On-chain data suggests Litecoin potentially has a major amount of resistance waiting just ahead, making a recovery more difficult for LTC’s price.

Litecoin Has A Large Supply Wall Waiting At Levels Just Ahead

As pointed out by X user Trader Kamikaze using data from the market intelligence platform IntoTheBlock, a large amount of LTC investors bought at levels that are coming ahead.

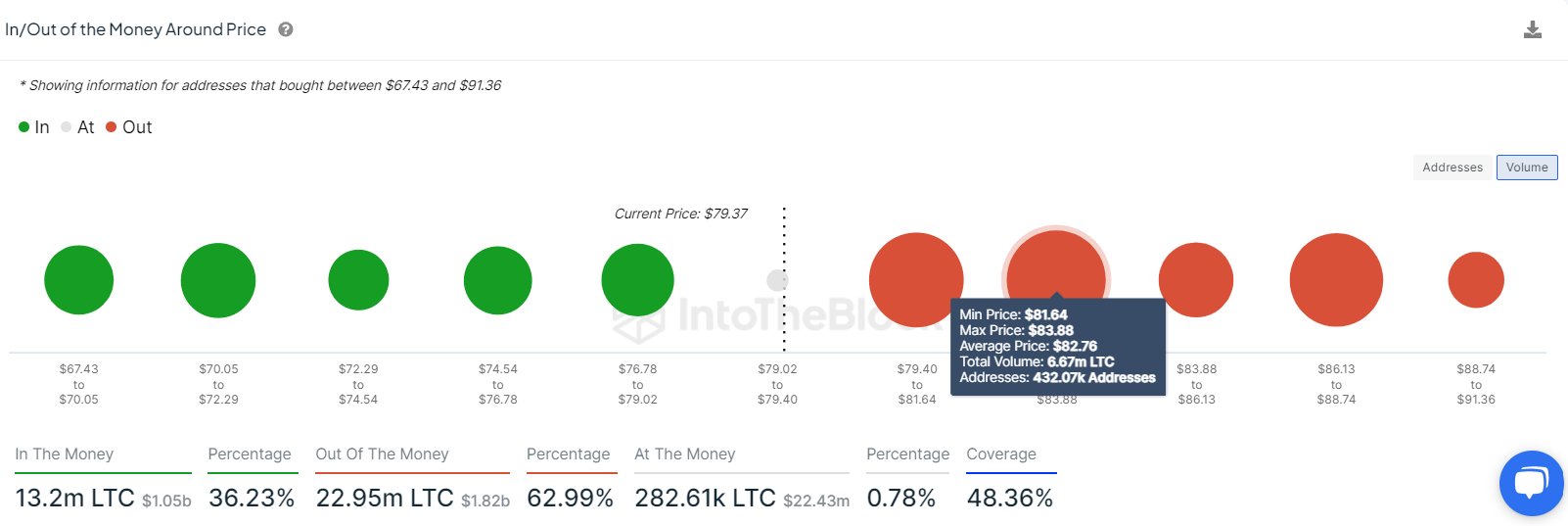

Below is the IntoTheBlock chart that shows the distribution of LTC addresses based on the price at which they last bought their coins on the network.

Here, the size of the dot correlates to the amount of cryptocurrency acquired in the corresponding price range. As is clearly visible, the $81.64 to $83.88 range has a large dot associated with it, meaning that a large number of tokens were bought while the asset traded within it.

More specifically, 432,070 addresses bought around 6.67 million LTC inside this range. This amount is worth north of $534 million at the current exchange rate.

Now, what relevance could this have for Litecoin? In on-chain analysis, the strength of any level as support or resistance comes down to how many coins were acquired at said level. As such, this thick LTC range with investors could potentially influence the cryptocurrency upon a retest.

The reason behind this theory is that the cost basis is an important level for any holder, so they may be more prone to show some reaction when a retest of it takes place. The larger the number of investors who share their cost basis inside a narrow range, the stronger this reaction would be.

What kind of reaction a retest would produce depends on whether it’s happening from above or below. Investors in losses just before the retest (that is, it’s taking place from below) might tend towards selling, as they could fear the price would go down again shortly. Exiting at the break-even mark would mean at least they can avoid realizing any losses.

On the other hand, holders in the green leading up to the retest could decide to take a further gamble, believing that the price would go up again.

Therefore, levels below the current price can be points of support, while those above resistance. As Litecoin has a notable supply wall at levels just ahead of the current one, it’s possible that a retest of it could produce a selling reaction.

It now remains to be seen if this thick range would impede LTC’s recovery, should the cryptocurrency rise to retest it.

LTC Price

Litecoin is currently situated just below the supply above wall, as its price is trading around $80.