On-chain data shows over half of the Ethereum supply is held by just 10 addresses. Here’s how other ETH-based tokens like Shiba Inu stack up.

Shiba Inu, Uniswap, & Ethereum Are Among The Most Centralized ETH Tokens

In a new post on X, on-chain analytics firm Santiment has talked about how the different assets in the Ethereum ecosystem line up against each other in terms of the amount of supply that’s concentrated on the top 10 wallets.

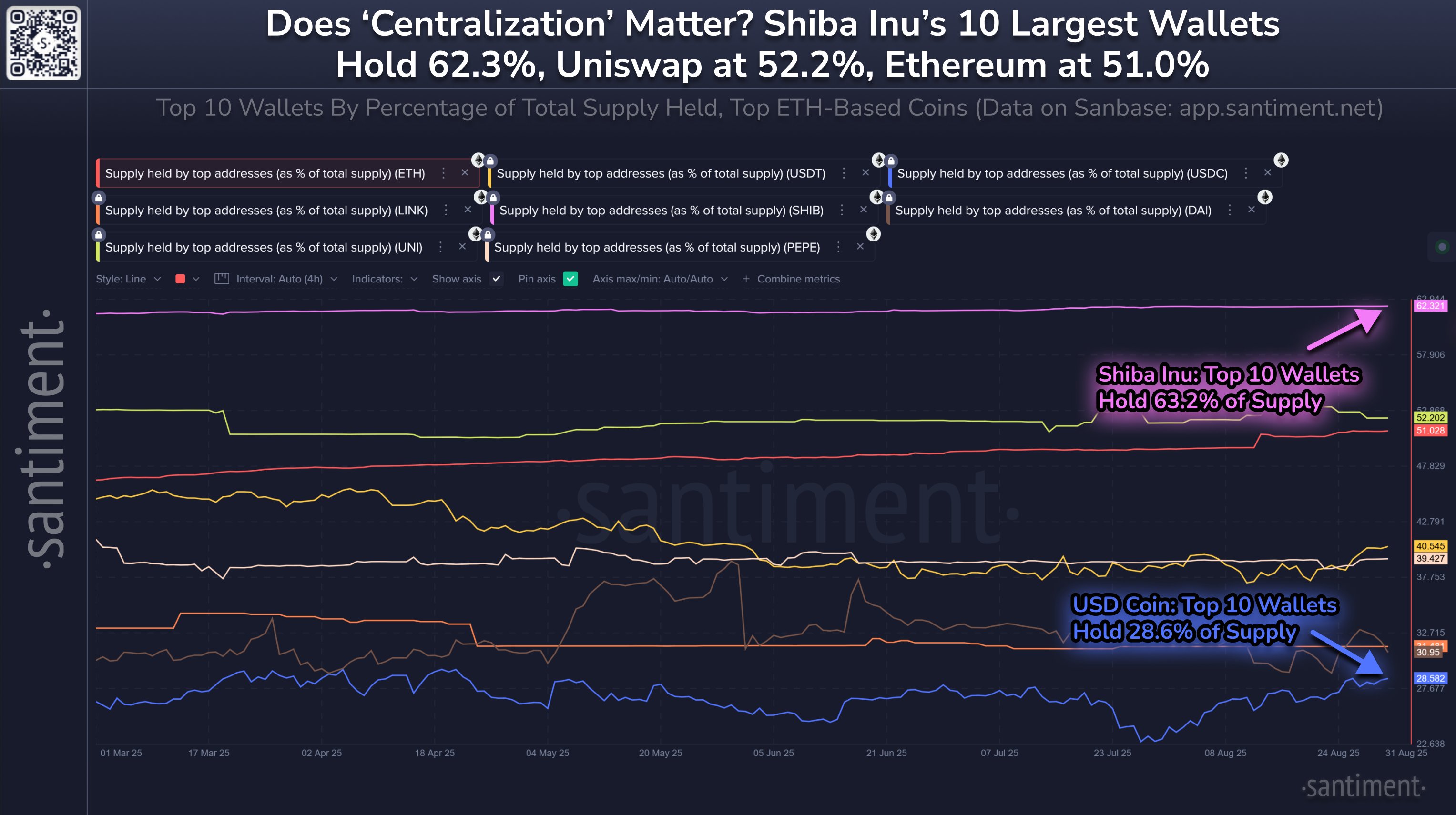

Below is the chart shared by Santiment that shows the trend in this metric for eight cryptocurrencies over the past few months.

From the graph, it’s visible that 51% of the Ethereum supply is owned by the 10 largest wallets on the network. This is more than most of the other ETH-based tokens on the list.

The two coins that are ahead in this metric are Shiba Inu (SHIB) and Uniswap (UNI). The latter is only marginally ahead of ETH with a value of 52.2%, but the former is significantly ahead at 62.3%.

Generally, a cryptocurrency’s supply being heavily concentrated on just a few hands doesn’t tend to be a constructive signal, as it means only a few players are needed to move the market.

Beyond market dynamics, supply centralization has another drawback: it potentially weakens the network security. Chains like Ethereum’s run on a consensus mechanism called the Proof-of-Stake (PoS). Under this system, validators called stakers have to lock up a stake in order to receive a chance at adding the next block to the chain.

The higher is a validator’s stake, the higher is the chance that they get picked. If a single staker crosses the 51% supply threshold, they can, in theory, gain total control over the blockchain.

This type of attack doesn’t exist on Bitcoin, where the Proof-of-Work (PoW) consensus mechanism is employed instead. In PoW networks, miners compete against each other using computing power. Here, too, however, if a validator gains control over 51% of the network computing resources, they can mold BTC to their will.

Considering that Ethereum has just 10 holders controlling 51% of the supply, an attack on the network is possible if these entities come together. The chances of it happening, though, are quite slim.

Still, the fact the likes of ETH, SHIB, and UNI are notably centralized on just a few holders could be something to watch for. In contrast, some other tokens in the ecosystem like USDC (28.6%), DAI (31%), and Chainlink (31.5%) are in a healthier zone in terms of this metric.

ETH Price

Ethereum has seen a surge of almost 4% over the last 24 hours that has taken its price to the $4,380 mark.