The post LINK Price Eyes Major 125% Breakout Before Year Ends? appeared first on Coinpedia Fintech News

The LINK price is attracting renewed attention as technical and on-chain factors align for potential upside. From the breakout odds of a short-term symmetrical triangle on the Chainlink price chart to major signs of a supply squeeze, LINK crypto is positioned for strong momentum that could push it toward fresh highs.

LINK Price Today and Technical Setup

At the time of writing, LINK price today stands at $23.185, with a market cap of $15.75 billion and a daily trading volume of $708.51 million.

The recent breakout on the 12-hour Chainlink price chart from a symmetrical triangle pattern has shifted sentiment, fueling speculation about further gains.

Short-term analysis points to a potential push toward the $25 level, which could unlock a rapid climb to $30. If LINK crypto breaks convincingly above $25 this month.

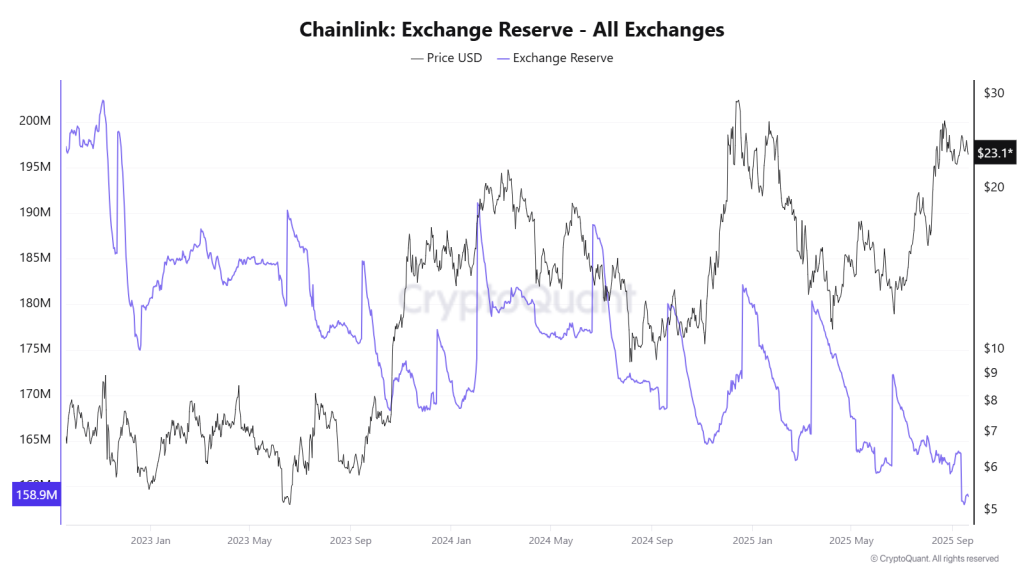

Shrinking Exchange Supply and a Possible Supply Shock

One of the most compelling factors driving optimism around LINK price is the supply dynamics underlined by an expert. He said that Exchange balances of Chainlink have fallen to their lowest level since 2022.

This indicates that holders are increasingly reluctant to sell, creating the foundation for a potential supply squeeze.

At the same time, adoption of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is accelerating across banking, tokenized real-world assets (RWAs), and gaming projects.

Overall, the developments technically and fundamentally are all pointing towards higher targets on the upside.

LINK Price Forecast and Bullish Targets

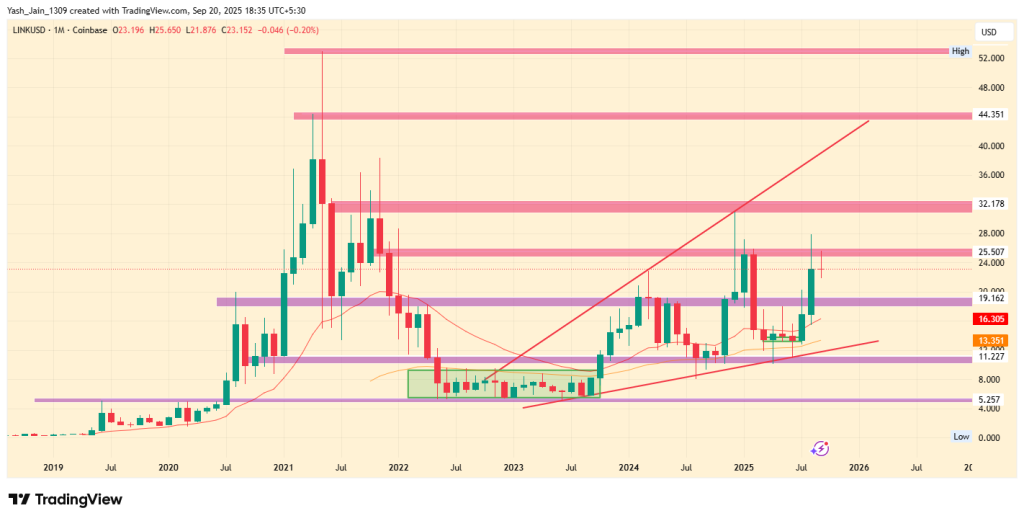

On the larger timeframes, the Chainlink price chart shows a powerful ascending broadening wedge formation.

During Q3, LINK took support from the lower border of this pattern, and it now appears to be approaching the upper resistance. A breakout from here could drive LINK price USD toward $44.

Beyond that, potential upside targets are being watched closely. The first is around $47.15, nearly doubling the current level, while the second stretches to $88.26, marking a possible tripling of value.

If LINK clears $47 with conviction, the rally could extend much further than short-term LINK price prediction models suggest.

Chainlink’s Expanding Role in Crypto Policy

Adding to the bullish narrative, Chainlink Labs’ General Counsel Ben Sherwin has been appointed to the CFTC’s Digital Asset Markets Subcommittee.

This highlights the growing influence of Chainlink crypto in shaping digital asset policy in the United States. Such recognition not only validates the project’s relevance but also strengthens institutional confidence.

NEW: Chainlink Labs General Counsel Ben Sherwin has been appointed to the

NEW: Chainlink Labs General Counsel Ben Sherwin has been appointed to the