During the past year, the increasing adoption of Chainlink Data Feeds was accompanied by the network’s release of new computation-based services–leading to a surge in the total number of integrations.

Powering hybrid smart contracts, the blockchain-agnostic protocol leverages the largest collection of decentralized services–supporting over 700 oracle networks.

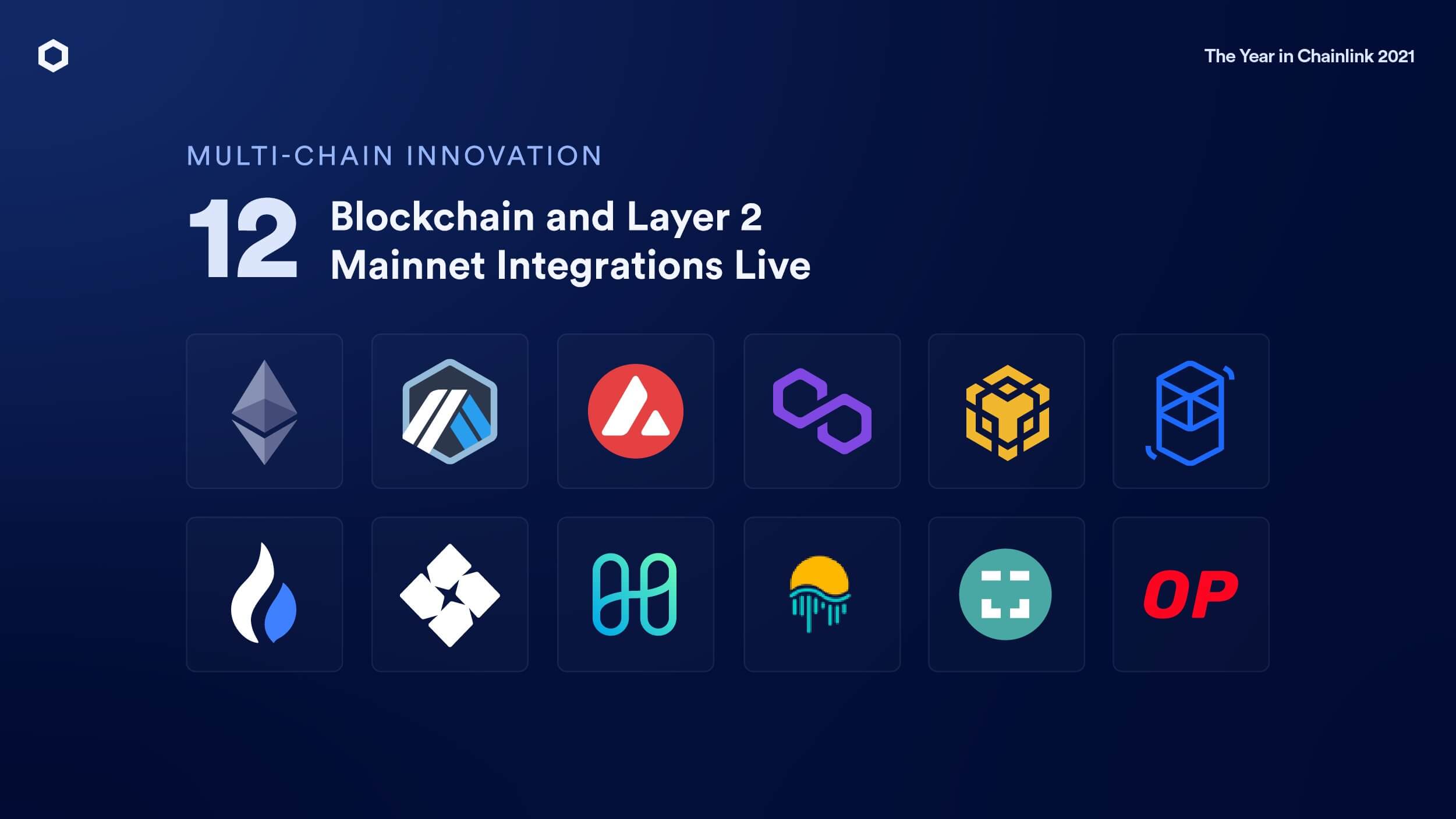

Integrations across Layer 1s and Layer 2s

The Chainlink ecosystem entered 2022 with over 1.000 projects, and half of all integrations took place in 2021, according to the protocol’s recent yearly report.

During the past year, Chainlink services launched on a number of Layer 1s and Layer 2s, including Arbitrum, Avalanche, Binance Smart Chain, Ethereum, Fantom, Harmony, Heco, Moonriver, Optimism, Polygon, Starkware, and xDai.

Furthermore, to accommodate the demand for inter-chain solutions, Chainlink is actively developing a generalized cross-chain communication protocol for the blockchain industry–Cross-Chain Interoperability Protocol (CCIP).

At the beginning of 2021, Chainlink secured a total of $7 billion across the blockchain ecosystem, and 12 months later–TVS topped $75 billion.

With currently over 700 decentralized oracle networks that are publishing data across numerous independent blockchains, the most used datasets by DeFi applications include financial market prices in the form of Price Feeds.

Providing access to secure off-chain computation

During the past year, Chainlink launched multiple services that provide various blockchains with secure and trust-minimized off-chain computation.

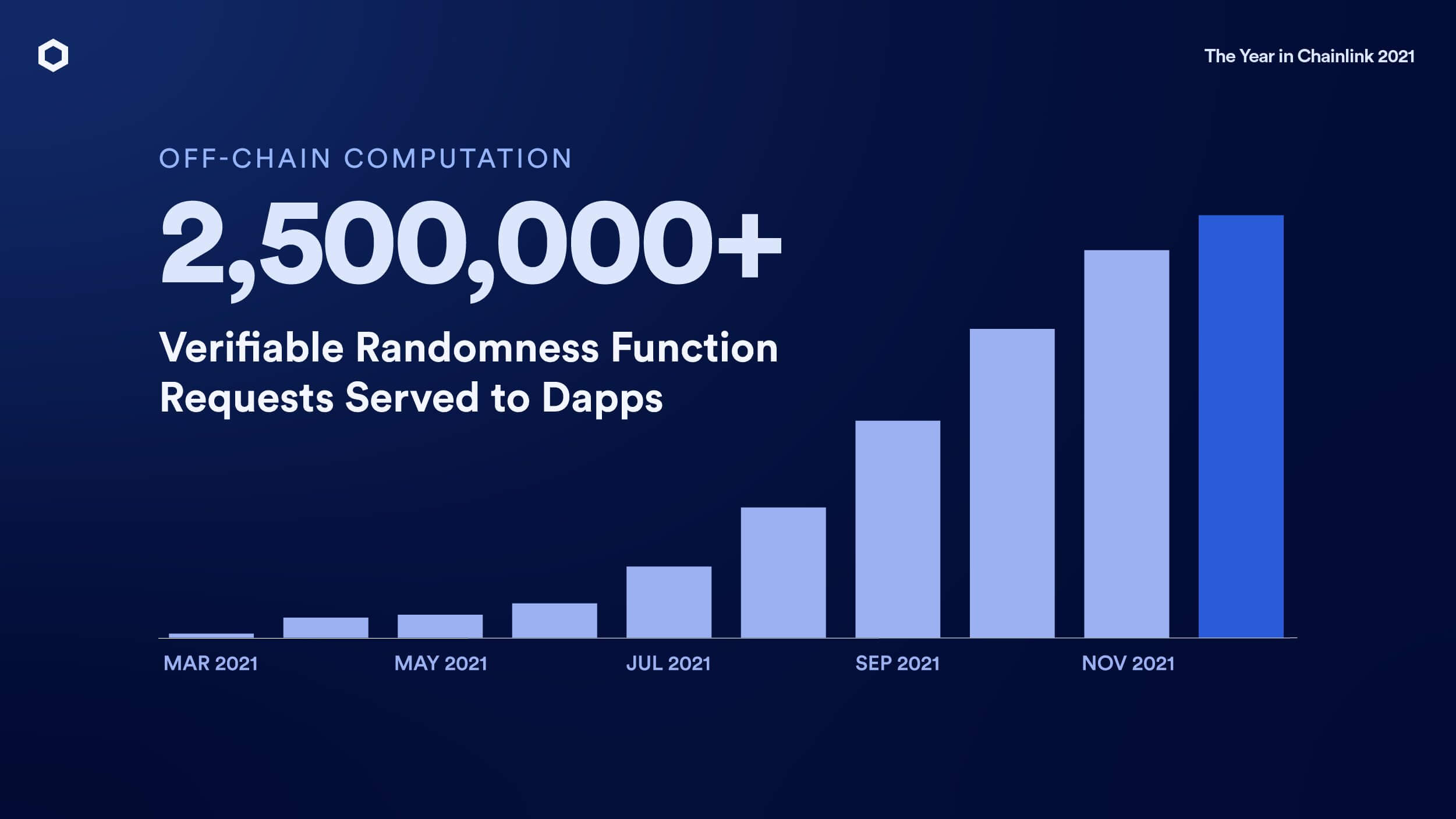

First released on Ethereum in late 2020, Chainlink Verifiable Randomness Function (VRF) expanded support for BSC and Polygon in 2021.

Chainlink VRF provides smart contracts access to a secure source of on-chain randomness–required by NFTs and on-chain gaming applications.

Supporting the multi-chain ecosystem, Chainlink VRF has risen exponentially–topping 2.5 million requests served to dapps.

Chainlink Keepers were also added in 2021–further expanding the support for off-chain computation while enabling developers to outsource and simplify DevOp tasks.

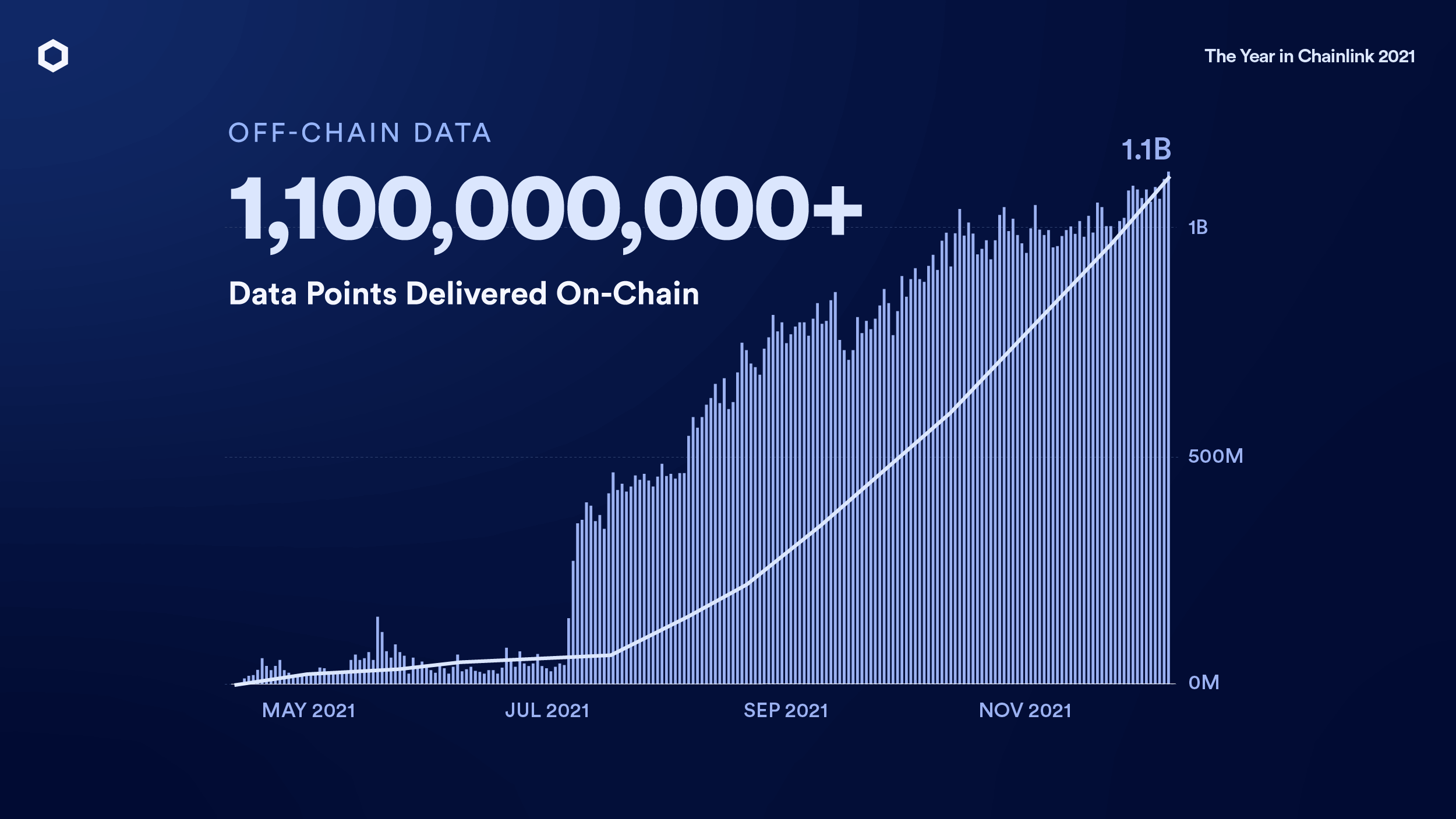

Meanwhile, Chainlink Price Feeds were upgraded to the Off-Chain Reporting (OCR) protocol, allowing 10 times more real-world data to be delivered on-chain.

During 2021, Chainlink oracles have expanded the scope of data available on-chain, to support Proof of Reserve, Proof of Supply, Ethereum gas prices, total market capitalization, Total Value Locked (TVL) in DeFi applications, sports game results, election race calls, identity data, compliance metrics, and weather reports.

By doing so, the network successfully and securely delivered over 1.1 billion data points on-chain.

In 2021, global enterprises, such as the Associated Press, AccuWeather, and Amazon Web Services, started using Chainlink as their “gateway to the blockchain economy.”

As more data becomes available on-chain, new hybrid smart contract use cases will arise, which is expected to drive the value secured up.

The post Key drivers behind Chainlink’s exponential growth appeared first on CryptoSlate.