The post John Deaton Warns: Crypto Reforms Delayed Until 2029 Without GENIUS Act! appeared first on Coinpedia Fintech News

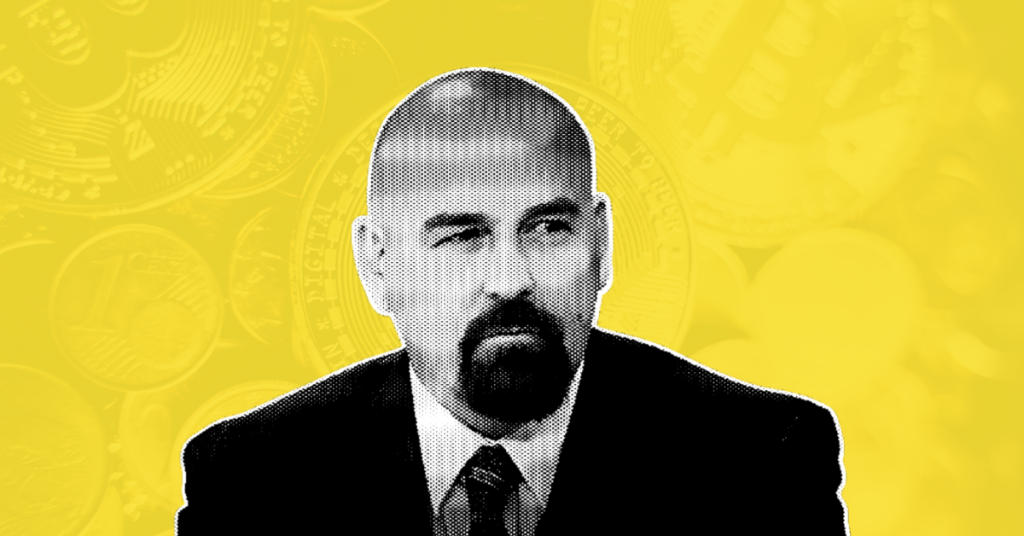

Pro-crypto lawyer John E Deaton has shared a warning that’s causing concern in the crypto community, If the U.S. Congress fails to pass the GENIUS Act now, then we may not see any strong crypto laws or reforms until 2029.

This may sound extreme, but Deaton isn’t alone in thinking this way. Other Messari founder Ryan Selkis stressed that without immediate progress, long-term reforms could be off the table until.

GENIUS Act: More Than Just a Crypto Bill

Deaton believes the GENIUS Act is something all politicians should support, because it’s not really a “crypto” bill. As Alex Thorn from Galaxy Research put it, it should be called the “Dollar Dominance Bill.”

He agrees with Ryan Selkis, the founder of Messari, who said that if the GENIUS Act doesn’t pass soon, even basic crypto legislation will be dead on arrival under any future Trump presidency.

Meanwhile, the bill is designed to support stablecoins backed by the U.S. dollar. In a world where countries like China and Russia are pushing for “de-dollarization,” Deaton says America must act fast.

Supporting dollar-backed stablecoins can boost demand for U.S. Treasury assets and help the dollar remain the world’s leading reserve currency.

Broken System of Political Swings

Deaton also shared how upset he is with how the U.S. keeps changing its approach to crypto. One government is very strict, while the next one acts too friendly, sometimes even turning crypto into a joke for votes.

But no matter who is in charge, Deaton says we’re still using laws from the 1930s and 1940s to control new technology like crypto and AI.

No Reform Without Action

Meanwhile, the bigger picture is clear, as Deaton says, without bipartisan support for the GENIUS Act now, there’s little hope for deeper market structure bills later. Ryan Selkis warned that failure to pass it this week would likely kill crypto reform under a Trump administration.

Deaton agreed and also called out Coinbase, suggesting its silence might be strategic, as regulatory uncertainty helps it stay ahead of competitors.