Credible Crypto, a widely followed market technician with 479,900 followers on X, turned decisively upbeat on XRP in an October 15 video, arguing that the token’s high-time-frame structure “still looks absolutely freaking fantastic” despite “the most devastating and most significant liquidation event in the history of crypto.” He framed last Friday’s cross-market crash—“around 10 times more than the FTX collapse”—as a bottom-forming anomaly and said XRP’s key support held on closing bases, keeping his double-digit price outlook intact.

XRP Targets Double-Digits

The analyst’s core claim is straightforward: the violent wick to fresh lows across many venues did not invalidate XRP’s high-time-frame uptrend. He points to a monthly demand band at roughly $2.00–$2.40, noting that even after the flash-liquidity cascade “we did not get any 4-hourly closes below $2.30,” and that the deeper prints to $1.17 on some exchanges were byproducts of forced liquidations rather than organic selling.

“Ultimately on the high time frames once again it looks fantastic,” he said, adding that XRP’s prior five-wave advance began at ~$0.49; as long as price holds above the origin of that impulse, he views the recent selloff as a mid-cycle correction, not a cycle top. In his words: “This is not the end of the bull run for XRP… we have much higher to go.”

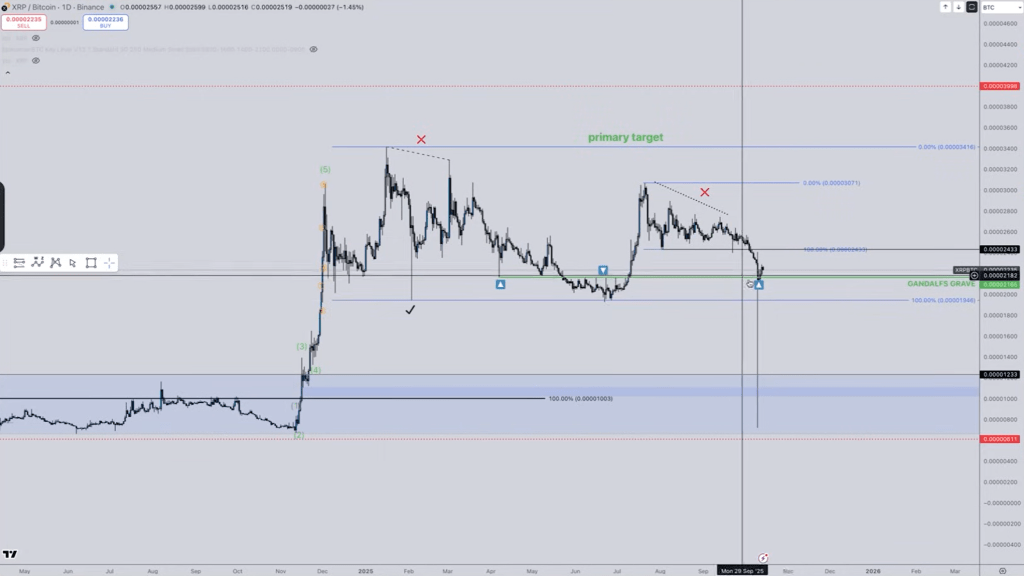

He lays out clear tactical markers. On the USD pair, the first meaningful supply band sits around $2.70–$3.11; acceptance above that region would suggest the next impulse has begun. On relative pairs, he highlights a now-familiar horizontal he calls “Gandalf’s grave” on XRP/BTC—a prior multi-touch resistance that recently flipped to support and was respected on hourly closes even during the crash.

The path forward, in his telling, splits into two equally plausible tracks. In the first, Bitcoin runs hot toward $130–$150k in a parabolic extension while XRP chops sideways; that rotational dynamic would push XRP/BTC lower toward a deeper, high-time-frame demand zone even as XRP/USD holds a higher base above ~$1.90–$2.30.

In the second, XRP stabilizes here and rips sooner, with XRP/BTC launching directly and “the minimum move… a 50% move up against Bitcoin,” which would place XRP/USD at new all-time highs. He cautions that a drift lower on XRP/BTC would be a feature, not a bug: “If you’re not fully loaded on XRP, that is when you should get fully loaded,” he said.

Crucially, Credible Crypto ties the XRP roadmap to Ethereum’s next leg. He argues ETH showed “one of the cleanest impulsive movements” in years—a full five-wave advance from ~$2,000 to ~$4,700—then sketched two scenarios.

In scenario one (the more aggressive), that $2,000–$4,700 move is wave one of a much larger sequence to $10,000+, with the current drawdown constituting wave two before a $5k–$6k expansion leg.

In scenario two (less aggressive), ETH is missing a final wave-five push to new highs just above $5k, and then would undergo a broader, deeper wave-two correction. He even provides a hard invalidation for scenario two: if ETH fell to ~$2,700–$2,800, the overlap with wave-one territory would scrap it, implicitly favoring scenario one. Either way, he says, “sub-$2,000 Ethereum is likely gone for the rest of the cycle.”

Why does this matter for XRP? Because if ETH makes a clean run to and through $5k first, XRP/ETH likely bleeds into a deeper green demand band before reversing—timing that would map to XRP/USD basing while the ETH leg completes. He sees that as constructive signal, not weakness: a final dip in XRP/ETH toward higher-time-frame demand would “tell us when we may be seeing good risk-reward opportunity for long trades on XRPUSD,” and the longer the base, “the greater the expansion.”

Credible Crypto’s playbook for confirmation is explicit. On XRP/USD, watch for an impulsive five-wave thrust off the lows and for clean acceptance above $2.70–$3.11. On XRP/BTC, either a swift reversal from the “Gandalf’s grave” retest or a controlled bleed into a deeper, pre-identified demand block that would time a stronger USD-denominated breakout later. On XRP/ETH, a drift to the green demand area would likely coincide with ETH’s final push past $5k, after which he expects the cross to reverse hard in XRP’s favor.

At press time, XRP traded at $2.42.