Here’s how much percentage of the total circulating supply the 10 largest Ethereum whales hold, according to on-chain data.

Ethereum’s Top 10 Addresses Have Only Continued To Grow Their Holdings Recently

In a new post on X, the on-chain analytics firm Santiment has revealed how much percentage of the total supply is held by the ten largest Ethereum wallets right now.

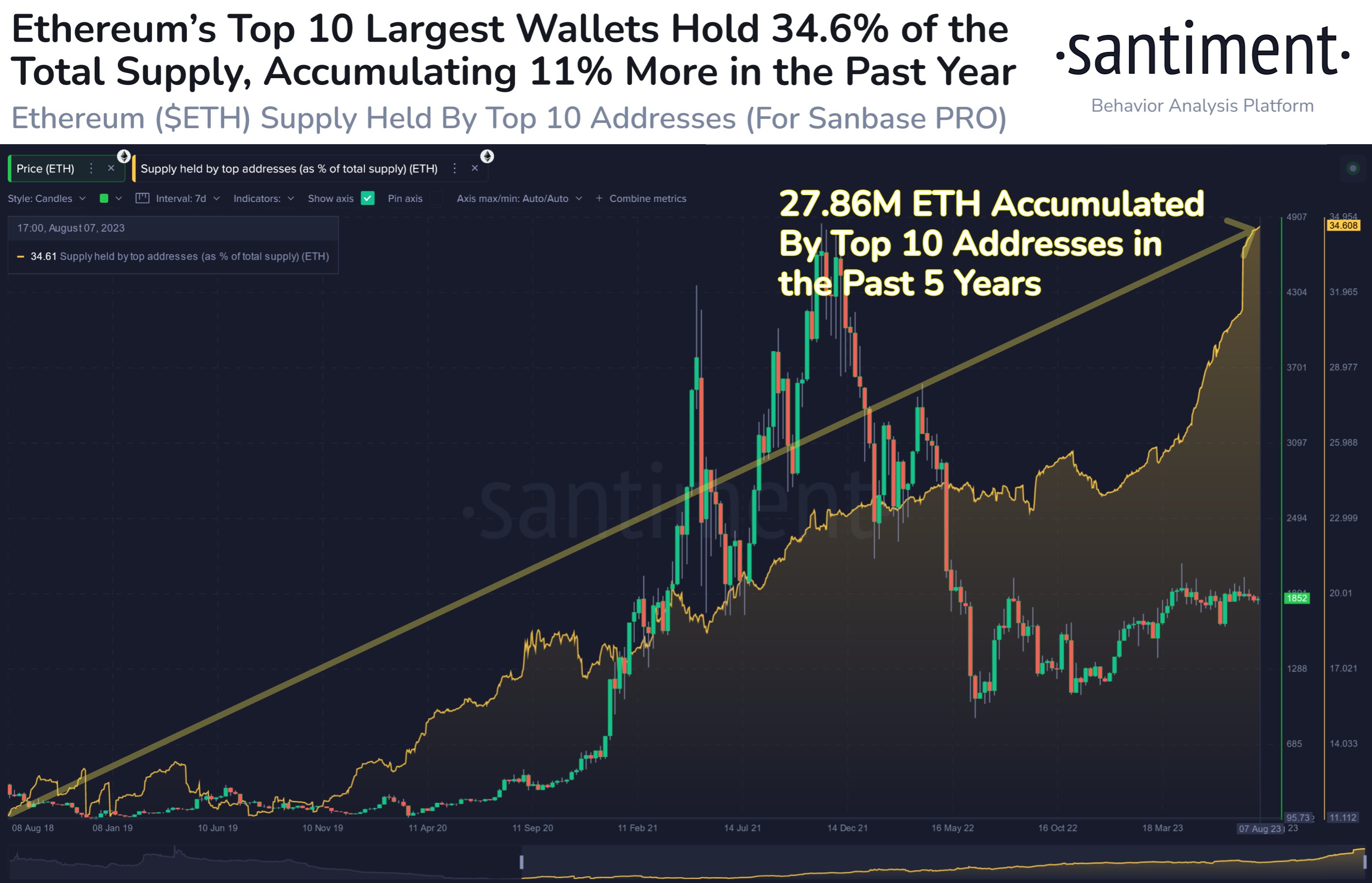

Here is the chart that displays this metric, as well as how it has changed during the past few years:

As displayed in the above graph, the percentage of the total circulating supply held by these whales was only 11.2% around five years ago. Since then, however, they have constantly expanded their holdings and now hold 34.6% of the supply.

Currently, 34.6% of the supply means that they hold 27.86 million ETH, which is equivalent to about $51.6 billion. Five years ago, the ETH supply appears to have been more spread out among the investors, but now it looks to be continually getting more concentrated on these ten biggest players in the sector.

From the chart, it’s visible that a large chunk of this accumulation has come this year alone, as these holders have ramped up their buying. In terms of the numbers, they have purchased 11% of the supply within the past year.

A few days back, the market intelligence platform IntoTheBlock revealed how wealth distribution differs between Bitcoin, Dogecoin, and Ethereum. For BTC, about 80% of the supply is held by 0.32% of the addresses (which include Satoshi’s dormant wallets).

For ETH and DOGE, on the other hand, a similar percentage of the supply is controlled by just 0.01% and 0.014% of the addresses, respectively. All three of the cryptocurrencies appear imbalanced in how their wealth is distributed, but BTC is still better off than these two.

IntoTheBlock also broke down the Bitcoin supply data for the different wallet ranges in another recent post on X:

From the table, it’s visible that the largest cohort with investors owning upwards of 100,000 BTC has four wallets and these addresses control 3.39% of the supply. The next largest group, the 10,000-100,000 BTC range, has 103 investors who hold 11.66% of the supply.

The top 10 addresses for BTC would include the four largest wallets, plus the top six from the next group. But even if all 103 addresses of the next group are included with the top 4, the total supply held by these investors would still just be 15.05%, once again showcasing how the Bitcoin supply is more decentralized than Ethereum.

Generally, the supply being concentrated on a few holders isn’t ideal for the market’s stability, as it means that only a few hands can move their coins around to induce volatility in the price.

ETH Price

At the time of writing, Ethereum is trading around $1,800, up 1% in the last week.