed that Dogecoin’s weekly chart has broken out of a long-standing symmetrical triangle pattern. According to him, last week’s candle close validates the breakout and establishes a 1:29 risk-to-reward trading opportunity.

The symmetrical triangle setup points to a strong trend continuation after a series of higher lows and lower highs since September 2025 that has now resolved upward. Interestingly, Trader Tardigrade predicted a rally that would see Dogecoin break above its current all-time high. Particularly, the analyst predicted that Dogecoin could rally as high as $1.7 if the breakout follows through.