Quick Take

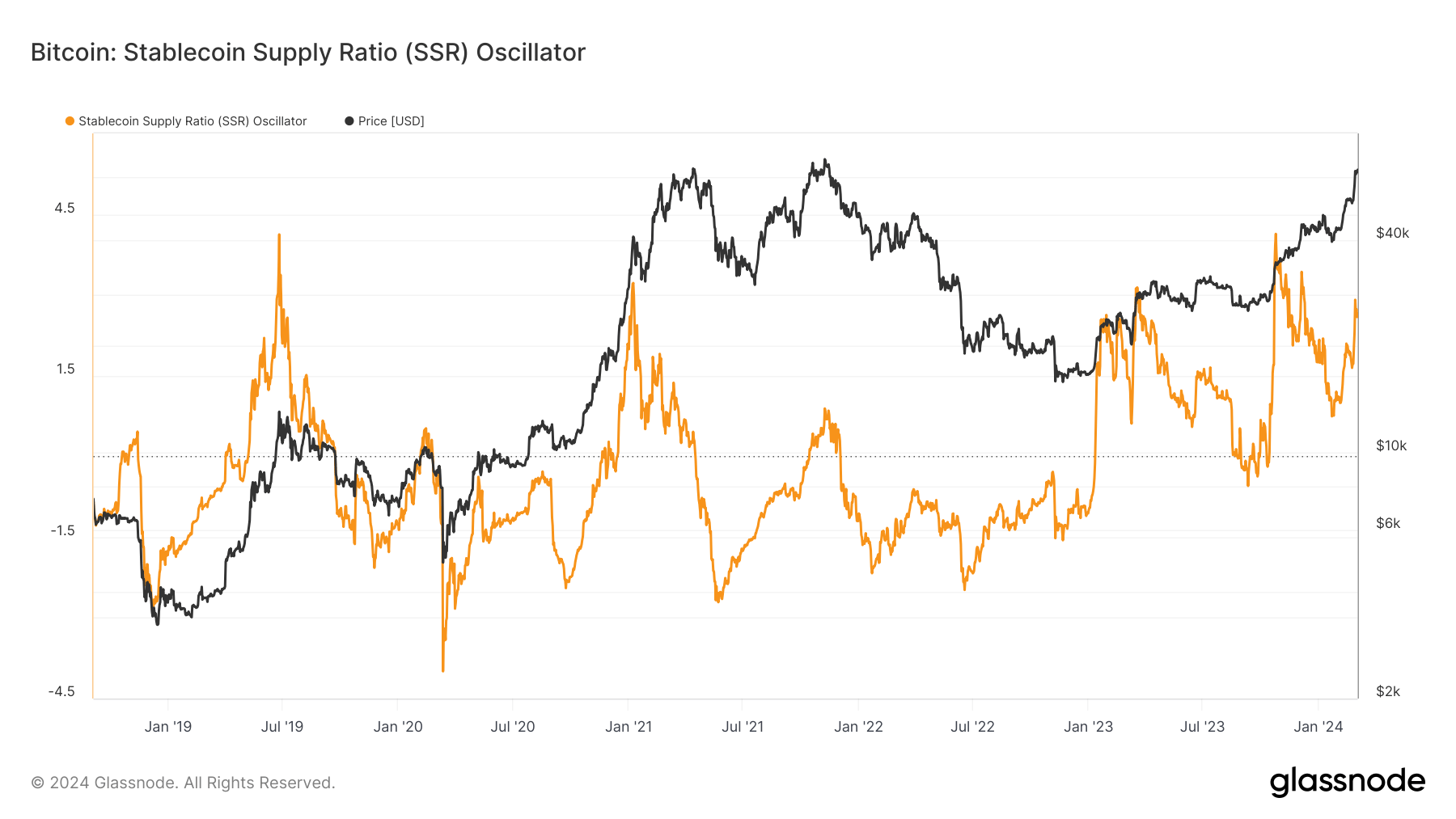

The Stablecoin Supply Ratio (SSR) created by Glassnode has emerged as a significant factor in analyzing Bitcoin price action. The SSR, a ratio between Bitcoin supply and the supply of stablecoins expressed in BTC, serves as a proxy for the supply/demand dynamics between Bitcoin and USD. This ratio reveals that when it’s low, the current stablecoin supply holds a stronger “buying power” for Bitcoin.

Since October 2023, CryptoSlate has observed an interesting correlation between the SSR and Bitcoin’s price. A rise in the SSR was observed on Jan. 29, which corresponded with an increase in Bitcoin’s price to $42,000. Similarly, a subsequent rise in the SSR two weeks later saw Bitcoin’s price climb to $52,000.

In a noteworthy trend, the SSR has recently reached one of its highest levels since 2019. This escalated SSR has coincided with Bitcoin’s price surging to $64,000. The rising demand appears to be driven not only by ETF inflows but also by increased liquidity from the stablecoin ecosystem.

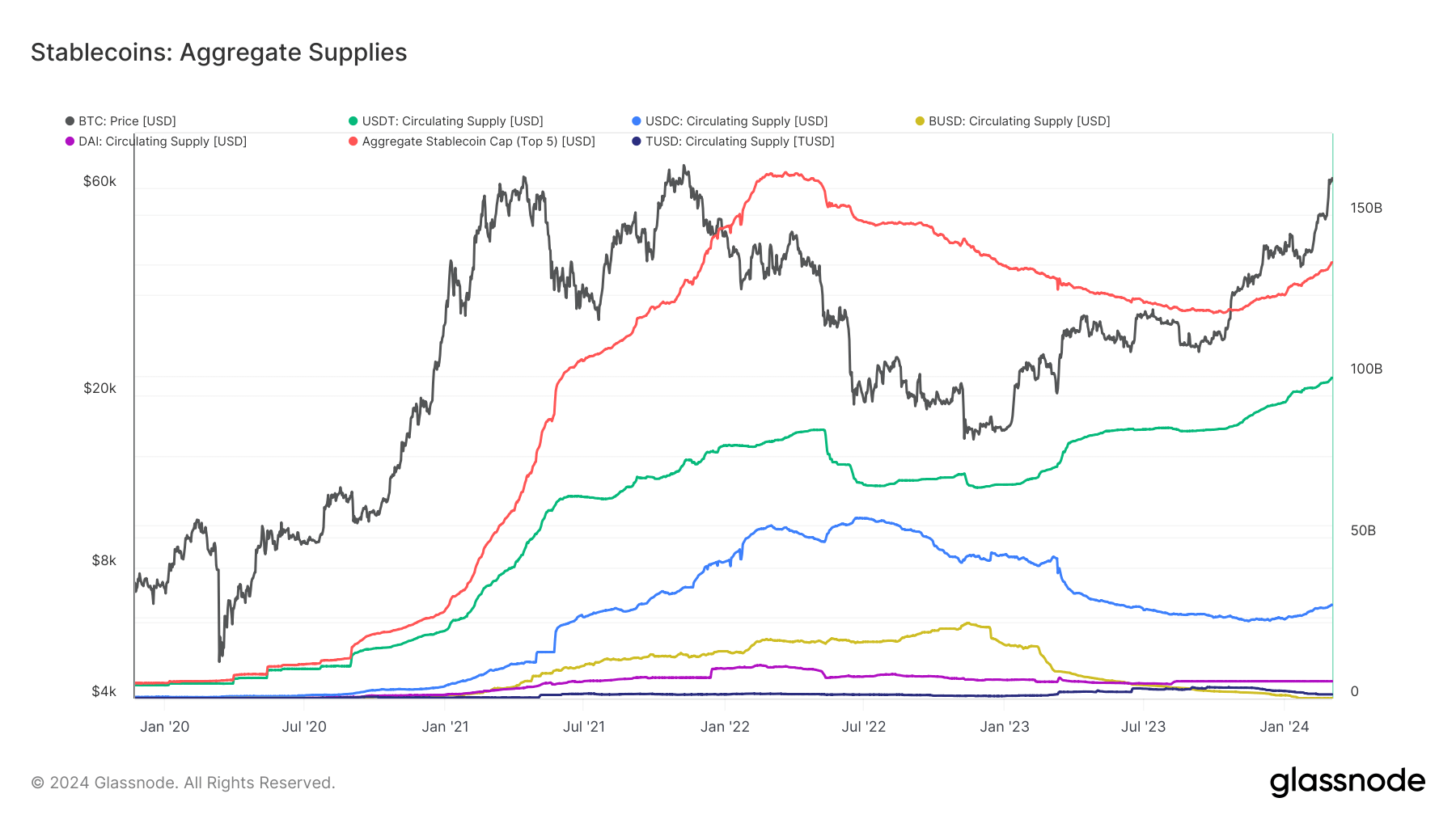

The stablecoin supply has experienced a significant surge in recent months, from October 2023 to the present. The collective market cap supply of the top five stablecoins has increased from $119 billion in October 2023 to its current level of $135 billion. Notably, Tether (USDT) is nearing a formidable market cap of $100 billion.

The post How stablecoins have fueled the recent rise in Bitcoin’s value appeared first on CryptoSlate.