Since early October, when the Ethereum price began its dive into bearish territory, it has struggled to regain any of its significant price levels. The Ether token failed to hold at multiple support zones throughout November, as it plunged downwards.

While Ethereum appears to be gaining bullish momentum to signal an imminent price reversal, a bearish continuation looks like the more probable scenario after the latest decline to $3,000. A popular analyst has recently put forward a prognosis, which paints a worrying picture for the second-largest cryptocurrency.

$2,400 Might Be The Next Price Cushion For ETH

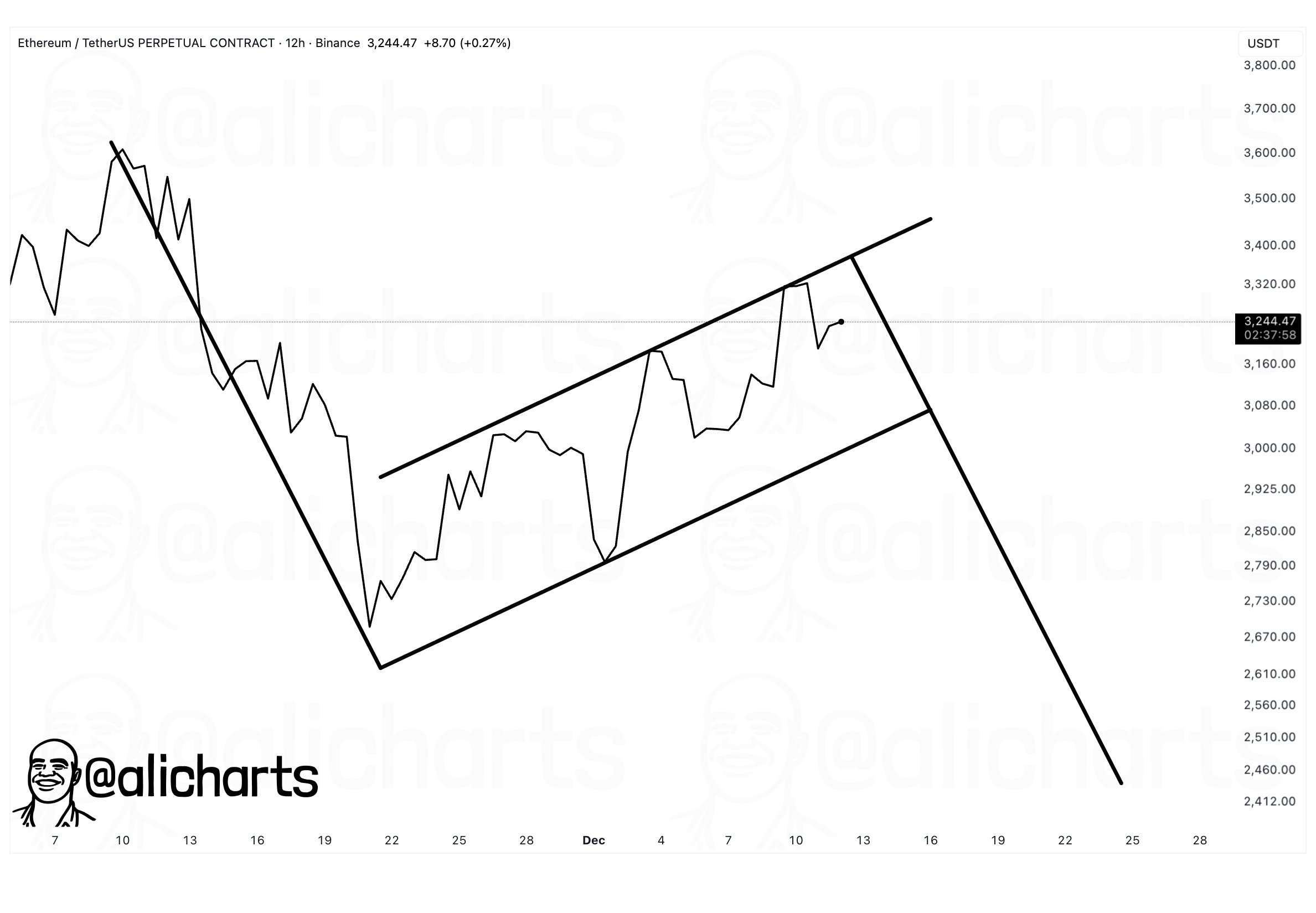

In a December 13 post on the social media platform X, market analyst Ali Martinez highlighted that the Ethereum price is showing an interesting sign of a potential bearish continuation over the coming weeks. Martinez’s analysis hinged on the bear flag pattern, a technical analysis pattern that is often used to confirm the continuation of a downtrend.

Typically, the pattern has two components — the flag and the flag pole. Price initially displays a sharp downward move, forming the flagpole. Afterwards, there is usually a brief period where the price displays upward movement or even sideways consolidation; this period of choppy price action makes up ‘the flag.’

What gives the flag its integrity is its upper and lower boundaries, which serve as resistance and support zones. Because breakouts beneath support zones typically indicate that the market could be bearish, a failure of the flag’s support would then be the needed confirmation of the earlier-seen sell signal.

In the scenario where this happens, the crypto pundit pointed out that Ethereum’s possible target could be the $2,400 price level. This is likely the case because all preceding regions may present with insufficient liquidity to sponsor any significant price reversal.

Ethereum Whales’ Realized Price Of $2,400 Comes In Sight — What To Expect

Interestingly, on-chain data adds credence to $2,400’s reputation as a relevant price level. In a Quicktake post on the CryptoQuant platform, a pseudonymous pundit, OnChain, revealed that Ethereum is currently happens to be trading very close to a significant price level.

According to the analyst, Ethereum whales — with holdings of at least 100,000 ETH — mostly procured their coins close to $2,400. Interestingly, the Ether token barely ever falls to price levels close to the realized price of this group of investors.

Since the last five years, there have only been four instances where the ETH price nearly reached the acquisition price of these whales, before eventually seeing major recoveries. If this historical pattern thus plays out, the second-largest cryptocurrency might have seen the beginning of yet another bullish rally.

As of this writing, Ethereum holds a valuation of $3,086, reflecting a 4% price decline in the past day.