Quick Take

Bitcoin has, for now, cemented itself above $70,000, boasting a market cap of roughly $1.4 trillion. The close on June 4 above $70,000 marks only day 13 that Bitcoin has achieved this level, with just seven days seeing a close above $70,954, according to Case Bitcoin.

| Price | Days Above | % of Bitcoin’s Life |

|---|---|---|

| $80,000 | 0 | 0 |

| $70,954 | 7 | 0.12% |

| $70,000 | 13 | 0.23% |

| $60,000 | 136 | 2.42% |

| $50,000 | 257 | 4.56% |

Source: casebitcoin

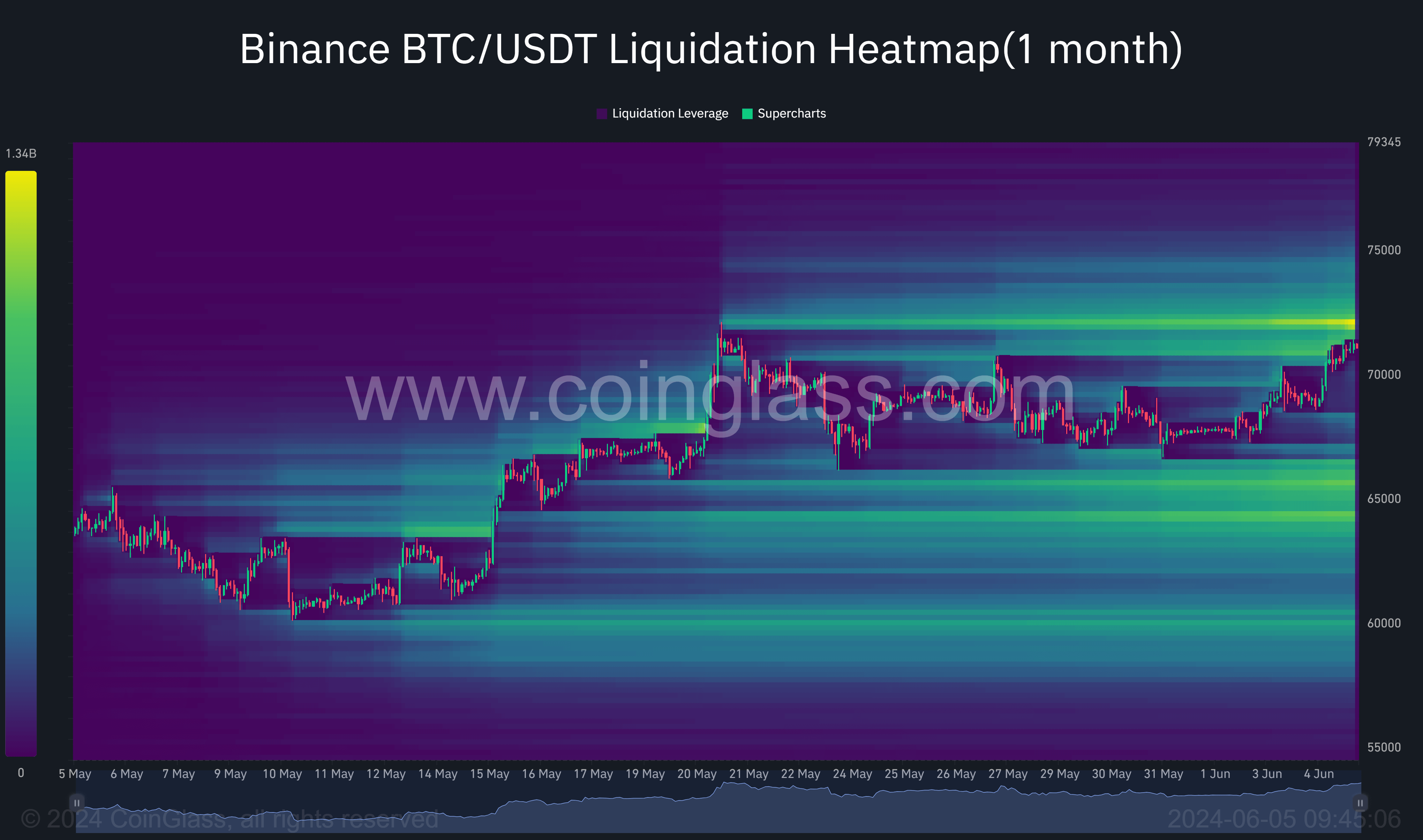

Coinglass data indicates substantial short positions on the BTCUSDT pair on Binance, with a few billion dollars of liquidation leverage above $71,000. The majority of this leverage is concentrated around $72,000, just below the current all-time high of $73,600. This positioning suggests the potential for rapid market movements if these levels are breached.

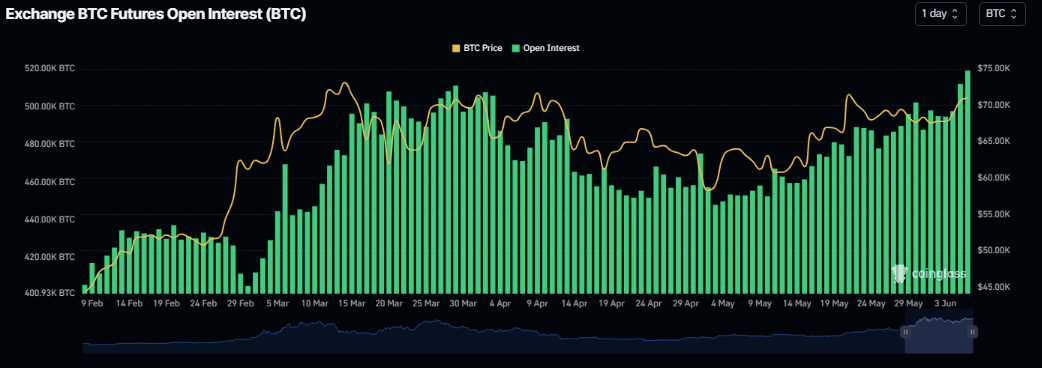

Open interest in Bitcoin, which refers to the total number of outstanding Bitcoin futures contracts, is also on the rise. Coinglass reports that 520,000 Bitcoin are currently allocated to open interest, surpassing the peak seen in March when Bitcoin reached its all-time high.

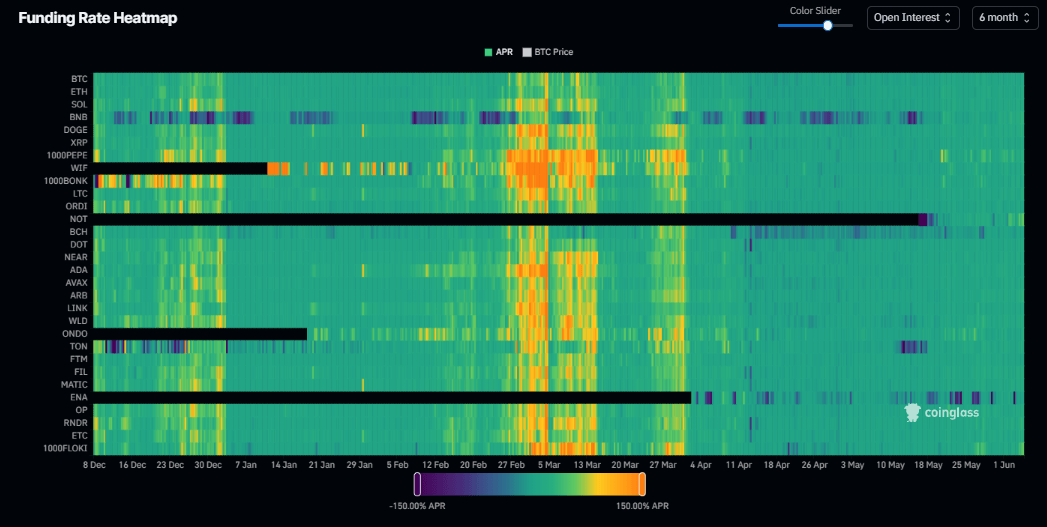

Although the funding rate heatmap shows a premium of 17%—a high but manageable level compared to the over 100% seen in March—the market appears relatively mild compared to then.

Despite some speculation, significant Bitcoin withdrawals from exchanges and strong ETF inflows from the US suggest that this rally could be sustained.

Disclaimer: According to Case Bitcoin, the term “closed” refers to the trading price of bitcoin at midnight UTC.

The post Huge short Bitcoin positions above $71k suggest potential for rapid market movements appeared first on CryptoSlate.