Data shows that Litecoin has seen a rapid surge in active addresses, making the asset the most used in the sector, compared to Bitcoin and Ethereum.

Litecoin Has More Than Doubled Its Active Addresses This Month

According to data from the on-chain analytics firm Santiment, the Daily Active Addresses have recently seen a big jump for LTC. The Daily Active Addresses here refers to an indicator that keeps track of the total number of addresses taking part in some transaction activity on the network daily.

Naturally, this metric considers both senders and receivers and only counts the unique number of such addresses. This indicator may be used as a proxy for the amount of traffic the Litecoin blockchain receives.

When the value of this metric is high, it means many addresses are making moves on the network right now. Such a trend implies there is high interest in the asset.

On the other hand, the low indicator suggests that investors may not pay much attention to the cryptocurrency as the network isn’t witnessing much activity.

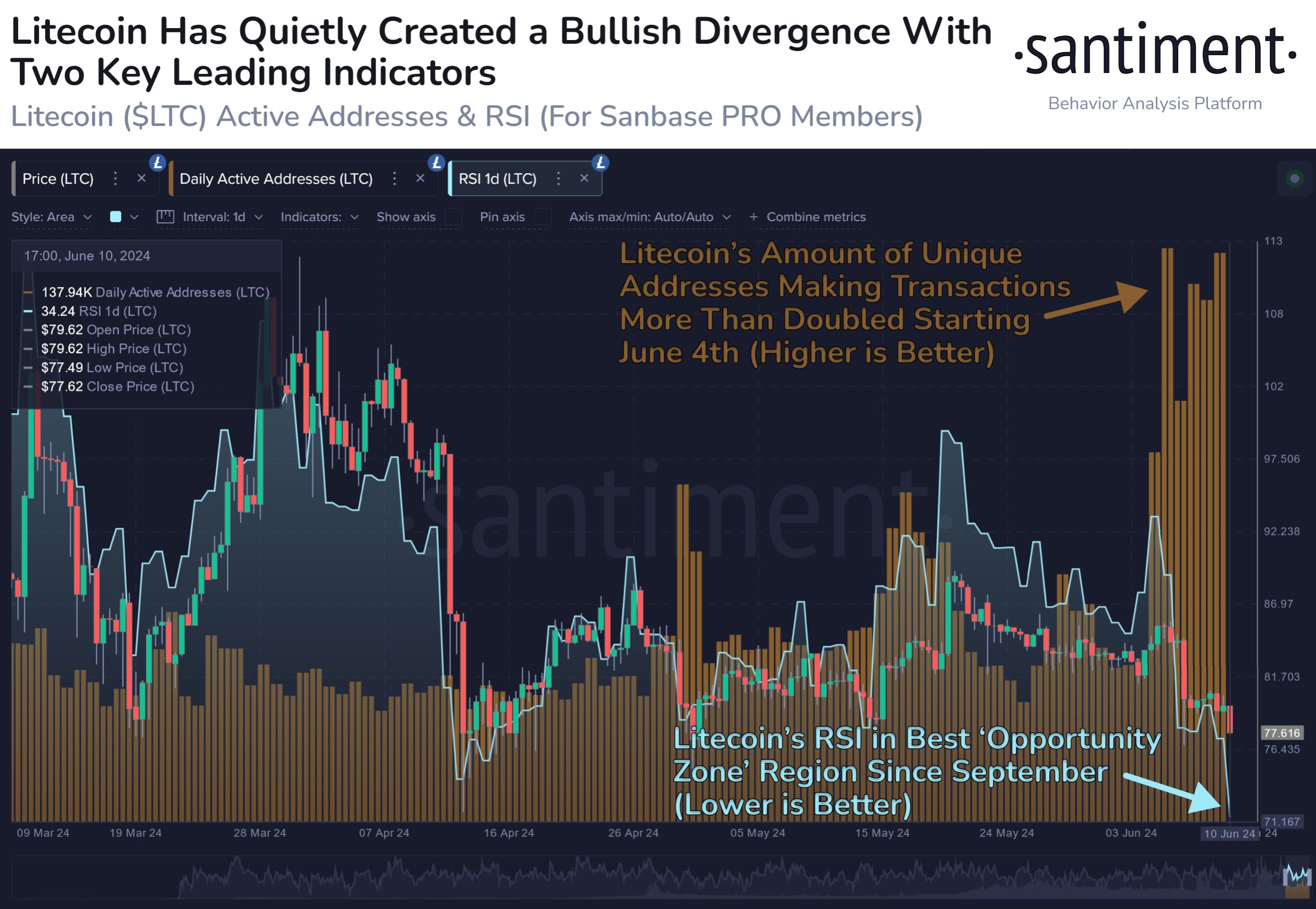

Now, here is a chart that shows the trend in the Daily Active Addresses for Litecoin over the past few months:

As the above graph shows, the Litecoin Daily Active Addresses have observed extraordinarily high values since the 4th of this month. During May, the asset had averaged a value of 345,000 on this metric, but over the past week, the average has been sitting at 704,000.

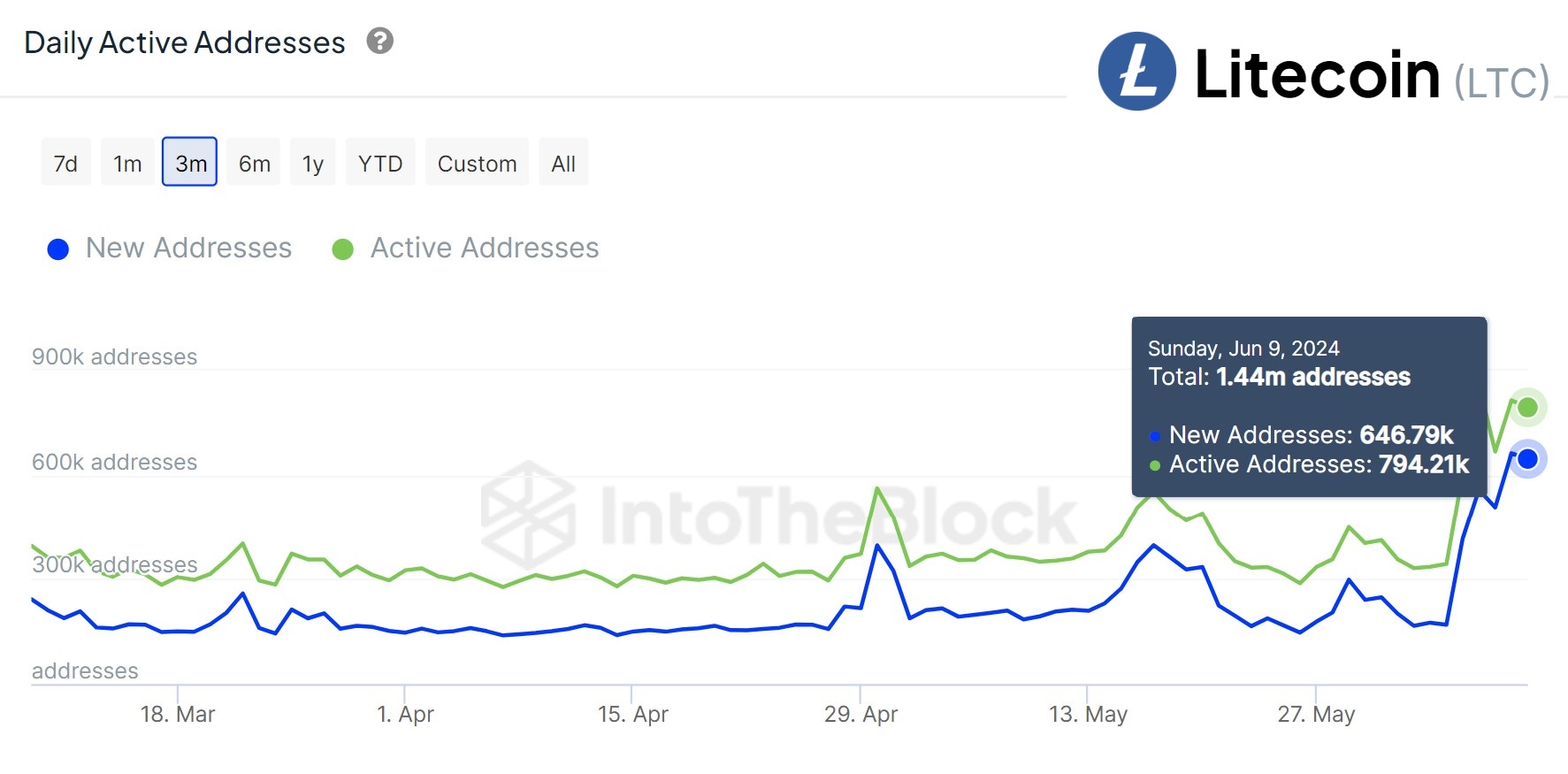

This means that the active user count on the blockchain has more than doubled compared to the past month. The official Litecoin X handle has also posted about this recent explosion in network activity, sharing a chart for the number of active addresses from the market intelligence platform IntoTheBlock.

This chart also includes the data for another metric: the daily number of new addresses being opened on the network. From its graph, it’s apparent that at the same time as this activity boom has happened, the adoption of the cryptocurrency has also picked up.

In the active addresses indicator, LTC has surpassed the top two cryptocurrencies by market cap, Bitcoin and Ethereum. “More people using Litecoin than any other crypto right now!” notes the LTC X handle.

Litecoin has historically been around the top of the sector in usage-related metrics because the network offers cheap and fast transactions. While LTC’s price has been stagnant, its usage metrics shooting up suggest that this network capability can still attract users.

LTC Price

So far, Litecoin has not been able to recover from the April crash, as its price is still trading around the $77 mark.