The governor of India’s central bank, the Reserve Bank of India (RBI), says the “ongoing U.S. banking crisis” clearly demonstrates the risks cryptocurrency poses to the financial system. The central bank chief added that the “Indian economy remains resilient,” emphasizing that the “worst of inflation is behind us.”

India’s Central Bank Governor on Crypto Risks and U.S. Banking Crisis

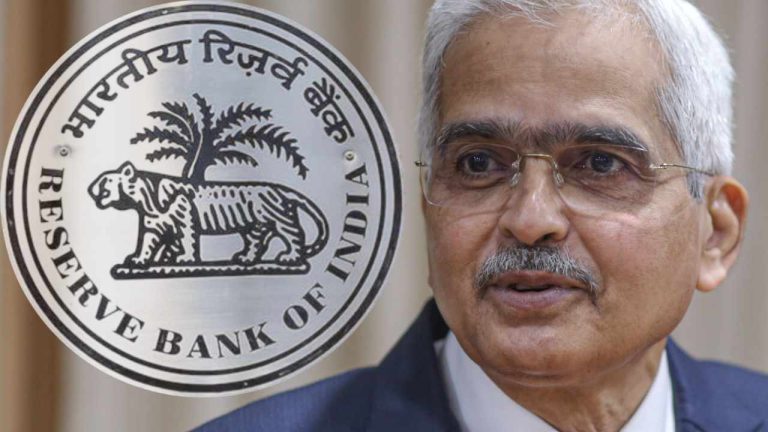

The governor of India’s central bank, the Reserve Bank of India (RBI), cautioned about the risks cryptocurrencies pose to the financial system while commenting on the U.S. banking turmoil at the 17th K P Hormis Commemorative Lecture on Friday. RBI Governor Shaktikanta Das said:

Ongoing U.S. banking crisis drives home the importance of robust regulators, sustainable growth and clearly shows risks of private cryptocurrencies to the financial system.

Das was referring to the recent collapses of several banks in the U.S. Last Sunday, Signature Bank was seized by the New York State Department of Financial Services while Silicon Valley Bank was closed down by regulators last Friday. They became the second and third largest banks in the U.S. to fail. In addition, Silvergate Bank announced voluntary liquidation earlier this month.

Some people believe that regulatory actions against crypto-friendly banks are related to cryptocurrency, including Senator Elizabeth Warren (D-MA) who attributed the failure of Signature Bank to its acceptance of crypto clients without sufficient safeguards. However, regulators have insisted that their actions have nothing to do with crypto.

The Indian central bank governor stressed that the U.S. banking crisis shows the “need for prudent asset liability management.” Furthermore, Das said:

Indian economy remains resilient. The worst of inflation is behind us.

Das, who was named Governor of the Year by the Central Banking Awards 2023 on Wednesday, has repeatedly warned about crypto risks. According to the Indian central bank chief, cryptocurrency not only poses a significant threat to India’s macroeconomic and financial stability but also seriously undermines the RBI’s capacity to determine monetary policy and regulate the country’s monetary system.

What do you think about the statements by RBI Governor Shaktikanta Das? Let us know in the comments section below.