Although sentiment toward Ethereum (ETH) remains largely pessimistic, crypto analyst Mister Crypto predicts that the second-largest cryptocurrency by market cap could be on the verge of a parabolic rally, mirroring its historical price action from 2020.

Ethereum About To Witness A Change Of Fortune?

Following US President Donald Trump’s highly anticipated reciprocal tariff announcement, the crypto market took a sharp plunge, wiping out over $140 billion in the past 24 hours. During this period, ETH tumbled by 5% and is at risk of setting fresh cycle lows in the $1,700 range.

Despite the negative sentiment, crypto analyst Mister Crypto suggests that ETH may soon experience a sharp momentum shift. In an X post shared earlier today, the analyst noted that while retail investors may have abandoned ETH, large investors – commonly referred to as whales – have not.

Mister Crypto shared the following chart, highlighting striking similarities between ETH’s current price action and its 2020 trajectory. He added that if history repeats itself, ETH could see strong bullish momentum in Q2 2025.

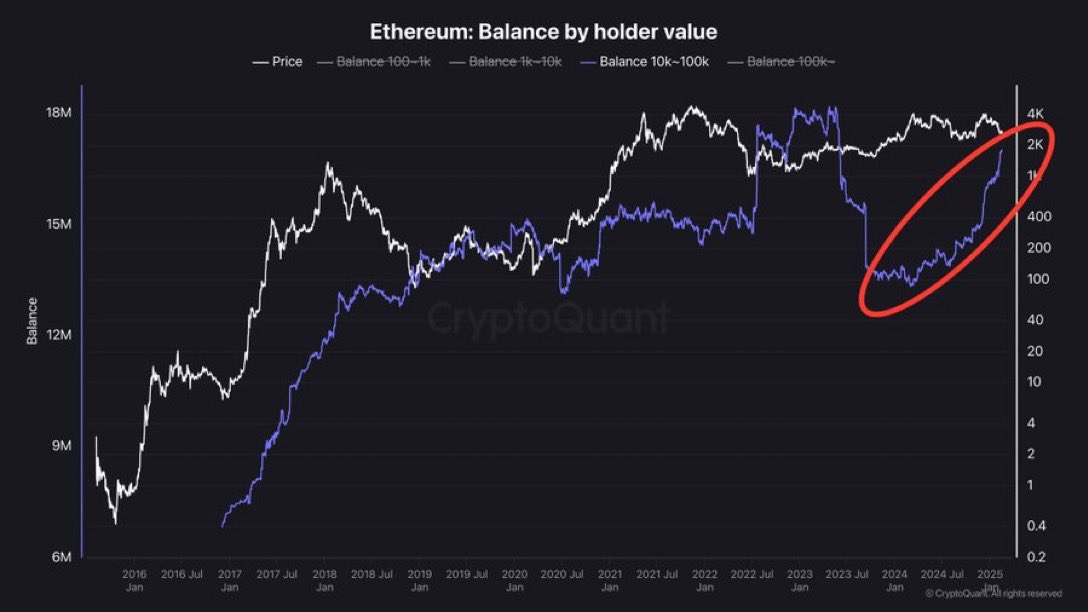

Fellow crypto analyst CryptoGoos echoed Mister Crypto’s perspective, arguing that ETH is “extremely undervalued” at its current price levels. The analyst also shared a chart illustrating how ETH whales are accumulating the asset at a record pace.

The data reveals that wallets holding between 10,000 and 100,000 ETH have been accumulating at an accelerated rate since early 2025. This trend persists despite ETH’s decline from approximately $3,350 on January 1 to around $1,700 at the time of writing.

Another cryptocurrency analyst, Crypto Caesar, noted that ETH is likely approaching a bottom, as it is currently trading near the same price level it held four years ago. However, he cautioned that if ETH breaks below its current support, it could decline further to the $1,200 range.

ETH May Have More Pain Ahead

While whale accumulation suggests long-term optimism for ETH, some analysts warn that further downside may be imminent before a potential recovery. In a recent analysis, crypto market expert Cryptododo7 predicts that ETH may eye bearish targets around $1,130 to $1,200.

Similarly, analyst CryptoBullet highlighted that ETH has now touched the 300-week moving average for only the second time in its history – an event that has historically signalled a bearish trend.

Despite these cautionary outlooks, market commentator Titan of Crypto recently stated that ETH is still on track to reach new all-time highs later this year. At press time, ETH trades at $1,777, down 5% in the past 24 hours.