The post How Low Can XRP Price Go In This Crash? appeared first on Coinpedia Fintech News

The XRP price has entered a turbulent phase in October, sliding sharply after a dramatic 44% intraday crash on October 10. This triggered by President Trump’s threat of 100% tariffs on China, the broader crypto and equity markets experienced a swift risk-off reaction.

During the selloff, roughly $19 billion worth of leveraged positions were liquidated across exchanges, according to Binance data. The XRP price today sits around $2.49, recovering from this weeks low but still reflecting fragile sentiment.

Whale Inflows Suggest Cautious Positioning

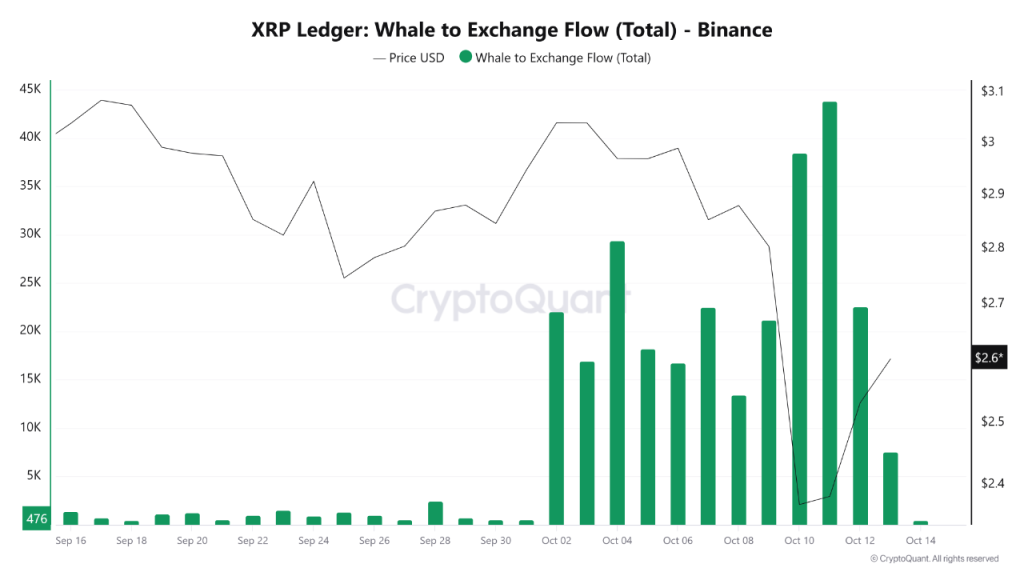

Fresh data from Binance, the largest exchange by trading volume, shows a significant increase in whale transfers of XRP crypto during the first half of October. This pattern marks a clear behavioral shift from September’s quiet phase to active selling or hedging by large holders.

Between October 10 and 12, whale inflows peaked exactly when XRP price USD dropped. Historically, large inflows to centralized exchanges signal intentions to sell, especially when accompanied by falling prices.

Each wave of inflows has correlated with a steep correction, confirming that whales are influencing the current XRP price chart direction.

However, following the inflow peak on October 11, transfer activity began to slow. The price has since stabilized near $2.60 to $2.40 range, suggesting the most aggressive phase of selling may have subsided. This stabilization might hint at a temporary market equilibrium as liquidity exits and traders await fresh catalysts.

Macro and Regulatory Factors Deepen Volatility

However, the Macroeconomic tension still remains a primary driver of volatility. The tariff issue between the U.S. and China has amplified global uncertainty, directly impacting risk assets like XRP and other altcoins.

Also, ETF tracker highlights only 6 XRP ETF product live, while many XRP ETF still hangs in the air for approval. the delay in the U.S. SEC’s decision on the long-awaited XRP ETF is due to the government shutdown that has dampened investor confidence that had earlier supported a bullish XRP price prediction narative for October and was even themed as “Uptober”, which is not sticking to its nickname.

Without timely regulatory progress, institutional participation could stall, preventing recovery. Meanwhile, escalating trade war is also critical or further macro deterioration could push risk-off sentiment even deeper, weighing on altcoins like XRP, XLM, ADA, LINK, and many other alts, especially those that lack the “store-of-value” appeal of Bitcoin.

How Low Could XRP Go?

From a technical perspective, the XRP price forecast identifies $2.30 as a crucial short-term support zone. Losing this level could expose $1.60 as the next test. Should selling intensify amid continued macro headwinds, structural support rests between $1.15 and $1.05, a zone representing both psychological and historical stability.

Nevertheless, sustained institutional accumulation, ETF progress, or renewed RWA activity could help absorb selling pressure. As the broader crypto market recalibrates, XRP crypto appears to be consolidating for its next decisive move either to reclaim the $3.00 range or to revisit deeper lows near $1.20.