The post How High Will XRP Price Go After the Bitwise ETF Goes Live Today? appeared first on Coinpedia Fintech News

Bitwise has officially announced that its spot XRP ETF goes live today on the New York Stock Exchange. The company called it a major step forward for XRP, now the world’s third-largest crypto asset by market cap. A listing page for the fund has already appeared on Bloomberg, and the ticker will simply be XRP, a rarity and a highly sought-after symbol.

Bitwise also purchased the domain BitXRPetf.com, signaling a strong marketing push behind the product. The fund has a 0.34 percent management fee, but Bitwise is waiving that fee for the first month on the first $500 million in assets.

What About XRP’s Price Today?

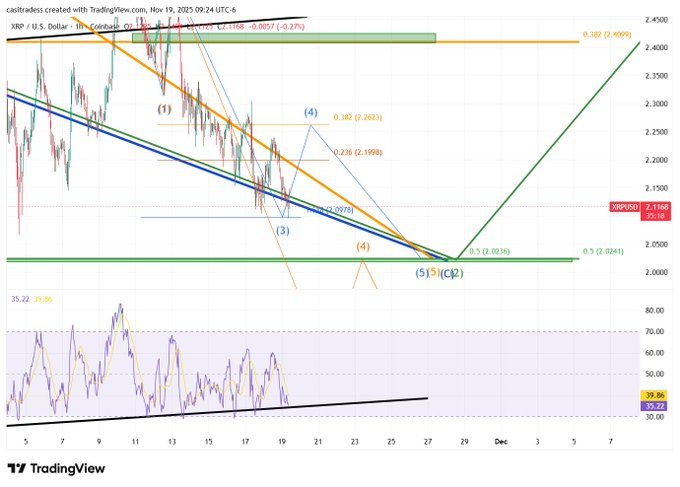

XRP recently dropped toward $2.10, but analysts say the move looks normal for a Wave 4 correction. XRP also touched its RSI support trendline, hinting at a possible bounce.

A push back to $2.26 is still possible in the short term, while the $2.03 macro Fib level remains the most important support zone of this entire correction phase.

Why This ETF Matters for XRP

Analysts say this ETF could cause a “supply shock,” because authorized participants must buy XRP to seed and support the fund.

They also expect demand to rise due to global macro shifts, including what analyst Jake Claver calls the “reverse carry trade”—a situation where rising rates in Japan could trigger huge financial flows into other assets, including crypto.

Claver says this domino effect could push XRP into a major long-term demand cycle, especially if institutions begin treating it as real payment infrastructure.

There is also speculation that BlackRock could launch its own XRP ETF in 2025, adding even more pressure to secure XRP supply.

Will the Bitwise ETF Trigger a Rally?

The launch could bring fresh inflows today, but analysts warn that XRP may still show “choppy” or sideways behavior early on, just like Bitcoin and Ethereum did when their ETFs first launched.

However, the main question is not whether XRP jumps today, but whether:

- inflows continue this week

- new ETFs launching on November 20–22 add more buying pressure

- institutions accumulate XRP throughout December

With more ETFs coming and growing interest from large financial players, today’s debut could be the start of a longer buildup in demand.

If inflows remain strong, XRP may attempt another rally once the wider correction settles.